Canara Bank provides lnternet Banking Facility for Financial and Non-Financial Transactions to the customers. The Internet Banking users are classified into Retail and Corporate based on the Customer Type.

Presently, Bank’s Retails customers have the option of both Mobile Banking and Internet Banking for performing online transactions to manage their accounts. While Banks Corporate Customers are not eligible for Mobile Banking and they have Internet banking as only option to perform online transactions.

With the increase in usage of the smart phones, Canara Bank has launched the Corporate Mobile Application (Canara Ai1 Corporate App) for Corporate Internet Banking Users. It is a convenient, secure and efficient way for Canara Bank Corporate Customers to access and manage their accounts. The Canara Ai1 Corporate App will be extension of the existing stable internet banking solution and will share the common infrastructure.

Canara Ai1 Corporate App will cater to the diverse needs of the Corporate Customers of the Bank, who can perform Banking transactions through Corporate Internet Banking and on the ‘Canara Ai1 Corporate App’ interchangeably.

App Download Link

Registration Procedure for Canara Ai1 Corporate App

All Corporate Customers who are registered for Corporate Internet Banking are eligible for registering on the App.

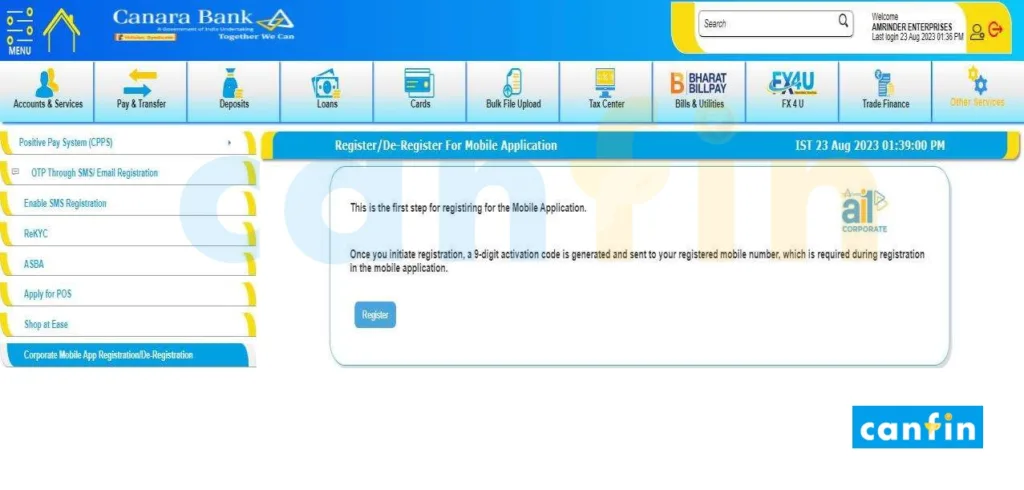

Step 1:

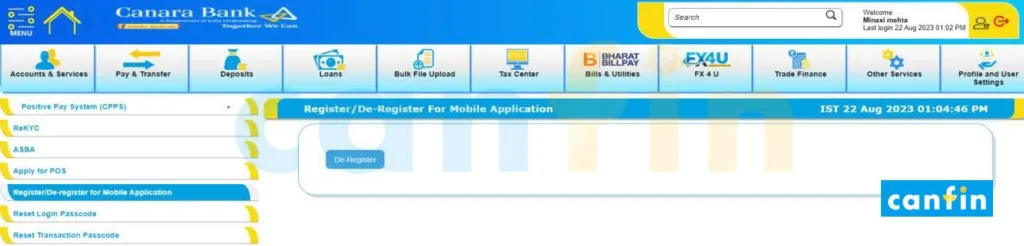

Login to Internet Banking > Go to Other Services Tab > Register/De-register for Mobile Application > Register

The User has to select the “Register” option then SMS along with “Activation Code” will be sent to the User’s mobile number. The Activation Code will be valid for 24 hours only. If the user is unable to onboard on the App within 24 hours, the Activation Code will be expired and the user has to re-generate the same.

