Streamlined Banking: Quick and Easy Canara Bank Online Account Opening

Embarking on your banking journey with Canara Bank is simpler than you might think, thanks to it’s hassle-free online account opening process. If you’re a new customer looking to join Can Bank family it’s user-friendly steps make it easy to get started. Dive in to discover how effortless it can be to manage your finances with Canara Bank!

Until recently, the Canara DiYA Application and portal served as the go-to platforms for opening a Savings Bank Account online, eliminating the need for branch visits. However, the Canara DiYA Portal is closed across the country from March 2024 to refine the account opening experience. Now, with the revamped Canara Bank Online Account Opening portal, users can enjoy advanced security features for a safer and more secure banking experience.

The Pre-requisites 🗂️

Please, make sure you have below things beforehand to make your journey quick and smooth for to Canara Bank Online Account Opening:

- A smart phone with Aadhar registered mobile number

- Original PAN Card and Aadhaar Card (Aadhaar & PAN to be linked prior to Video KYC)

- A blank sheet of white paper and pen (preferably with blue/black ink).

Significant Revisions in Account Opening Steps 🔀

- Only new customers can open accounts.

- In addition to Canara SB General, Canara SB Select is now available for new customer account openings.

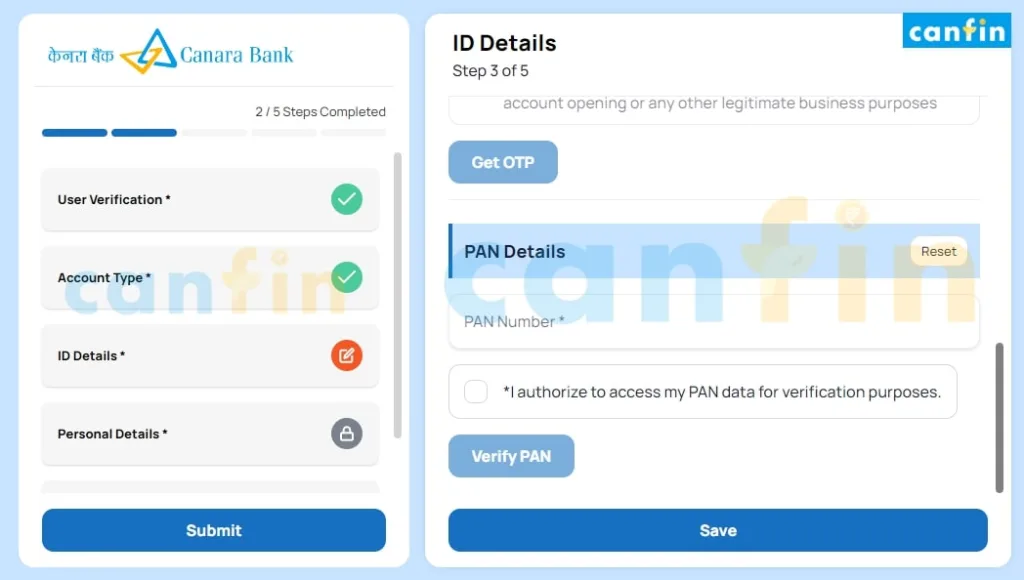

- A PAN Number is mandatory.

- Only the Aadhaar-registered mobile number can be used for registration.

