Effortless Finance Control: Discover the Benefits of Canara Ai1’s Latest Account Aggregator Integration

Account Aggregator (AA) acts like a middleman that gathers and shares your financial info from different places (Financial Information Providers or FIPs) to those who need it (Financial Information Users or FIUs). Using electronic consent, you can easily share your data through the Account Aggregator, making things simpler.

Canara Bank has added the Account Aggregator to it’s Mobile Banking App. This means you can now check your financial info from different places, all in one secure and easy-to-use app. No need to go to different banks or use different apps.

Right now, the app can show your Savings Account details like balance and statements. In the future, more info will be added like Current Account details, Deposits, Insurance, Investments, and more, as soon as it’s available through the Account Aggregator.

Prerequisites to access Account Aggregator facility ✅

- Customer shall be a user of Mobile Banking app (Canara Ai1 app).

- To access detail of accounts maintained with other Banks through Account Aggregator facility, Mobile Number used for registration of Mobile Banking shall also be linked with accounts maintained in other Banks.

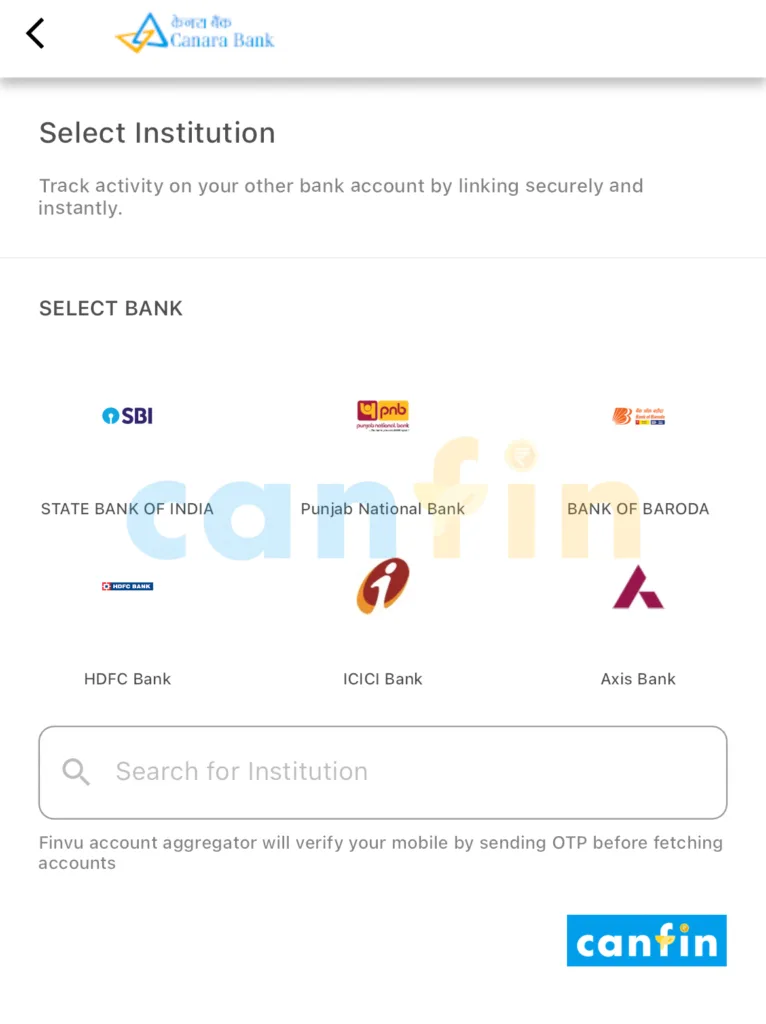

- The Other Bank shall be a participant of the Account Aggregator ecosystem.

- User shall give OTP based explicit digital consent to Account Aggregator M/s FinVu to collect the user’s financial information from other Banks and to share with Canara Bank to be displayed in Mobile Banking Application.

10 Steps to avail Account Aggregator facility 🗂️

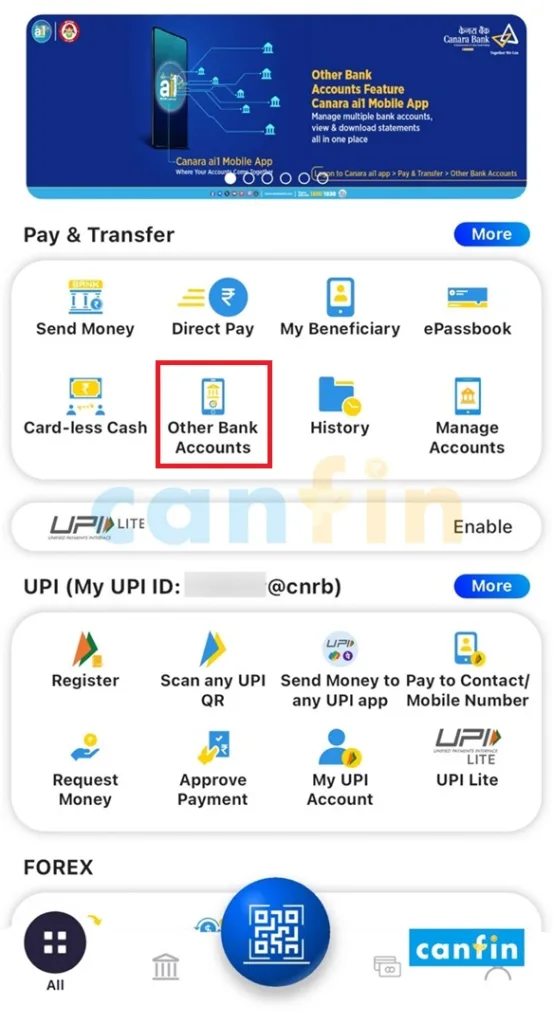

1. User shall login to Canara Ai1 Mobile Banking Application. User shall click on “Other Bank Accounts” option under Pay and Transfer.

