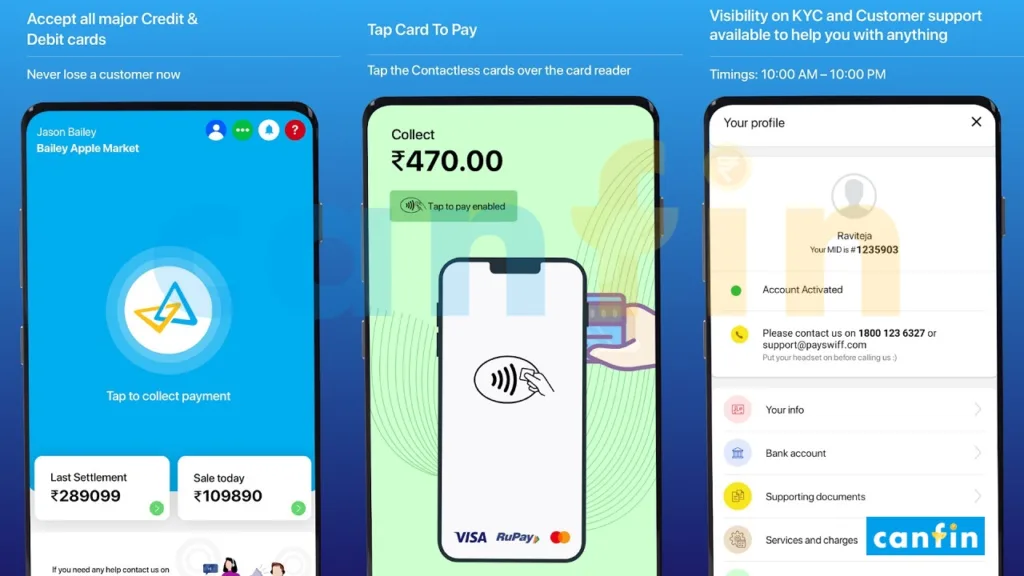

Canara Bank introduces “Canara Bank Soft-PoS,” (Software Point-of-Sale) a new digital payment solution for Merchant Establishments (MEs), effective from 07.12.2024. This innovative service allows MEs to accept debit/credit cards (Rupay, VISA & MasterCard) and Dynamic QR Code (UPI) for contactless payments through NFC-enabled Android devices without requiring physical PoS machines.

This user-friendly platform caters to a diverse range of businesses, including small retailers, delivery services, grocery shops, and restaurants. By offering a modern digital payment solution, Canara Bank aims to attract fresh business while maintaining a competitive edge in the evolving digital payment market.

Features of Canara Bank Soft-PoS 🌟

- No physical PoS device need to be delivered to ME as their NFC enabled android mobile 📱 can be used as a PoS by simply downloading the application.

- It is capable of accepting digital contactless payments through 💳 cards, UPI and wallets.

- There is zero installation & hardware cost 🛠️ as no additional PoS device is required and ME’s mobile itself will work as a PoS device.

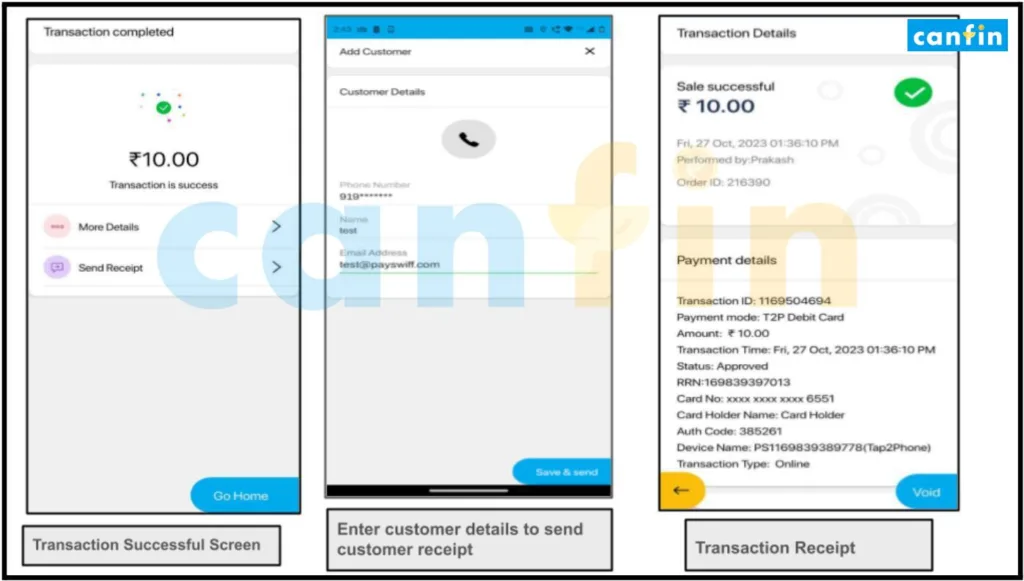

- Paperless transaction receipts 📜 will also be sent to consumer through SMS instantly.