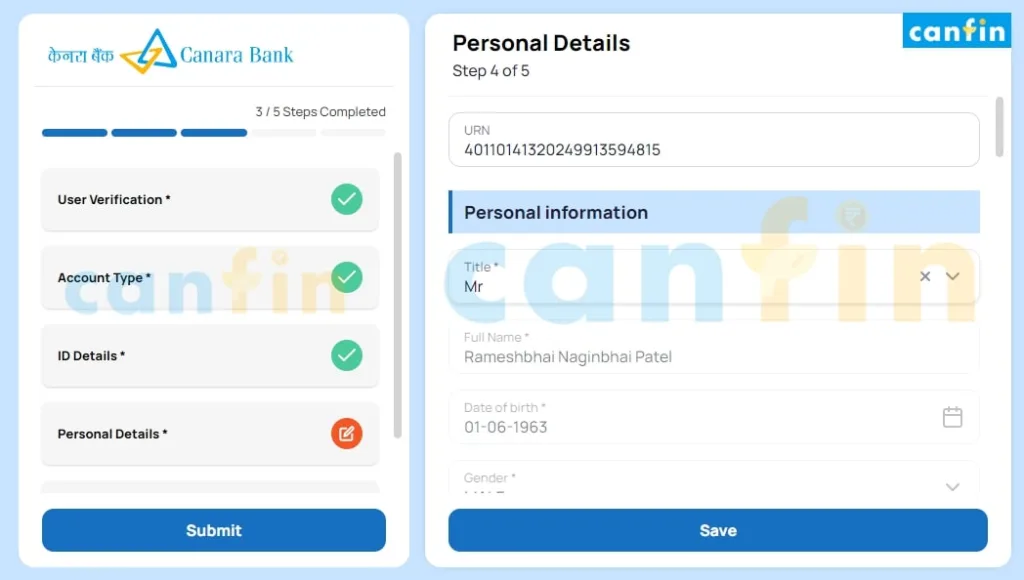

- After completing the initial steps, you’ll receive a Unique Reference Number (URN) before starting the Video KYC process.

- Customer Due Diligence (CDD) is not needed for the first year, as the account number generated will be a KYC Compliant Normal Account.

6 Simple Steps to Canara Bank Online Account Opening 📝

Here’s a quick guide to the six straightforward steps that will lead you to your new Canara Bank online account:

- User Verification by Mobile number & Email id 👤

- Select Account Type 🗃️

- Identity Verification of Pan and Aadhaar 🪪

- Fill Personal Details 📝

- Fill Additional Information 📋

- Video KYC 🕵️

Go to www.canarabank.com/pages/online-account-opening

or click button below:

Step-1. User Verification 👤

For Canara Bank Online Account Opening, users undergo verification through their mobile number and email address for added security and confirmation.

Please input the mobile number linked to your Aadhaar for OTP verification. Additionally, provide your email address to receive and verify the OTP.

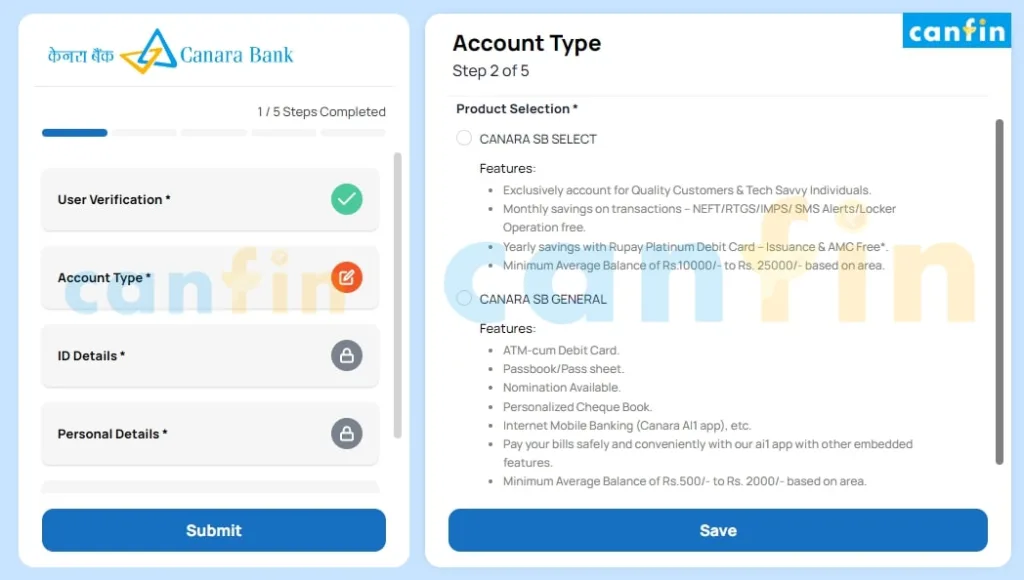

Step-2. Select Account Type 🗃️

Next, users can select their preferred account type from the options provided below to suit their banking needs.

1. Canara SB General

Read more 👉 Canara Bank Savings Account – 8 Things You Must Know!

2. Canara SB Select

Read more 👉 8 Value Added Features of Canara SB Select Saving Account for Tech Savvy Individuals

Tick checkbox to agree all Terms and Conditions and save to proceed further. Also note down URN for future reference.