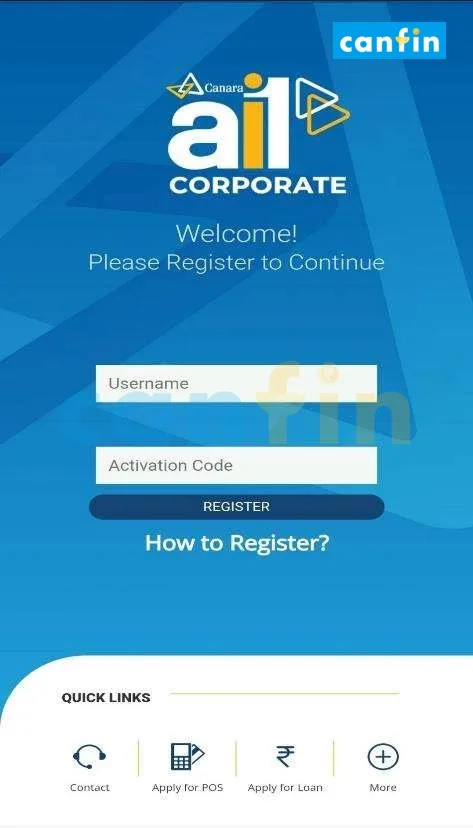

Step 2:

Download the Canara Ai1 Corporate App from the Play Store / iOS App store and complete the Registration in App as below:

1) Open ai1 Corporate Mobile App > Enter IB User Id > 9 digit Activation Code > Click Register button

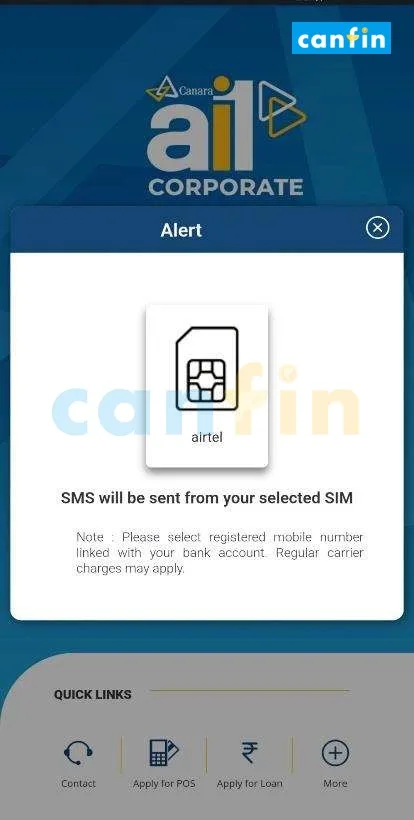

2) SMS will be sent from registered SIM. Please select registered mobile number linked with your bank Account. Registration time for Sim Binding/ Device Binding is restricted to 30 sec. If not completed within 30 sec ‘Session time out Message’ will be displayed.

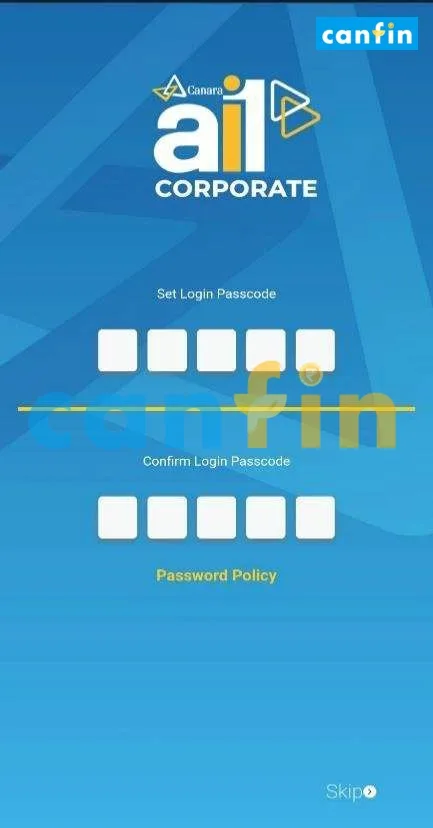

3) Once registration SMS gets validated User needs to Set 5-Digit Login Passcode, Confirm the Login Passcode by entering it again.

