Enjoy Zero Service Charges 🚫 on 23 Premium Banking Services with Canara Crest Savings Account!

In the fast-paced world of modern banking, customer expectations are evolving rapidly. As financial services become increasingly competitive, banks must adapt to provide exceptional value and personalized service to their clients. Recognizing this need, Canara Bank has launched an exclusive membership program called Canara Crest Savings Account. Designed to offer privileged benefits and services, this program sets a new benchmark for premium banking experiences.

- What is Canara Crest Savings Account? 🗃️

- Membership Highlights 🔥

- Who is Eligible for Canara Crest? 👨🏻💼

- Canara Crest Membership Tiers 🗂️

- About New Canara Crest Savings Account 🚀

- 23 Free Banking Services in Canara Crest 🤑

- 32 Call Centre Facilities 24x7 ⚡

- Elevate Your Banking Experience 📈

- Frequently Asked Questions (FAQs) 🤔

What is Canara Crest Savings Account? 🗃️

Canara Crest is a savings account-based membership program tailored for customers who maintain a high Annual Average Balance (AAB) or Quarterly Average Balance (QAB) in their accounts. The program is specifically designed to reward and recognize valued customers who maintain an AAB/QAB of ₹10 lakhs or more in a single savings account.

This initiative reaffirms Canara Bank’s commitment to delivering superior value and ensuring a seamless banking experience for its premium customers.

Membership Highlights 🔥

While specific perks will be unveiled upon enrollment, members can expect features like:

- Priority Service across all branches 🔝

- 20+ Services offered At-par across Branches 🤝

- Zero Fee banking across 25+ Banking Services 🆓

- Dedicated Single Point of Contact (SPOC) for all banking needs – Branch Head 👨🏻💼

- Access to exclusive Crest Premium lounges in select branches 💺

- At-Par Services Across Branches (including Non-home Branches) for selected services 📝

- Enhanced Cheque Withdrawal limit of Rs. 5 lakhs 💵

- Unlimited service charge waivers on Selected Services 🎁

- Debit & Credit Cards with benefits worth up to Rs. 10 lakhs p.a. 💳

- 24×7 Exclusive & Direct Call Centre support (1800-1030) 📱

- Complimentary Personal accident, Baggage Insurance and Purchase Protection Cover as per CanCare policy in addition to Card based insurance covers 🛡️

Who is Eligible for Canara Crest? 👨🏻💼

Eligibility for Canara Crest is straightforward:

- Existing Customers: Savings account holders who meet the eligibility criteria will be automatically invited to join the program. Invitations will also be extended as and when customers meet the required balance thresholds.

- New Customers: Those interested in joining the program can open a new Canara Crest Savings Account to enjoy the exclusive benefits.

Canara Crest Membership Tiers 🗂️

Joining the Canara Crest program is simple. The Canara Crest program offers two distinct membership tiers to cater to different customer needs:

- CREST: For customers maintaining an AAB/QAB of ₹10 lakhs to less than ₹50 lakhs in a single savings account.

- CREST PLUS: For customers maintaining an AAB/QAB of ₹50 lakhs and above in a single savings account.

These tiers ensure that all eligible customers receive services tailored to their financial standing, enhancing their overall banking experience.

About New Canara Crest Savings Account 🚀

1. Type of Account 📁

- Savings – Individual with age 18 years and above

- Joint Accounts, Foreign Nationals, Customers having BSBD Accounts and any Non-Individual Account Like HUF, Trust, Society, Company, Association, SHG, Institutional Customers, etc are not eligible!

- Existing Savings account over 1 year old.

2. Minimum Balance of Membership 💲

- No Minimum Balance Maintenance Charges

- Initial & Quarterly Average Balance (QAB): Rs. 10.00 lakh – Crest, Rs. 50.00 lakh – Crest Plus; Initial deposit to be deposited within 7 working days of opening account.

- Penalty on Non-Compliance of Initial Deposit: Nil; However, if the customer fails to bring the Initial deposit within 7 working days, the account will be converted to SB General Account.

3. Free Premium Debit & Credit Cards 💳

The Canara Crest Membership Program offers exclusive premium Debit and Credit Cards with top-tier benefits. ‘Master World’ cards and ‘RuPay Platinum’ cards are being offered to the customers with maximum daily ATM Cash withdrawal limit of Rs. 1.00 lakh and maximum daily POS limit of Rs. 5.00 lakhs.