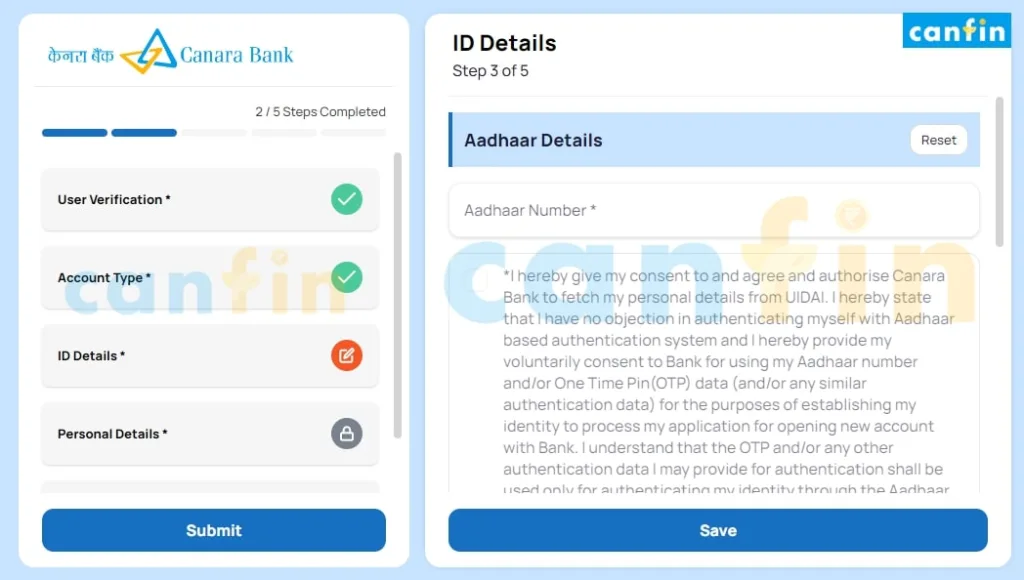

Step-3. Identity Verification 🪪

Identity verification requires submission and verification of both PAN and Aadhaar details to authenticate the applicant’s identity.

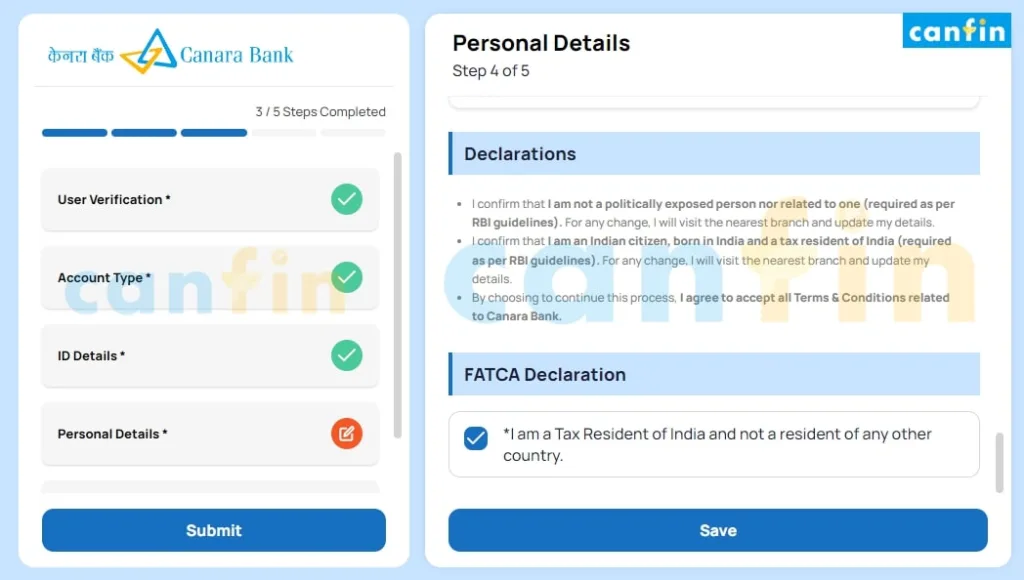

Step-4. Fill Personal Details 📝

Personal details such as name, date of birth etc. must be filled in accurately to proceed with the account opening process.