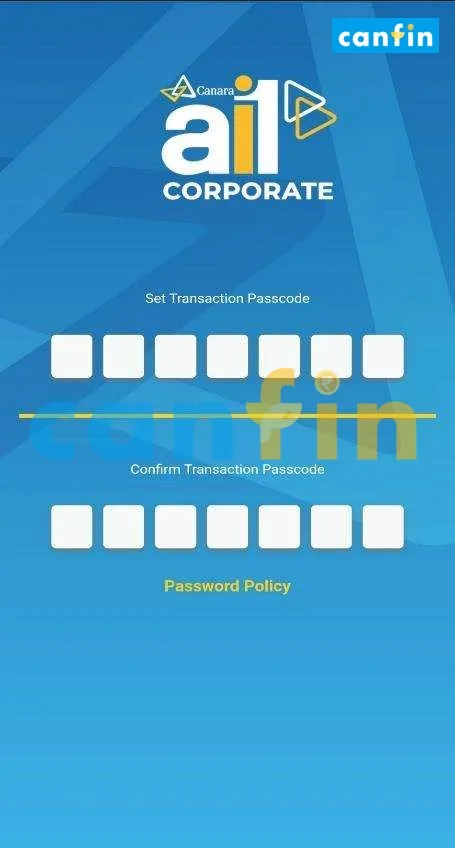

4) Once Login Passcode set, App will prompt user to Set 7-Digit Transaction Passcode, Confirm the Transaction Passcode by entering it again. (Use Transaction Passcode for Authorization of Transactions in the Canara Ai1 Corporate App.)

5) After Creating the Login Passcode and Transaction Passcode Activation will be successful.

User can now use ai1-Corporate App after entering their Login Passcode or Login Password.

(Note: User can skip creation of Login Passcode and Transaction Passcode and can login by entering IB User id and Password.)

6) Onboarding of the same user from Multiple devices restricted.

7) If the User provides incorrect Details for 3 attempts, the registration will be blocked for 24 hours from the last failed attempt.

Financial Transaction Flow

- After the User is logged in Using the Login Credentials all the accounts linked to the User ID will be displayed.

- If the user logs in using the Login Passcode, then the user must use the Transaction Pin along with OTP to perform the Financial Transactions. Alternatively, if user logs in using the User ID and Login Password, the user must use the Transaction Password and OTP to perform the Financial Transactions.

- For Users who have Maker/Checker facility, the transactions initiated in the App will be displayed in the Desktop version and vice- verse.

Security Aspects

- The App ensures both ‘Device and SIM binding’. Any change in SIM in any slot will prompt the user for re-registration.

- Mobile Application Security System (MASS) which is presently used for our mobile Banking is integrated in Corporate Mobile App.

- If any rooted/jailbroken device is detected, the user cannot operate the App.

- The App will identify screen mirroring, remote access applications and prohibit login to the Canara Ai1 Corporate App and recommends the user as notification/message to uninstall such Apps.

- Security and control policies of Internet Banking are applicable to the Corporate Mobile App also.

Frequently Asked Questions

Q. What is Canara Ai1 Corporate App?

Canara ai1 Corporate App is an app launched by Canara Bank, which enables it’s Corporate Internet Banking users to perform transactions through app without using Desktop/Laptop.

Q. Who are eligible for the Canara Ai1 Corporate Mobile App?

All the Customers who are registered for Corporate Internet Banking are eligible for registering the Ai1 Corporate App.

Q. What are the Features /services offered in the Canara Ai1 Corporate App?

A Total of 150+ Features like Accounts and Services, Pay and Transfer, Deposits, Loan services, Bulk File Upload, Tax services, Bill Payments, FX4U and Trade Finance etc. are available in the App.

Q. On which platforms the Canara Ai1 Corporate App offered?

The app is available on Android and iOS platforms.

Q. How can the user Login to the Canara Ai1 Corporate App?

The user can login either using the User ID/ Login Password or the Login Passcode.

Q. What if the user changes the Mobile handset / SIM Card?

The User has to again register for the App with new Mobile handset / SIM card.

Q. What are the security features available in the Canara ai1 Corporate App?

Security features such as Device and SIM binding, Mobile Application Security System (MASS) for Detection of Remote Administration Tools and Dynamic Keyboard have been embedded in the application.

Q. Are any transaction limits permitted in the Canara Ai1 Corporate App?

The Transaction limits are same as that of the Internet Banking. There is no change in the Transaction limits while using Canara Ai1 Corporate Mobile App.

Q. In case of “Maker & Checker” can the Maker initiate the transaction in the Desktop version and the Checker authorize the transaction in the App and vice-versa?

Yes, in case of “Maker & Checker”, the Maker can initiate the transaction in the Desktop version and the Checker authorize the transaction in the App and vice-versa.

Q. Will there be any change in the roles of the users?

There will not be any change in the Existing roles of the users i.e. Maker can only initiate the transactions and checker can only authorize the transactions as currently being done for desktop version. The authorized users assigned with the specific role in the net banking can play their role in the App also.