Card Benefits 📢

| Debit Card | QMC* | Approx. Annual Benefits |

| Mastercard Crest Debit | Rs. 750/- | Rs. 2.25 lakh |

| Mastercard Crest Plus Debit | Rs. 925/- | Rs. 3 lakh |

| Credit Card | QMC* | Approx. Annual Benefits |

| Mastercard Crest Credit | Rs. 1,000/- | Rs. 3.5 lakh |

| RuPay Crest Credit | Rs. 1,000/- | Rs. 3.5 lakh |

| Mastercard Crest Plus Credit | Rs. 3,000/- | Rs. 10 lakh |

| RuPay Crest Plus Credit | Rs. 3,000/- | Rs. 10 lakh |

*QMC (Quarterly Maintenance Cost) is Zero if MITC (Most Important Terms & Conditions) complied.

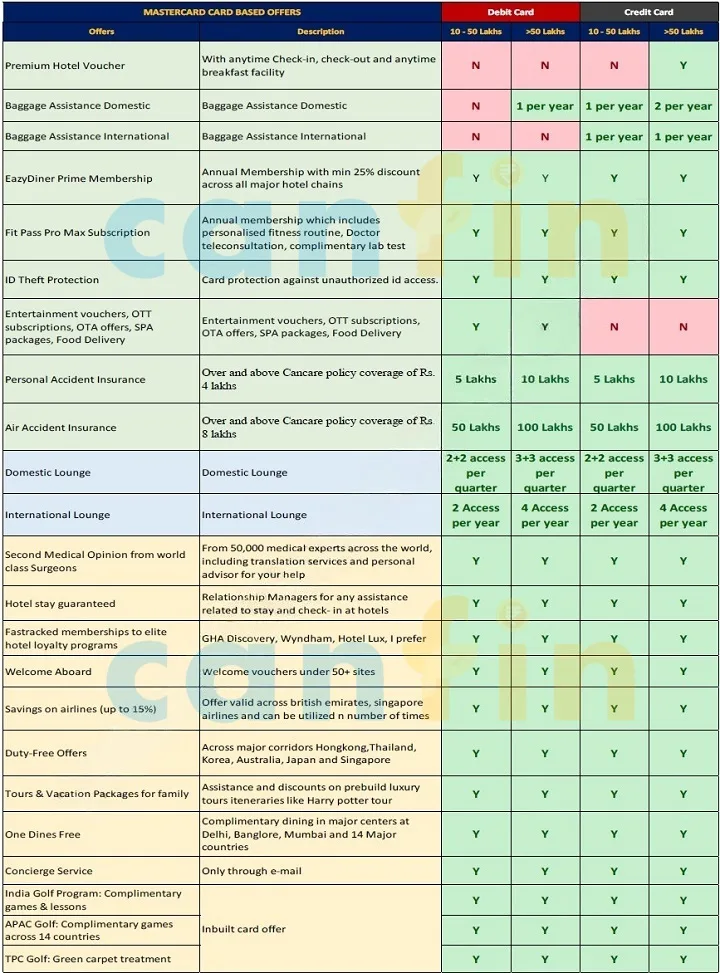

MasterCard Card Based Offers 🎁

To avail offers, Click below.

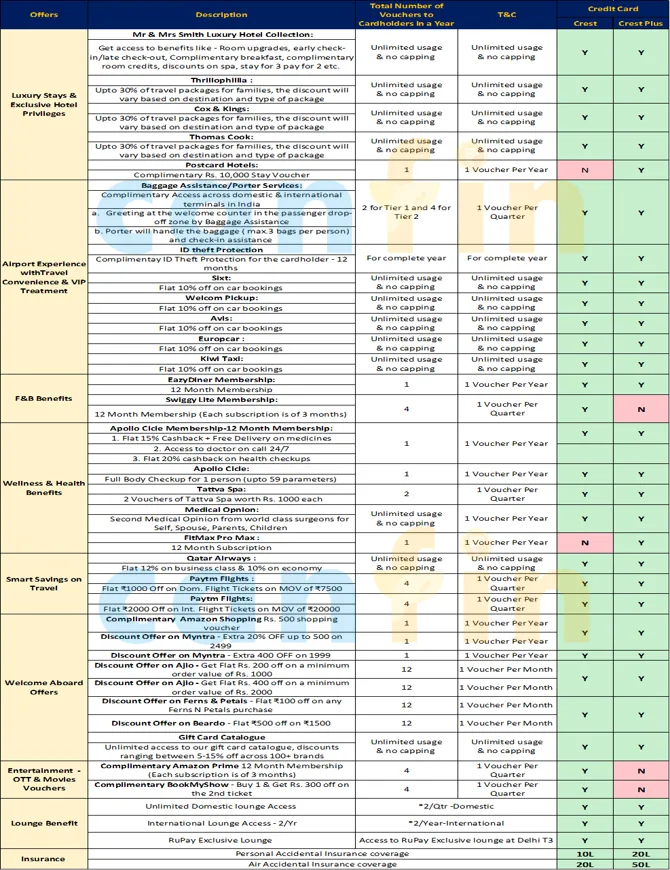

RuPay Card Based Offers 🚀

To avail offers, Click below.