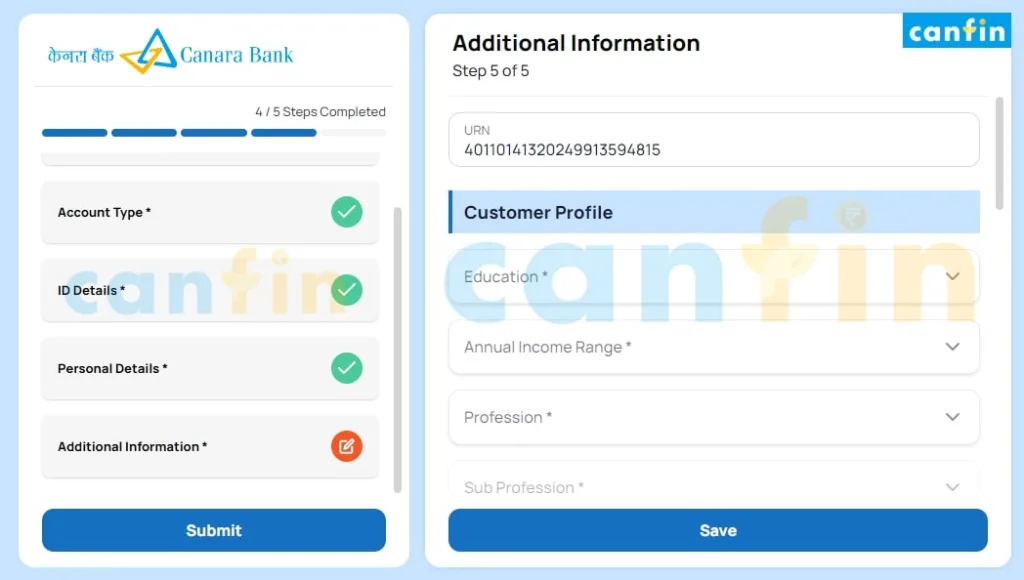

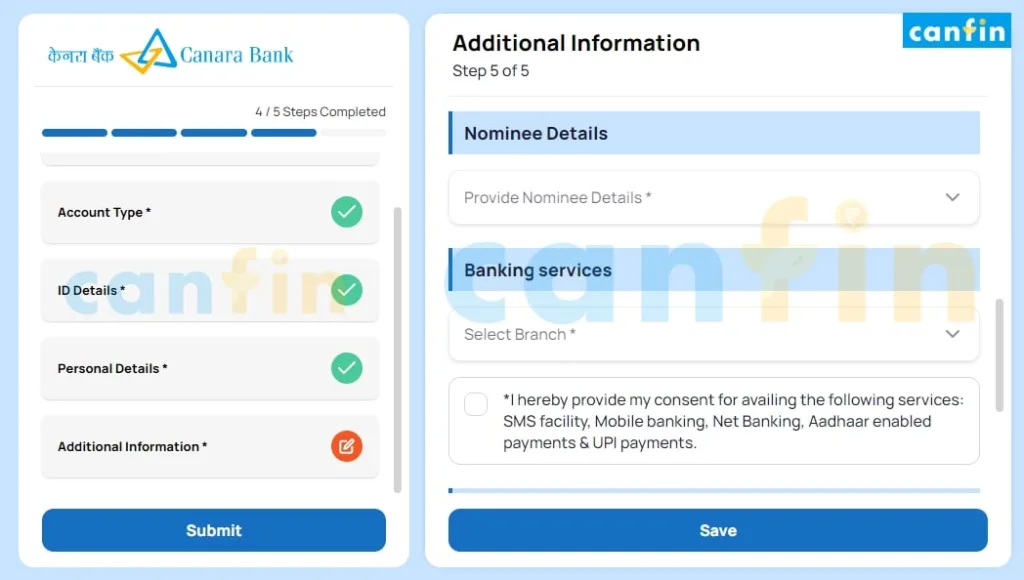

Step-5. Fill Additional Information 📋

Users are then prompted to provide additional information such as education, annual income, nominee, branch etc. as required by the bank to complete Canara Bank Online Account Opening setup.

