Canara Aspire Savings Account: A Youth-Centric Savings Account to Fuel the Dreams of Young India

In today’s competitive banking landscape, attracting and retaining young customers is vital for sustaining long-term growth and building customer loyalty. The 18 to 28 age group presents a key opportunity for customer acquisition, as individuals in this demographic are in the early stages of developing their financial habits and preferences.

To stay ahead of this trend, Canara Bank has introduced a new savings account called “CANARA ASPIRE,” specifically designed for youth between the ages of 18 and 28. This account offers a range of benefits, including free Coursera certificate courses, concessions on education loan interest rates, free SMS alerts, card-based offers, and no minimum balance requirement.

Top 6 Features of Canara Aspire Savings Account 🔥

1. Rupay Platinum Millennial Debit Card 💳

- Free, If customer possesses multiple debit cards for same account, applicable charges to be debited for the second card onwards.

- Card Limit:

- ATM Cash Withdrawal Limit – Rs. 1,00,000/-

- POS Limit – Rs. 5,00,000/-

- Lounge Access:

- 2 Complementary Domestic Visits per Quarter and

- 2 Complementary International Visits per Year

- The list of participating lounges is available on Rupay website

- Card Charges:

- Debit Card Issuance Charge – Nil

- Annual Maintenance Charge – Nil until the age of 28

- Debit Card (Rupay Platinum Millennial Card) will be automatically dispatched along with the Welcome Kit to the Customer’s address.

2. Zero Balance Account 0️⃣

- No minimum balance stipulation. (If course not availed from Coursera)

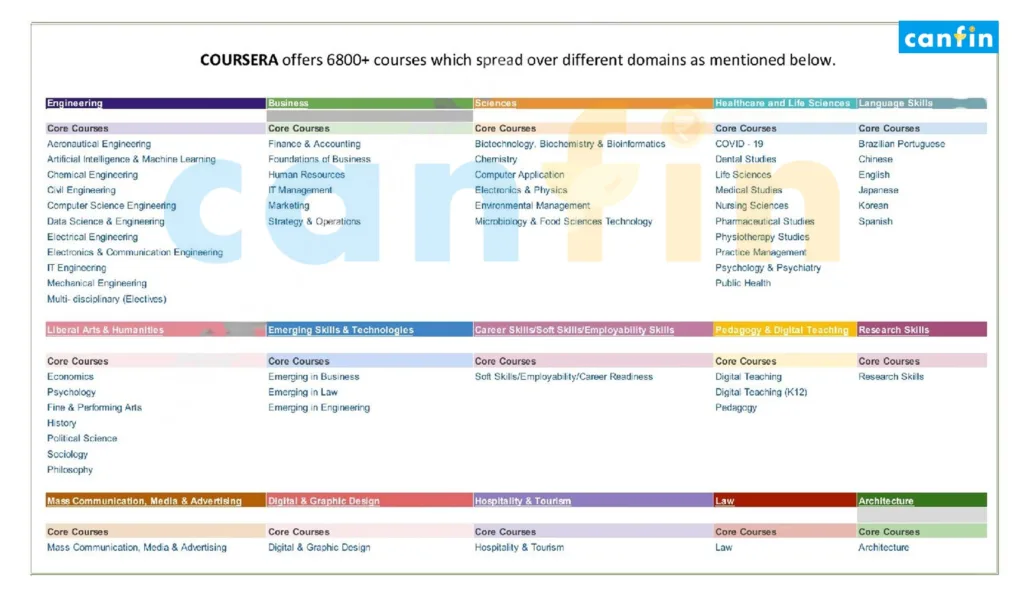

3. Certificate Course from Coursera 🎓

Maximum of two courses Free subject to terms and conditions:

- Complimentary one certificate course through Coursera Platform for customers maintaining Quarterly Average Balance (QAB) above Rs. 5000/-

- One more additional course for customers maintaining QAB above 25,000/-

- The customer can avail the course through a portal developed by Coursera logging in using their registered e-mail id’s

- Non-Maintenance of QAB charges up to Rs. 250/-

Email Subscription

Sign up for our newsletter and stay up to date!

4. Education Loan 🤝

- Additional 0.50% concession over and above the existing Rate of Interest if any, for fresh education loan for customers maintaining Rs. 5000/- QAB.

- Only Education loan sanctioned on or after opening of Canara Aspire Saving account will be eligible for ROI concession.

5. Card Based Offers 🎁

| Brand | Offer |

| Amazon | Card Discount: Flat 20% off upto Rs. 100/- Minimum Purchase: Rs. 129/- Frequency: One Friday in a Month |

| Gaana | Annual Subscription |

| Swiggy One lite | Annual Membership (yearly 4 quarterly vouchers, effectively annual subscription) |

| Book My Show | Flat Rs. 250 off on minimum purchase of 2 movie tickets once per month |

6. Cancare Policy ⛑️

| Insurance | Self | Spouse |

| Personal Accident | Rs. 6 lakhs | Rs. 2 lakhs |

| Air Accident | Rs. 8 Lakhs | Rs. 4 Lakhs |

| Baggage | Rs. 25,000/- | – |

| Purchase Protection Cover | Rs. 25,000/- | – |

Key Benefits of Canara Aspire Savings Account ✨

Eligibility

All Resident individuals in the age group of from 18 and up to 28 years (including both years), as on date of account opening, are eligible to open accounts under this product.

Account Opening

Canara Aspire Savings Account can be opened through all the existing channels such as Branch, Tab Banking, Online Account Opening through VCIP, Aadhar based A/c opening, Diya, KIOSK and through any other digital channels.

Cheque book

25 leaves free per annum

SMS Alerts

Free

Mobile Banking / Internet Banking

Available

NEFT / RTGS / IMPS / UPI / DD

Available

Account Portability

- From all accounts.

- Anytime to Premium Payroll Accounts after opening of Canara Aspire Savings Account.

- To all other accounts after 1 year of opening the Canara Aspire Savings Account.

Other conditions

- Only one account per customer can be opened.

- Joint accounts are not allowed.

Related: 8 Value Added Features of Canara SB Select Saving Account for Tech Savvy Individuals

Frequently Asked Questions (FAQs) 🤔

Q. What documents are required to open a Canara Aspire Savings Account?

Following Documents are require while account opening:

- Account Opening Form

- Proof of identity and address (Aadhaar Card)

- PAN Card / Form 60 or 61

- Photograph (2 copies)

Email Subscription

Sign up for our newsletter and stay up to date!

[…] 6 Reasons Why Canara Aspire Savings Account is a Game-Changer for Young Bankers […]

[…] educational institutions maintaining an Institutional Canara TruEdge Account shall be granted Coursera licenses to students, subject to the tier of the account and eligibility balance criteria as on 30.06.2025. This feature […]