- A cost-effective 🤑 variant of PoS suited for all kind of MEs from micro & small retailers, to delivery & courier services, small grocery shops, restaurants, and departmental stores, this device helps accept payments even on-the-go.

- Make the payment experience seamless, secure 🛡️ and increasingly contactless.

- Transaction Limits 📈 are as fixed by card issuers or as set by card-holder, whichever is less.

Monthly Rentals 🤝

The standard monthly rent fixed for Canara Bank Soft-PoS is Rs. 100+GST per Terminal ID (TID) issued.

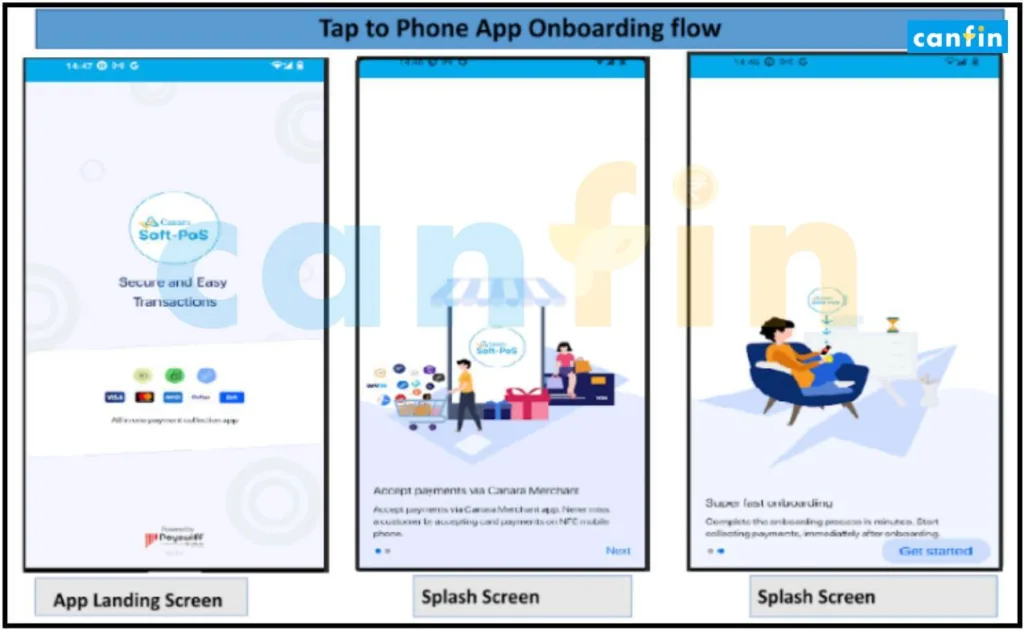

On-Boarding Process 📋

- Merchant can submit a request for PoS to their home Branch and once it is approved by Bank, service provider will on-board the Merchant and a welcome SMS will be sent to the Merchant’s registered mobile number.

- Merchant can download the “Canara Bank Soft PoS” application from Google Play-Store.

- Once sign-up is completed successfully, Merchant is good to go for accepting contactless digital payments through Tap-n-Pay cards and UPI.