Q. What is Activation code and how can the user generate the Activation Code?

Activation code is a 9 digit code used during the registration on the App. To generate Activation Code:

- Login to Internet Banking

- Other Services

- Register/De-register for Mobile Application

- Register and click on Register for generating the Activation.

Currently, this is the only way the user can generate the activation code.

Q. What is the De-registration process for the ai1 Corporate App?

There are two ways in which the User can deregister App, either through Internet Banking Login or through the App:

From Internet Banking Login:

- Login to Internet Banking

- Go to Other Service tab

- Register/De-register for Mobile Application

- De-Register.

- Click on the Deregister Option for Deregistering the App.

The Message “De-Register for Mobile Application submitted successfully”.

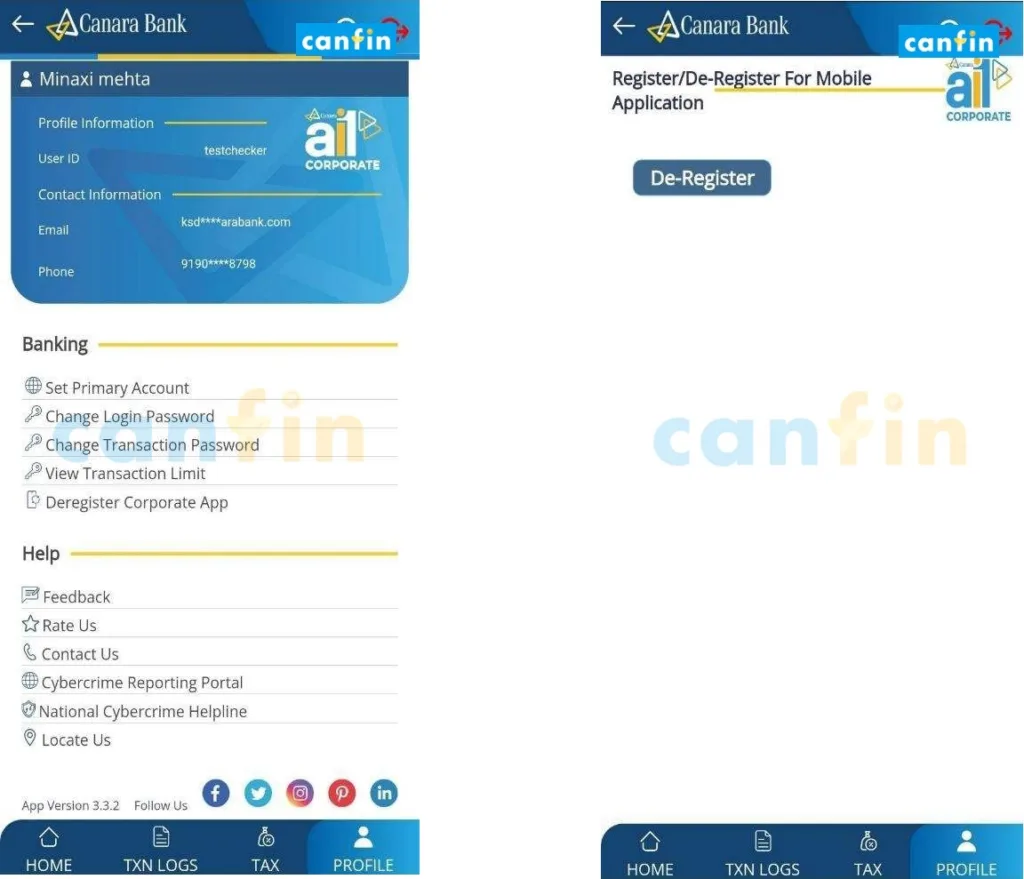

From ai1 Corporate Mobile Application:

- Login using Login Pass code or IB Password

- Go to Profile

- De-register Corporate App for Mobile

- De-Register.

- Click on the Deregister Option for Deregistering the App.

The Message “De-Register for Mobile Application submitted successfully”.

Q. Can the users perform UPI transactions using the ai1 Corporate App?

Currently the users cannot perform UPI transactions using the ai1 Corporate App.

Q. User already registered for Can-digital, Can use Ai1 Corporate App?

Yes. The users who are registered for Can-digital can use the ai1 Corporate App. CanDigital shall be required only while using Desktop/Laptop.

I have two company . I have register one mobile number. I register one company in mobile. How to register 2 nd one company

Try adding other account from Profile > My accounts