Canara DiYA Portal is Closed!

To refine the account opening experience; Now, with newly revamped Canara Bank Online Account Opening portal, users can enjoy advanced security features for a safer and more secure banking experience. This facility is available only for New Bank Customers.

Canara DiYA Application was introduced for online opening of Saving Bank Account without visiting the branch. As the account was opened in non-face-to-face (OTP based e-KYC authentication) mode, Customer Due Diligence (CDD) was required for that Customer within one year of opening the account failing which account was getting automatically closed by the system on the expiry of one year.

Further, Canara DiYA Application was blocked on Pan India basis from June 2021 onwards for modification to the existing process flow of account opening. The revamped Canara DiYA Application with additional security features to mitigate operational risk is made available with effect from 24.05.2022.

Currently, Canara DiYA App is removed from Google Play Store / iOS Store, only portal is accessible through Canara DiYA URL.

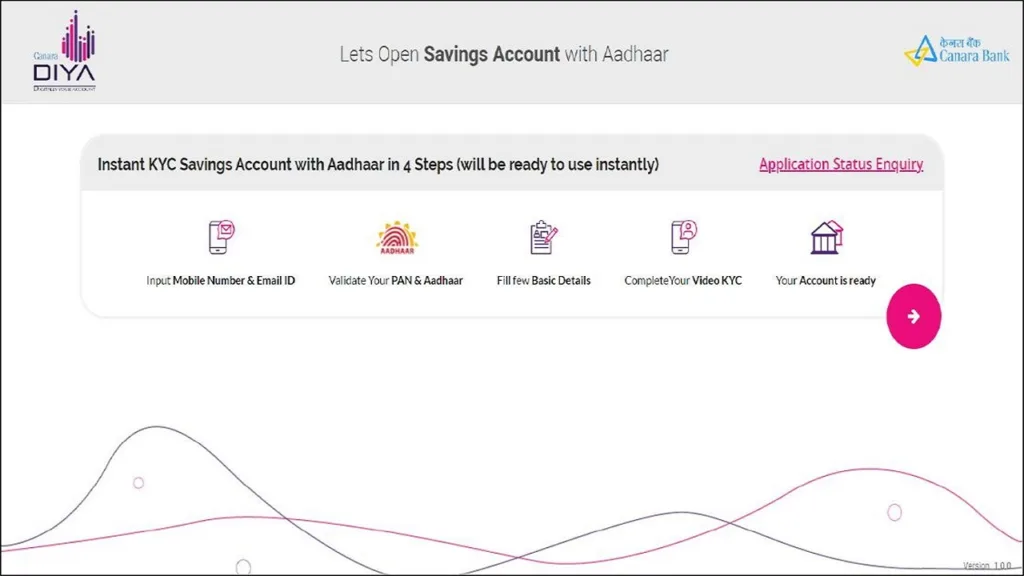

4 Easy Steps to open Instant Saving Bank Account online without visiting the Branch:

- Input Mobile Number & Email ID

- Validate your PAN & Aadhar

- Fill few Basic Details. Select Debit Card type & choose Nearby Branch

- Complete your Video KYC by selecting Time Slots

The Major Changes in Account Opening Process

- Only New Customer is allowed to open the account.

- Apart from SB General (Product code 101), Canara Jeevan Dhara (Product code 110) is enabled for Senior Citizens/Pensioners for opening account of new customer.

- PAN Number is compulsory.

- Only Aadhaar registered mobile number shall be used as registered mobile number.