💳 Credit Card Eligibility and Pre-Approved Limit

Based on a comprehensive assessment of account history, CIC (Credit Information Company) score, and other relevant parameters, eligible customers will be extended a pre-approved Credit Card with a limit of Rs. 1.00 lakh.

💳 Credit Card Selection and Issuance

Eligible customers with pre-approved credit limits will have the option to select either a Mastercard or RuPay Credit Card at the time of membership enrollment. Customers who do not qualify for a pre-approved credit card may apply through the standard process, which will follow the current Credit Card Policy and applicable guidelines.

💳 Credit Limit Enhancements

Requests for any enhancement in credit limits shall be processed in accordance with the Credit Card Policy.

4. Membership Validity ⏳

- Lifetime Membership subject to satisfactory compliance of Quarterly Average Balance of the selected membership segment – every quarter.

- Failure to comply with Terms & Condition for 4 consecutive quarters shall result in automatic Cancellation of Membership.

Related: Unlock 30+ Financial Benefits with Canara Angel Woman’s Saving Account!

23 Free Banking Services in Canara Crest 🤑

On Compliance of Membership MITC (Most Important Terms & Conditions) following service charges are waived:

- IMPS charges (outward)

- NEFT charges (outward at branches)

- RTGS charges (outward at branches)

- SMS alert charges

- Cheque book re-issuance charges

- Debit Card issuance charges (Once for the Specialised Debit Card)

- Debit Card replacement/re-issuance charges

- ATM transaction charges at Canara Bank ATMs

- ATM transaction charges at other bank ATMs

- Demand draft/pay order issuance charges at branches

- Duplicate statement issuance charges

- Duplicate passbook issuance charges

- Balance certificate issuance charges

- Interest certificate issuance charges

- Stop payment of cheque charges

- Standing instruction setup charges

- Standing instruction failure charges

- Demand draft cancellation/revalidation charges

- Signature attestation charges

- Address confirmation charges

- Charges for retrieval of old transactional records

- Debit Card Pin regeneration charges

- Photo attestation charges

Wherever QAB criteria are not maintained, all the service charges as applicable to SB General Account shall be applicable during the subsequent quarter.

32 Call Centre Facilities 24×7 ⚡

Follwing Services available under 24×7 at Bank’s Call Centres:

- Customers Detail

- CASA Transaction Enquiry

- Last five transactions

- List of Cards of Customers

- Balance Enquiry

- Account Statement Request Information

- Status of Pan card and Aadhar card

- Debit Card Hot listing

- Debit Card related queries

- Credit Card Hot listing

- Credit Card related queries

- Cheque related to Centralize Positive Payment

- TD Balance Enquiry

- TD Details

- TD Renewal maturity date

- RD Balance Enquiry

- OD/CC related Information

- List of active Debit and Credit Cards

- Account Freezing

- Customer Complaint registration (Through CCR/CPGRS package)

- Follow up on complaints

- EMI details

- Outstanding Balance- Loans

- Catering to NRI Customers’ queries- NRI products, Documents required, SWIFT Code information

- Internet Banking Login and Block status

- UPI Blocking on IVR

- Account Status inquiry (Regular, Dormant, Debit freeze, etc.)

- AEPS status (Enable/Disable)

- Pre-Approved offers

- Blocking of UPI channels

- Mobile banking blocking

- Canara Crest Membership related query redressal keeping Debit card type as identifier

Elevate Your Banking Experience 📈

With the launch of Canara Crest, Canara Bank has taken a significant step forward in redefining premium banking services. This program is a testament to the bank’s dedication to providing exceptional value and personalized service to its customers. Whether you are an existing customer or looking to open a new account, Canara Crest promises a banking experience like no other.

Take your banking to the next level with Canara Crest. Visit your nearest Canara Bank branch today to learn more and become a part of this exclusive program!

Frequently Asked Questions (FAQs) 🤔

Q. What happens if the QAB is not maintained?

- If the QAB (Quarterly Average Balance) is not maintained, the financial waivers/benefits shall be withdrawn with limited benefits up to the end of the quarter.

- The cycle shall continue every quarter and accordingly the waivers/benefits will be available to the customer quarter on quarter basis.

- Wherever QAB reinstated during a quarter, all applicable benefits shall be restored for the subsequent quarter.

- If QAB not maintained for 4 consecutive quarters, Membership will be Cancelled.

Q. Are there any restrictions on account types eligible for the CANARA CREST program?

Yes, certain account types such as joint accounts, minors, and non-individual accounts are not eligible for the CANARA CREST membership. Also, existing accounts opened less than a year ago are not eligible.

Q. Are NRIs eligible for onboarding the program?

Yes, NRIs are eligibles are eligible for Crest Membership.

