Mobile Banking for Minors: Canara Bank Expands Services for Young Account Holders

In today’s competitive banking landscape, attracting and retaining young customers is essential for ensuring long-term growth and fostering loyalty to the Bank. The 10 to 18-year-old demographic presents a valuable opportunity for customer acquisition, as individuals in this age group are just beginning their journey into the financial world and developing financial habits and preferences.

To stay ahead of this trend, Canara Bank has introduced a Mobile Banking for minors customers aged 10 to 18 years.

Eligibility Criteria for using Mobile Banking for Minors

- Only individually operated Minor accounts are eligible for Mobile Banking services i.e., Minors accounts where guardian/s are linked are not eligible.

- Mobile number linked with multiple Customer IDs cannot avail mobile banking services.

- These accounts are eligible: SB General, Basic Savings Bank Deposit Account (BSBDA), Canara Champ Deposit, SB-Junior, SB- National Scheme of Incentive to Girls for Secondary Education (NSIGSE)

Related:

Key Features and Benefits

For the purpose of providing Mobile Banking for Minors, customers are divided in two categories based on their age group:

Group-I

(Aged 14 years and up to 18 years)

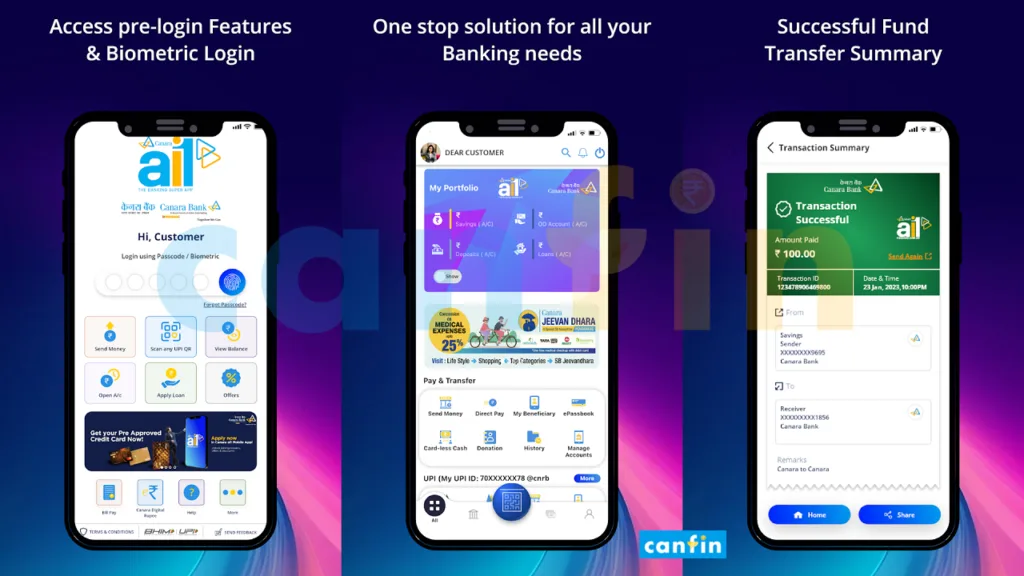

The eligible customers in this age group can avail both Financial and Non-Financial Mobile Banking services. The customers can avail following services through our Mobile Banking application, Canara ai1:

- Pay & Transfer (up to Rs. 5000 per day)

- View Balance

- e-Passbook

- Help

- Fraud Reporting to Bank & Cyber cell

- Calendar, Theme & Change language etc.

Mode of Activation:

The customers under this category can activate Mobile Banking services using their AADHAR details, Debit card and Branch-Activation code. The prerequisite of maintaining same mobile number in Bank and in UIDAI servers prevails.

Group-II

(Aged above 10 years and less than 14 years)

The eligible customers in this category can avail only non-financial services through Canara ai1 Mobile Banking application. Few of the non-financial facilities available to Minor customers in this Group are as under:

- View Balance

- e-Passbook

- Help

- Calendar, Theme & change language etc.

Mode of Activation:

The customers in this category can activate Mobile Banking services through Debit card and Branch-Activation code only.

On attaining majority, the erstwhile minor can avail unrestricted Mobile Banking Services after updating KYC at his or her Home Branch.

Email Subscription

Sign up for our newsletter and stay up to date!

Canara Ai1 App Links

To activate Mobile Banking for Minors, download the Canara Ai1 app using the link below:

[…] Related: Mobile Banking for Minors […]