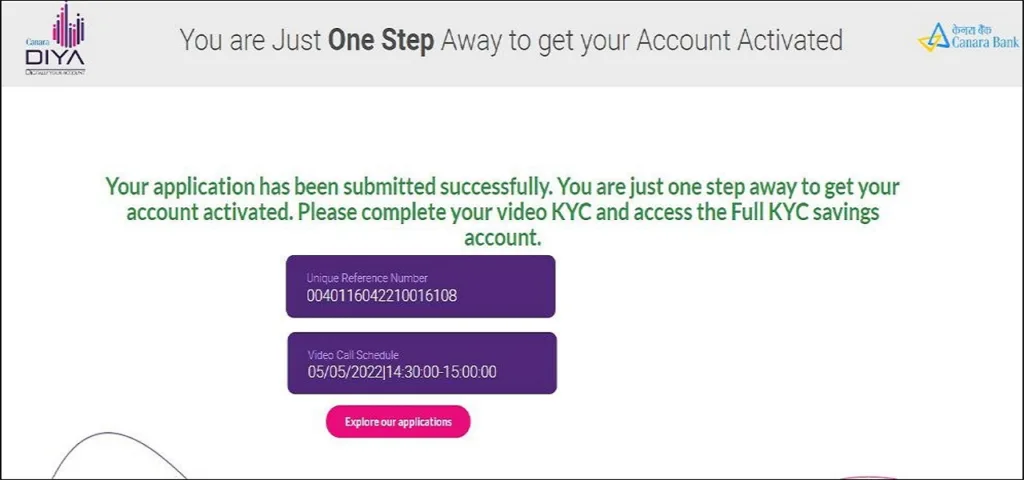

- After successful completion of the account opening process using Canara DiYA, an URN (Unique Reference Number) shall be provided instead of account number. The fully KYC compliant account number shall be generated.

- Customer Due Diligence (CDD) is not required within one year of opening the account as the generated account number shall be KYC Compliant Normal Account.