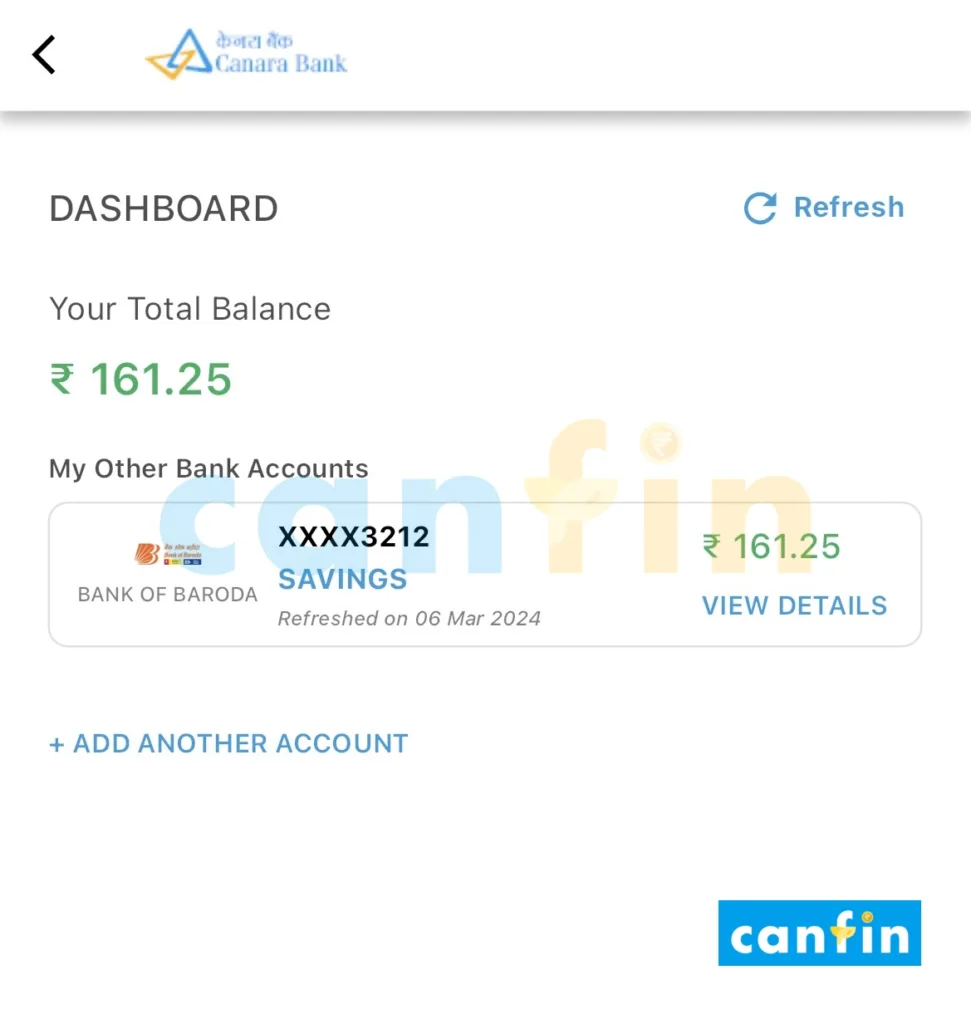

2. User can view the Account Balance and Generate Statement of Account (up to last 12 months / 1 year) maintained with Canara Bank as well as accounts maintained in any other Bank.

3. By default, Masked Account Number and Available Balance of Savings Accounts maintained with Canara Bank will be displayed. For each account, options to generate Statement and to view A/c Details will be displayed.

4. To View Other Bank Account details, User shall Click on “Other Bank Accounts” button and choose “Proceed” in disclaimer pop-up providing authorization to Canara Bank.

5. The User shall then click on Add Another Account Option and an OTP will be triggered to customer’s Registered Mobile Number.

6. The User shall validate the request by entering the OTP received.

7. The User shall then select the Bank’s Name and subsequently the desired account to access details of his/her account with Selected Bank.

8. An OTP will be sent to the User’s Registered Mobile Number. The User shall enter this OTP and approve the confirmation for addition of selected account.

9. The User will be able to view the details of selected Bank Accounts.

10. By repeating the steps, multiple accounts from various Banks can be added under this option.

This way Account Aggregator (AA) is a new and cool way to handle your money info, making managing finances simple and giving you more control over your financial story. It’s like a digital tool that helps you share things like bank statements and tax info safely with your permission. This lets you see all your money stuff in one place, making it easier to plan your finances. Plus, it keeps things private and secure because you don’t have to share your login details.

AA works by getting your approval before sharing anything. It also helps different money services work together, making money management simpler. This isn’t just about handling money; it’s about giving you more say and control over your financial story.

[…] for logging in to HEAL application should be registered with Salary Account of the customer for Account Aggregator […]