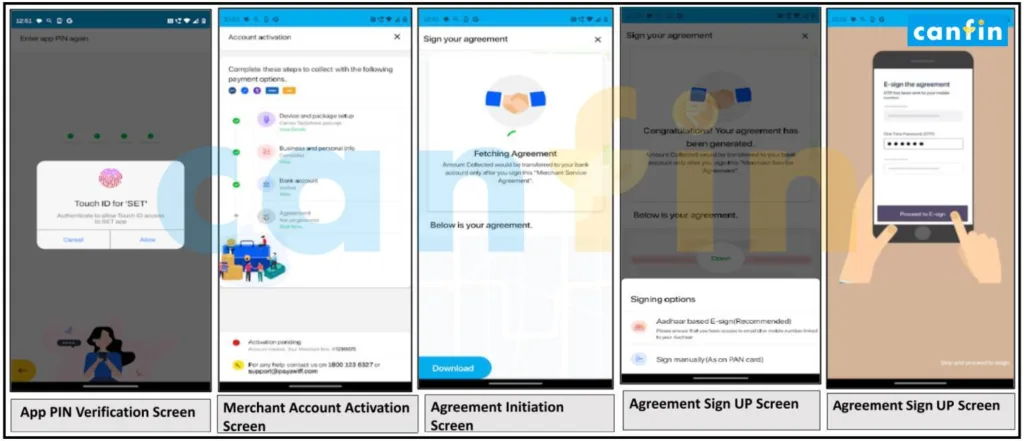

- Since, it is a Software based PoS where no physical device will be delivered, the merchant enrolment agreement will be executed digitally at the time of merchant on-boarding by PoS service provider.

Canara Bank Soft-PoS App Link 📲

Merchant can download the “Canara Bank Soft PoS” application from Google Play-Store on any NFC enabled android mobile using the link below:

Related: Step-by-Step Guide to Upgraded Canara Bank Online Account Opening Process in 15 Minutes