Steps for Online Account Opening on Canara DiYA

1. Log on to https://canarabankdigi.in/canaradiya or click button below.

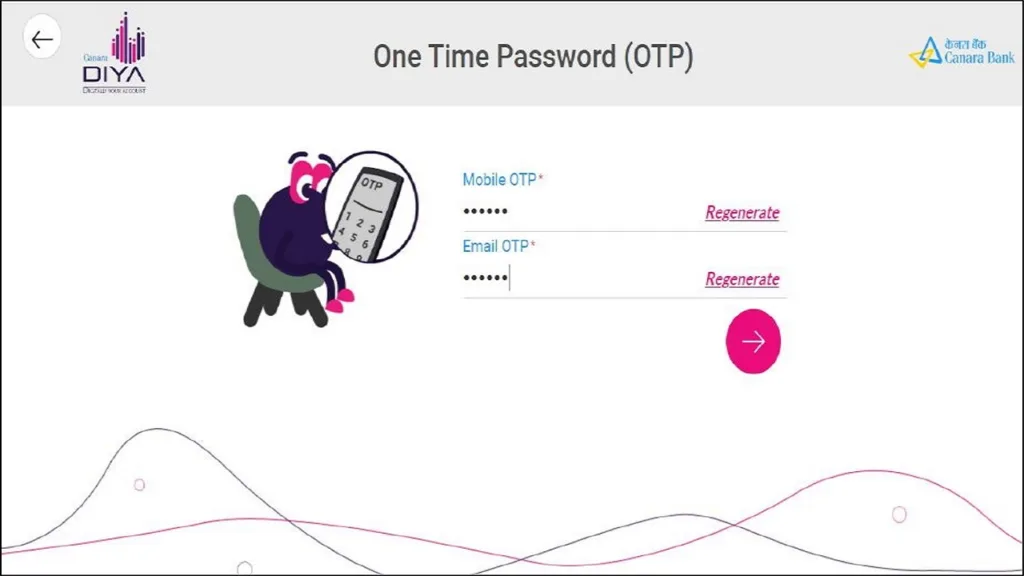

2. Enter your Mobile Number & Email and OTP sent.

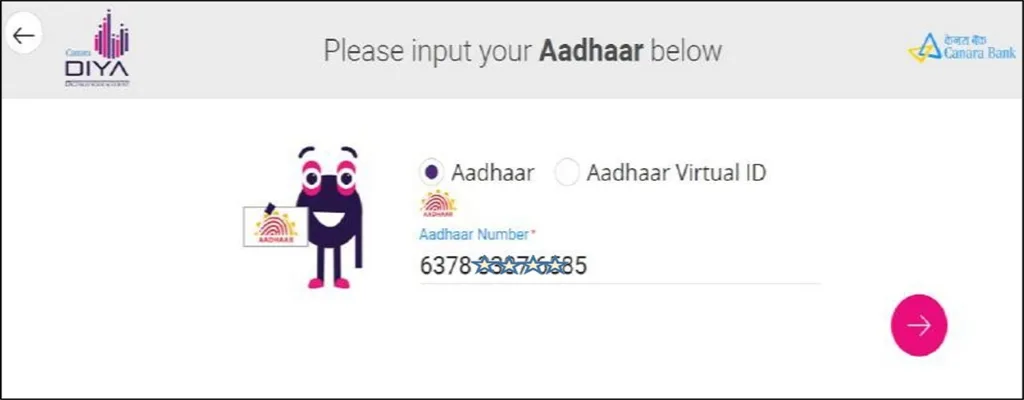

3. Enter Aadhaar number and accept Aadhaar Consent For e-KYC verification.