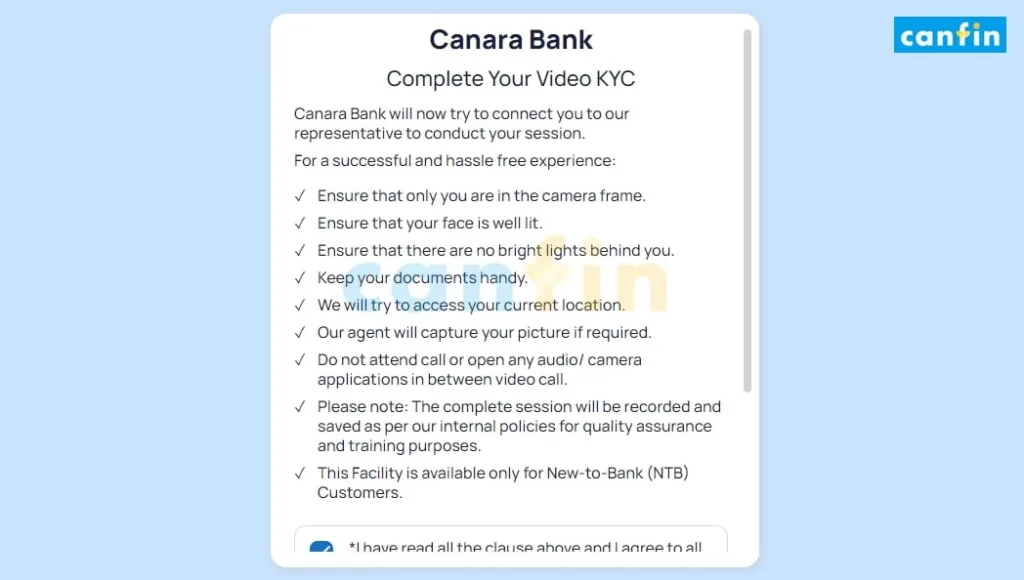

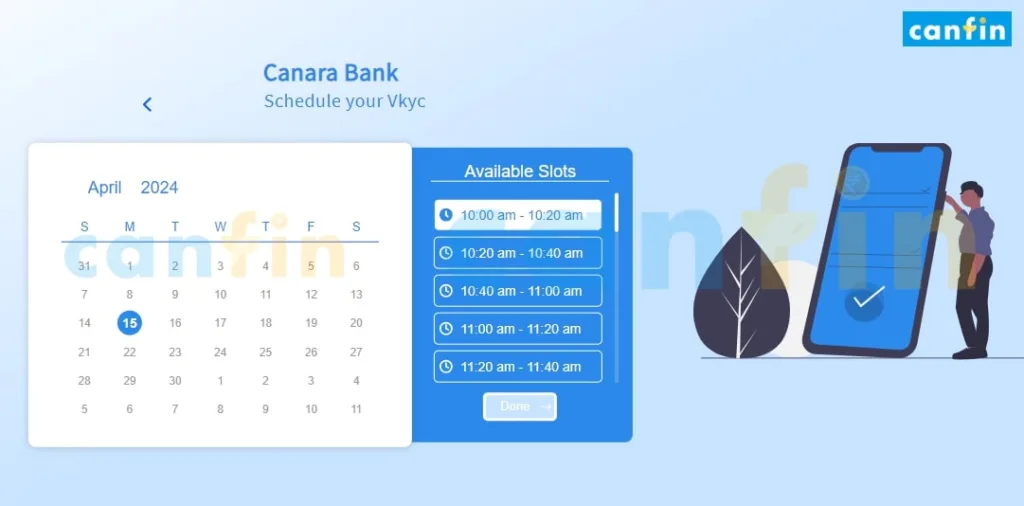

Step-6. Video KYC 🕵️

Finally, the account opening process is finalized with a Video KYC (Know Your Customer) session to ensure compliance with regulatory and security standards.

Begin immediately or book your Video KYC session at a time that suits you best.

This way Canara Bank Online Account Opening involves a straightforward six-step process that prioritizes user verification, identity authentication, and comprehensive data collection. This streamlined approach, culminating in a video KYC session, ensures both security and compliance, making the Canara online account opening experience convenient and reliable for applicants.

Frequently Asked Questions 🤔

Q. What is the Average Minimum Balance (AMB) for the Canara Bank Savings Account?

The average minimum balance of the savings account for Individuals residing in Metro and Urban areas is Rs. 2000, while it is Rs. 1000 for customers residing in Semi-urban and Rs. 500 for Rural areas. For More Details click below:

Q. Is a PAN card mandatory to open Canara Bank account online?

Yes, PAN card is mandatory for Canara Bank Online Account Opening.

Q. What is an Interest Rate for Canara Bank Saving Account?

Rate of interest on Savings Account is 2.9% for deposits below Rs. 50 lakhs. For deposits above Rs. 50 lakhs, check rates form link below:

[…] Read More […]

[…] Related: Step-by-Step Guide to Upgraded Canara Bank Online Account Opening Process in 15 Minutes […]