SOP for Application Usage 🧾

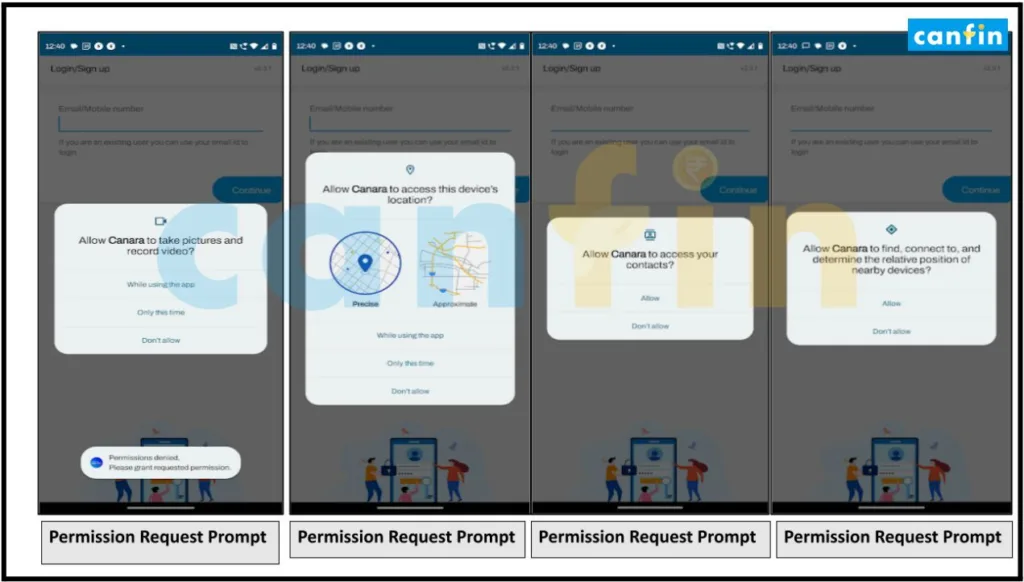

1. Application installation and permission prompt

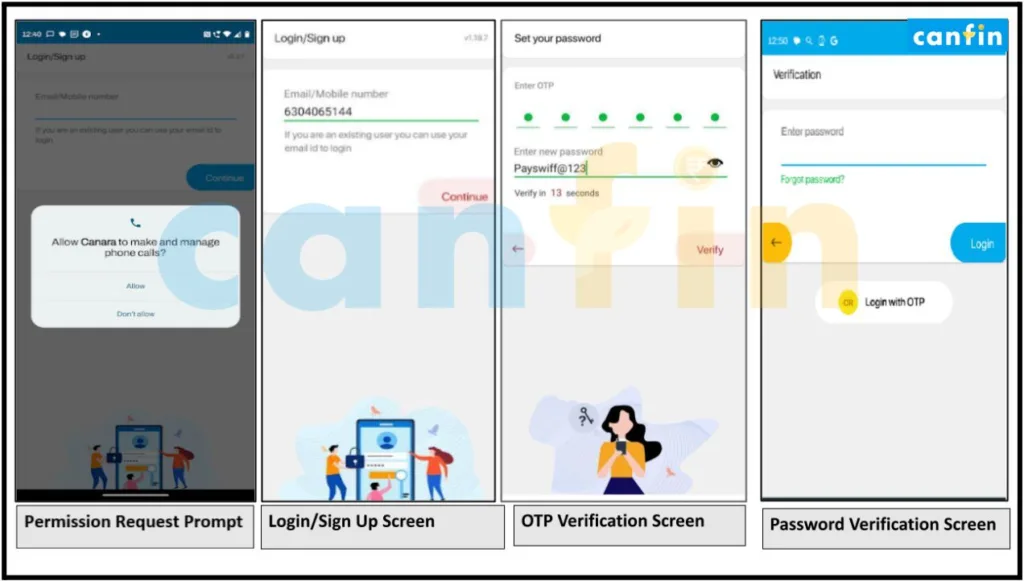

2. Signup & OTP Verification

3. App PIN Verification and Agreement Execution