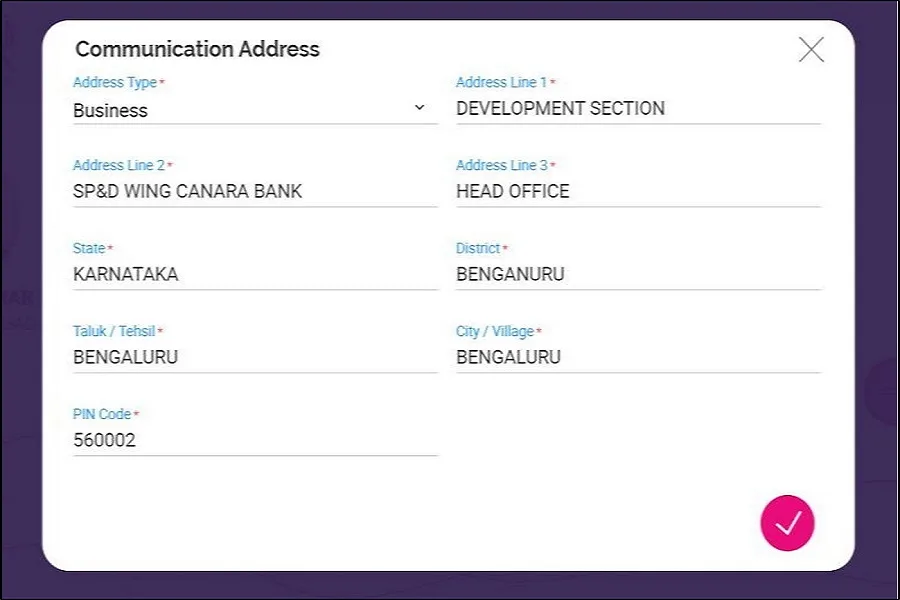

4. Enter your Permanent and Communication Address.

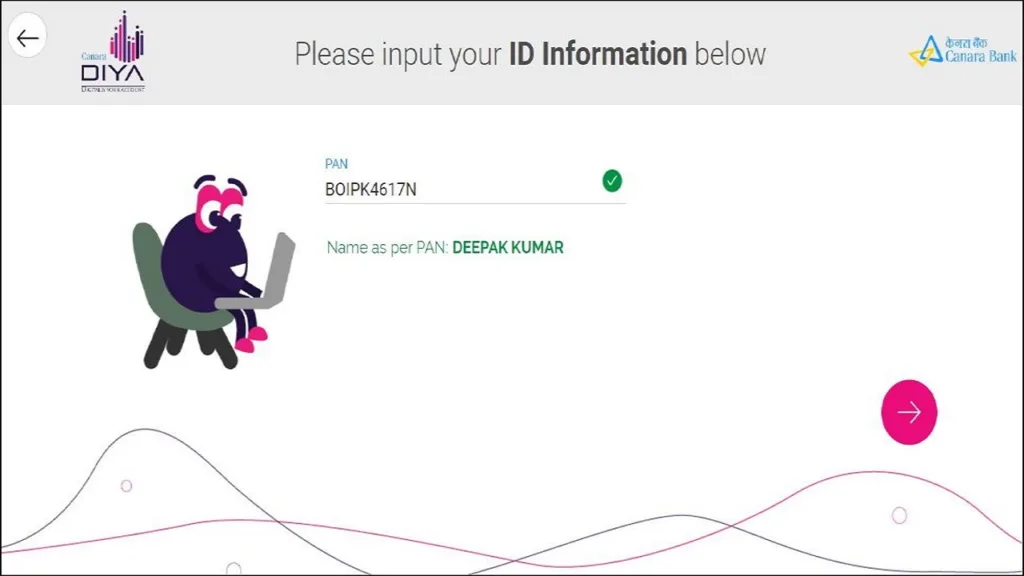

5. Validate your PAN.

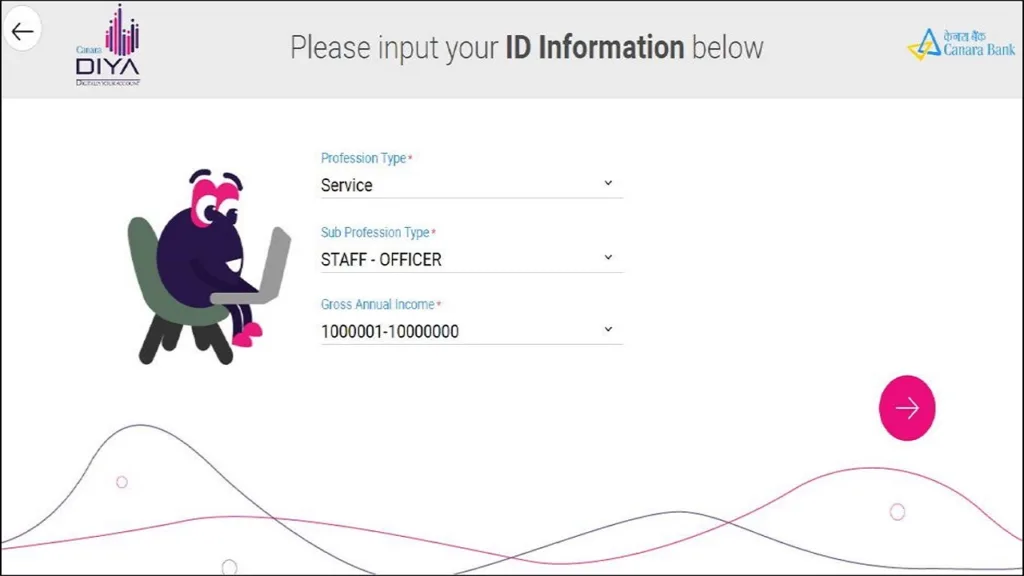

6. Enter your Profession Details.

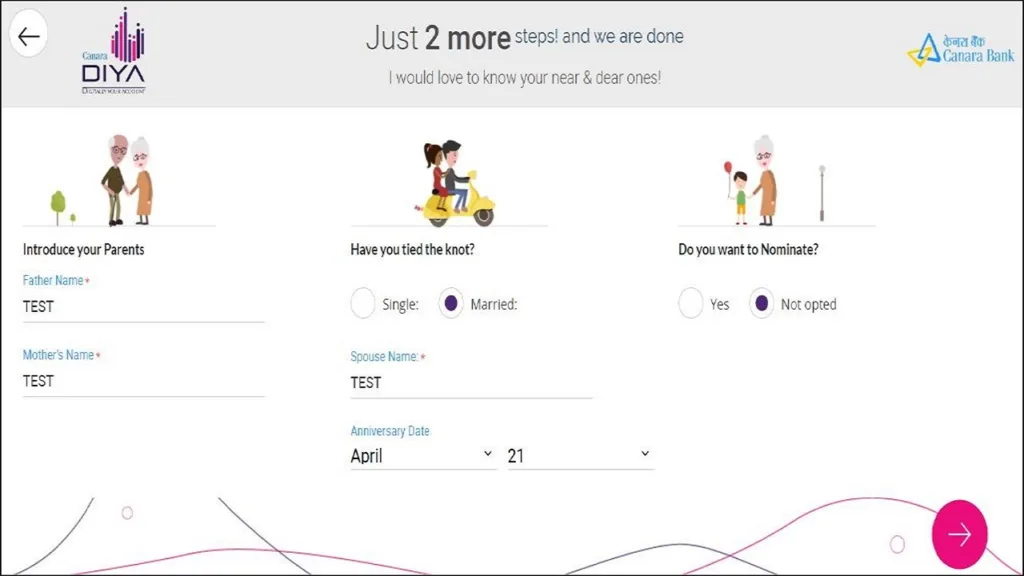

7. Enter your Personal Details.

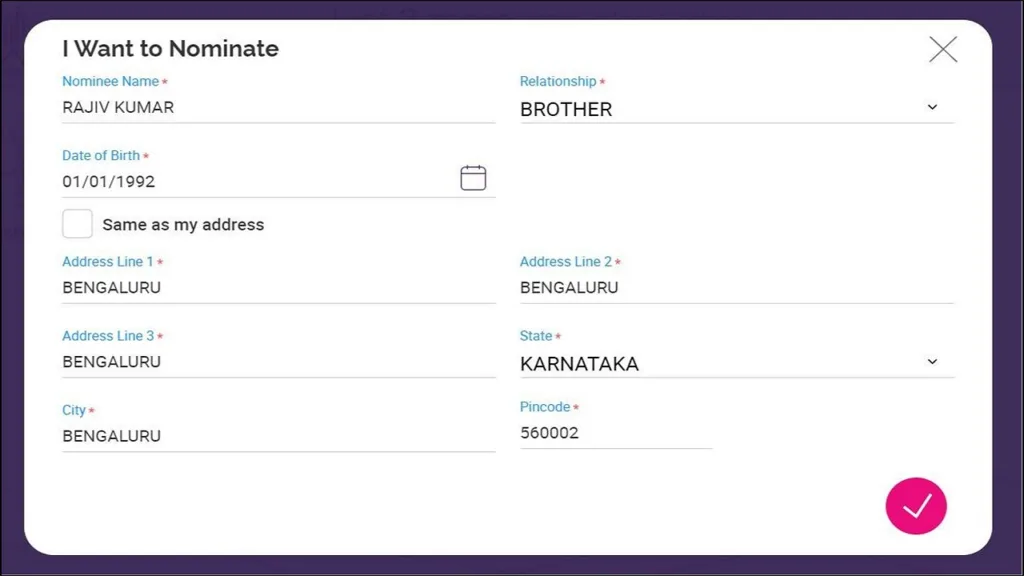