Q. If existing customer is identified as eligible for Crest program, however at present the account balance is below Rs.10.00 lakh / Rs, 50.00 lakh. Can the customer be still onboarded? If yes, whether he will have to bear charges for cards and other services?

Yes, an identified customer can be onboarded even if the current balance/ average balance is below Rs. 10.00 lakh / Rs, 50.00 lakh by analyzing the last one year historical balance in the account. Thus, if the customer is eligible as per package, he can be onboarded to the program.

Implementation or waiver of charges is only dependent on maintenance of QAB in the account after onboarding the program. Moreover, the onboarding quarter is a buffer quarter, hence exempted from monitoring of QAB allowing time for customers to bring in balance shortfall. Thus, no additional charges will be collected such customers shall enjoy the waivers if they maintain account QAB post onboarding else the same shall be chargeable quarter on quarter basis.

Q. Are there any specific requirements for KYC updates?

Yes, as a part of Customer Information and KYC requirements, the following details must be up to date in CBS before onboarding:

- PAN Card

- Passport (Mandatory of NRIs)

- Email ID

- Mobile Number

- Address

Q. Are customers maintaining over Rs. 10.00 lakh balances in accounts other than savings account, like individual Current Accounts, Jointly Operated Savings accounts, Term deposits balances over Rs. 10.00 lakh etc., eligible for membership?

No, only Individual – Savings Accounts are eligible for membership.

Q. Are there any penalties for not making the initial deposit?

If the initial deposit is not made within 7 working days, the account will be converted to a general savings account or any other eligible product of the customer’s choice.

Q. How is the membership status reviewed?

Membership status is reviewed quarterly at the end of the quarter based on the maintenance of the required QAB during the quarter.

Q. What is the process for reinstating membership after cancellation?

Membership once cancelled cannot be auto reinstated. However, by maintaining an Annual Average Balance of over Rs. 10.00 lakh customer becomes eligible for membership and receive membership invite from bank.

Q. How do customers access 24×7 call center support?

Members can contact the dedicated call center for assistance with various banking services, including account inquiries, card-related issues by dialing 1800-1030.

Can a customer opt out of the membership?

Once onboarded, customers can opt-out at any time by submitting a written request to their branch. However, proportionate Crest card charges shall be collected, if the card is surrendered along with the membership.

Q. Will the membership benefits continue if the customer opts out of the program?

Upon opting out, all membership benefits and privileges will be withdrawn, but any issued debit/credit cards will remain valid until their expiry and Quarterly Maintenance Charge/ Annual Maintenance Charge for the card/s shall be collected periodically.

Q. What is the role of the Branch Head in the CANARA CREST program?

- Branch Head is the relationship manager for all crest Customers of his branch.

- The Branch Head also acts as the primary point of contact for all service requests from CREST customers presenting themselves at his branch ensuring prompt attention to their needs.

- For example, Branch head of ‘Branch A’ is the Relationship Manager for all Crest Customers of ‘Branch A’. He is also the primary point of contact for any other Crest customer from any branch visiting ‘Branch A’ for any service.

Q. What to do if a customer is interested in becoming a Crest member but does not want to avail Crest Debit/Credit Card/s?

Customers, while onboarding the program, will have the option of choosing:

- Only Credit Card

- Only Debit Card

- Both Credit & Debit cards

- None of the cards.

Hence, Existing customers may be onboarded without issuance of any card.

However, since the cards are exclusively curated for the Crest program offering significant benefits over other cards customers must opt for Crest card.

Q. Can a customer apply for multiple Crest Debit Cards or multiple Crest Credit Cards?

One customer is eligible to apply for only one Crest Debit card and one Crest Credit Card. Under no scenario can one account be issued more than one of the exclusive Crest Debit & Crest Credit card.

Q. Who is eligible to apply for Crest Credit Card?

Only Crest members are eligible to apply for Exclusive Crest Credit cards and the same is not available for issuance to general customers.

However, based on certain criteria determined by Bank, only selected customers will have a pre-approved limit of Rs. 2.50 lakh/ Rs. 5.00 lakh as per respective membership tier. Such customers will be issued the card with the specified limit, if requested while onboarding the program.

Q. How to apply Crest Credit Card if the customer is not eligible for Pre-approved Credit limit?

Wherever the customer is found not eligible for Pre-approved Credit Card, branches will follow the existing credit card application procedure. However, the card variant to be applied will be an appropriate Crest Credit Card variant.

Q. Is there any inactivity fee for Crest Credit Cards?

There is no inactivity fee for the Crest Credit card, however, if the Credit Card is not used for a period of more than one year, the process to close the card, as per existing guidelines, will be initiated after intimating the cardholder.

[…] Post Office Savings Account is a safe and reliable savings option offered by India Post, providing an interest rate of 4.0% per […]