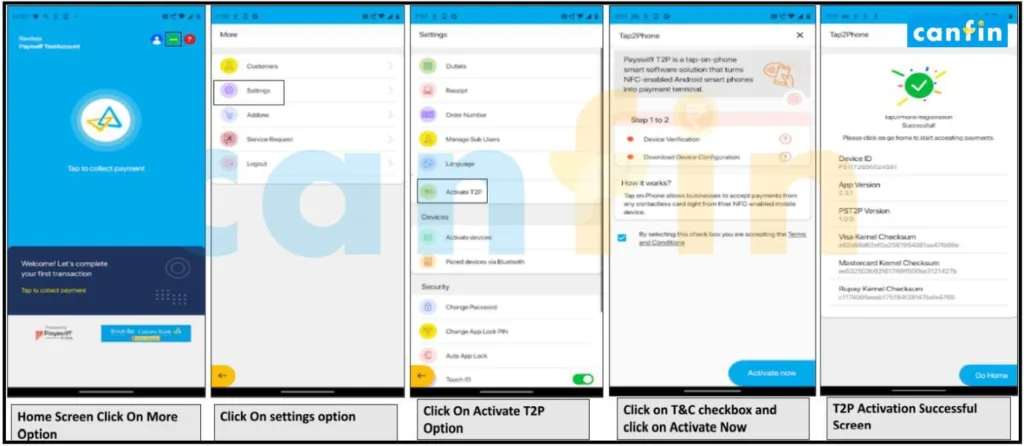

4. Canara Bank Soft-PoS Activation

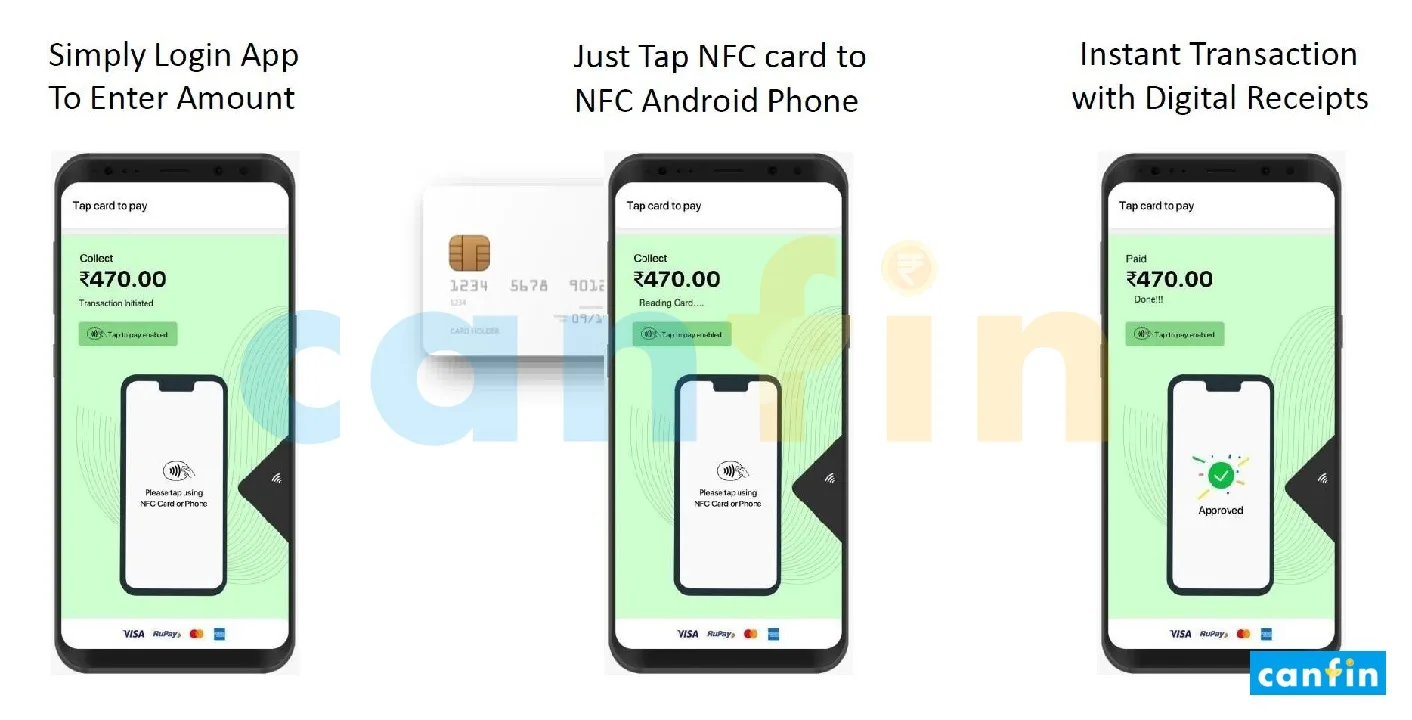

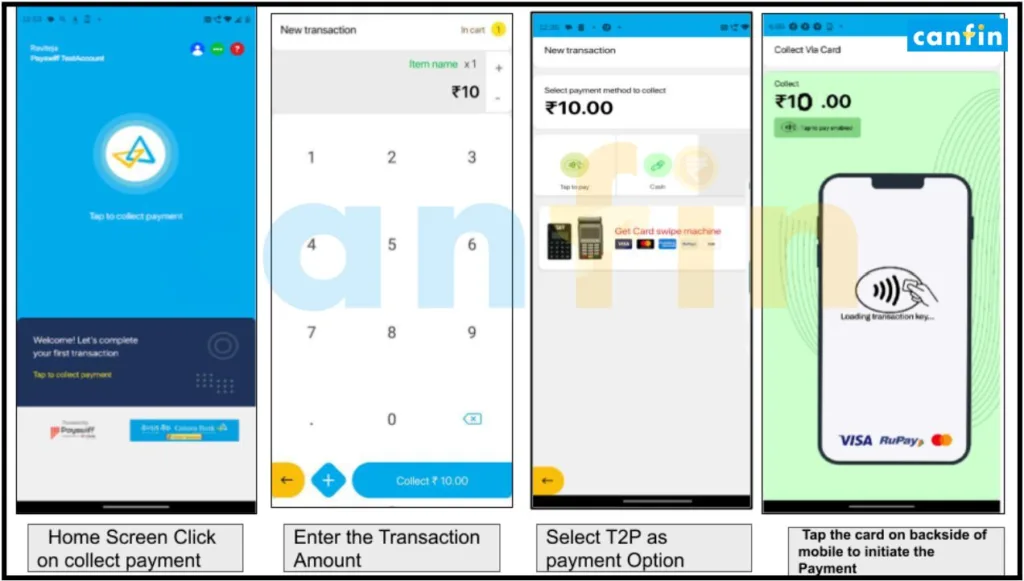

5. Tap-n-Pay Transaction through Contactless Cards