8. Provide your Nominee Details

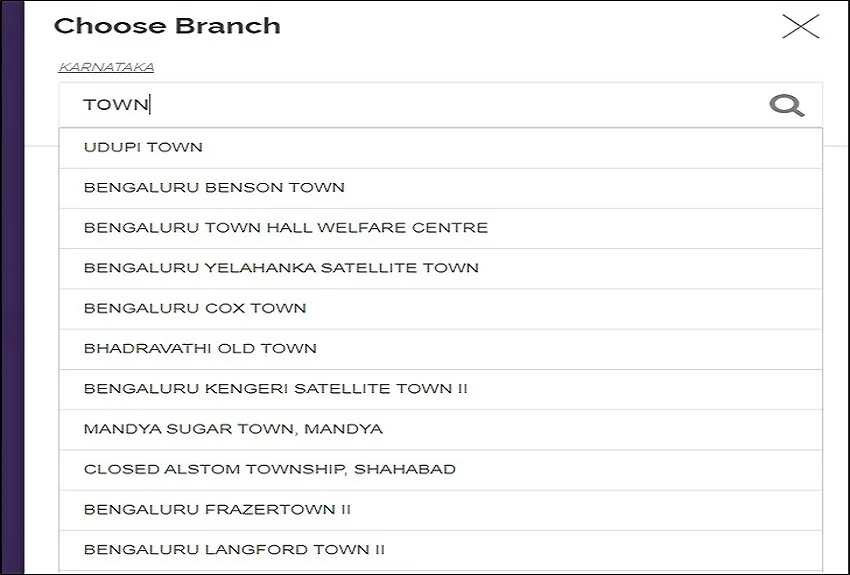

9. Search for a branch nearest to your home.

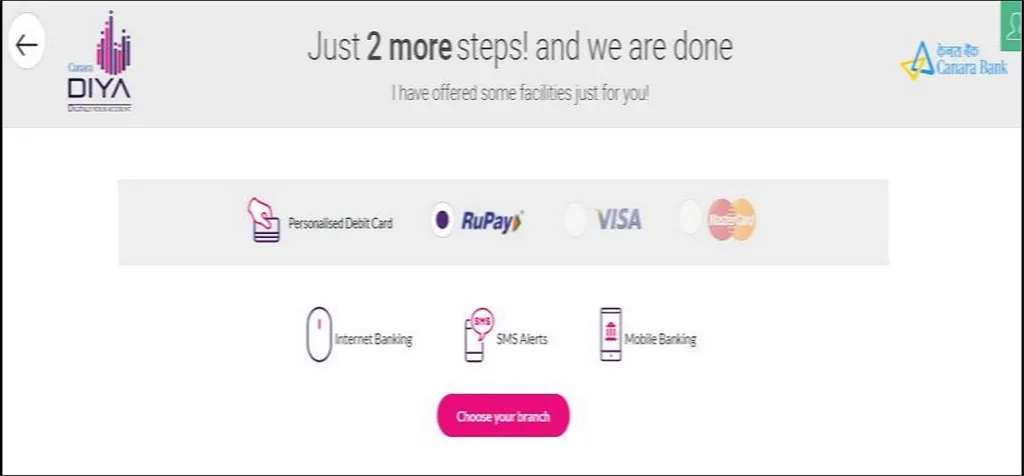

10. Select Type of Personalized Debit Card of your choice.

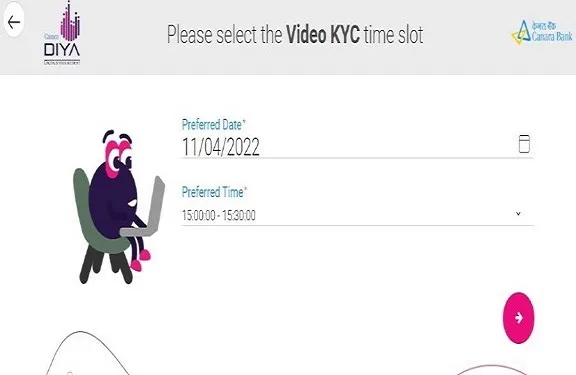

11. Select date and time slot for your Video KYC.