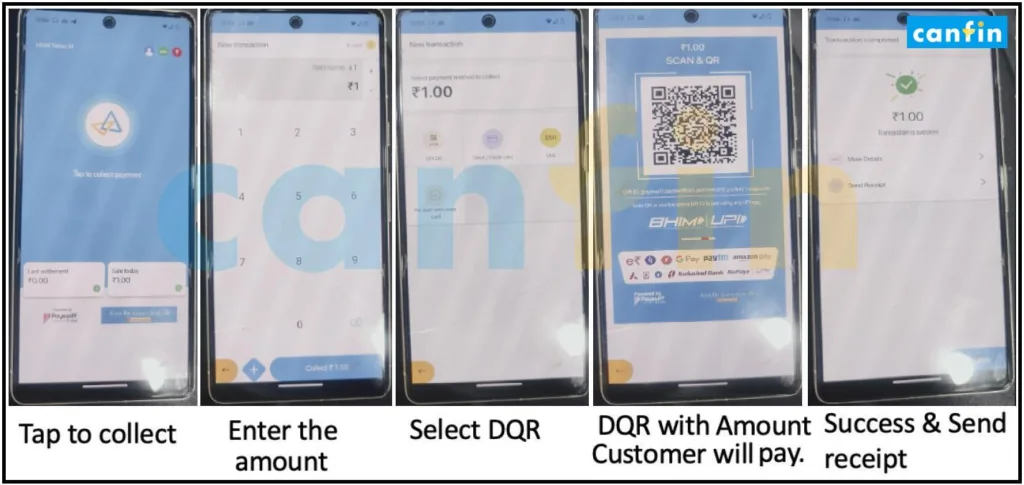

6. Dynamic QR (BHIM-UPI) Transaction

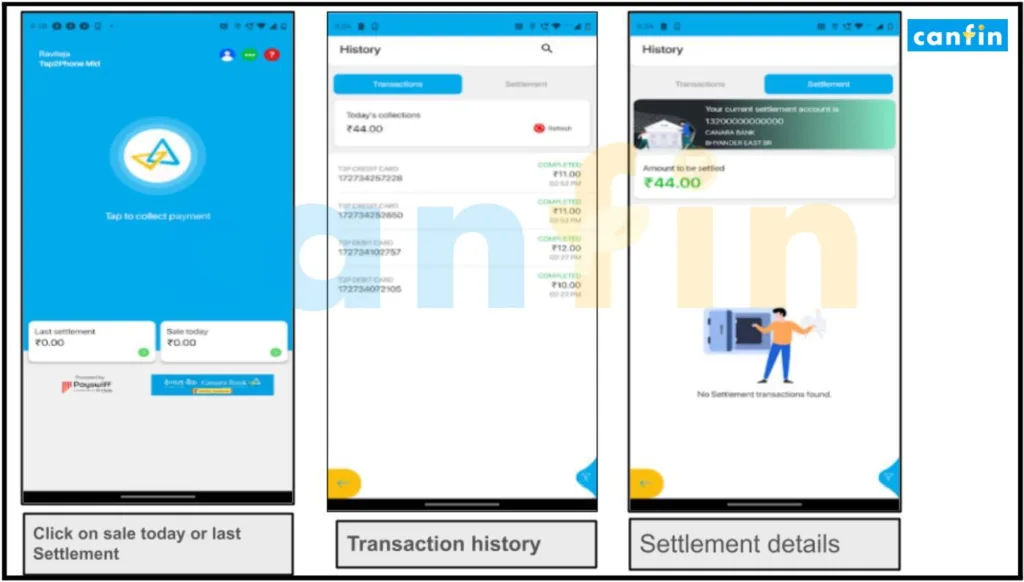

7. Transaction History

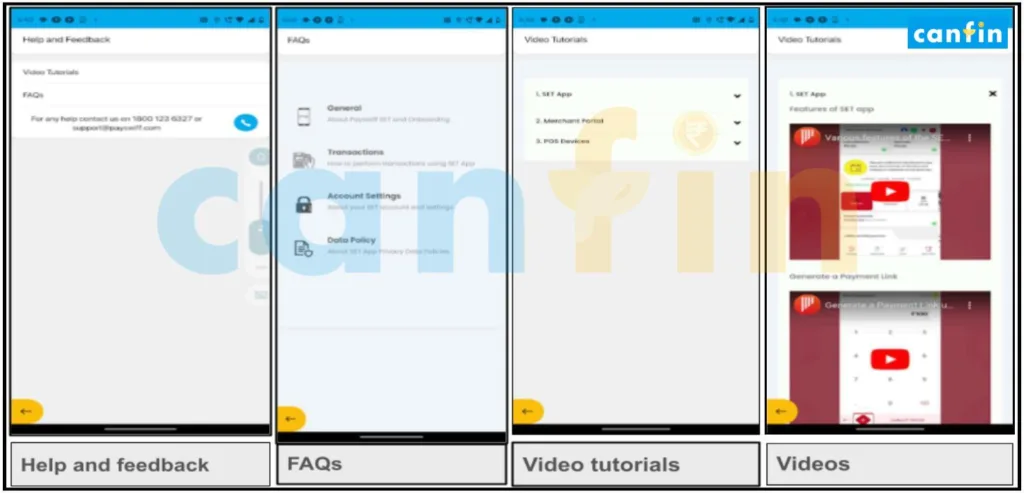

8. Help & Support