12. An URN will be generated for your reference. Your Account number shall be communicated through SMS/Email on successful completion of Video-KYC.

On successful opening of the account,

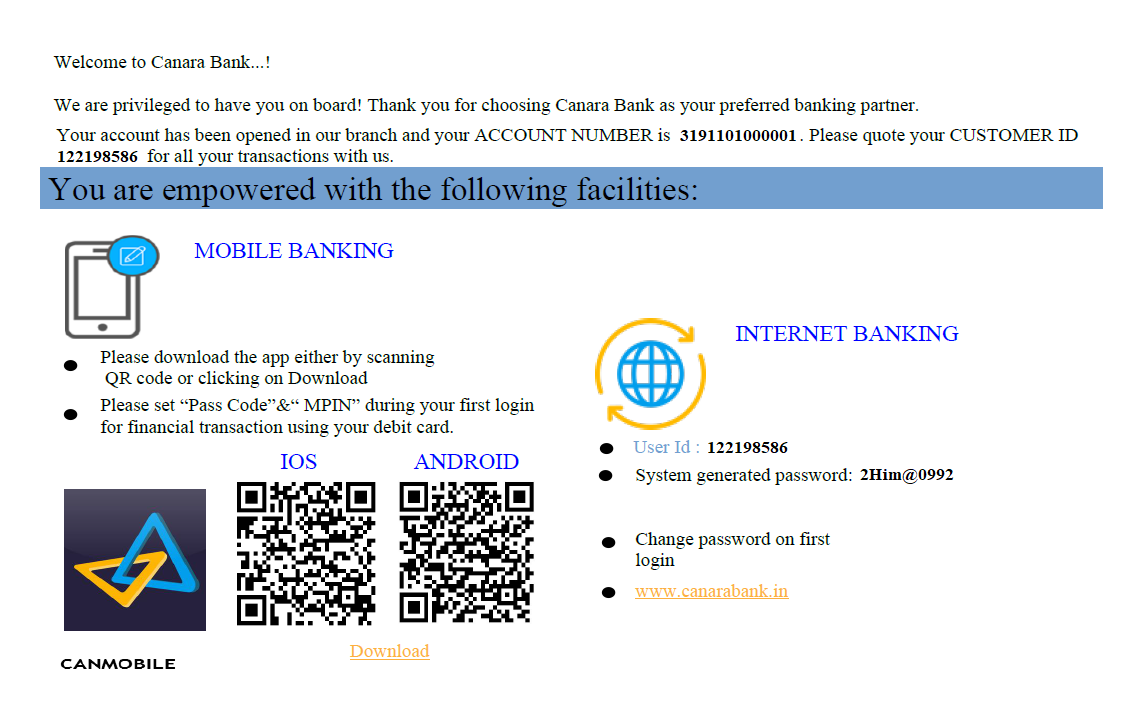

- Customer will instantly get the Welcome Kit on their registered Email ID and it contains important information like Customer ID, Account Number, Nomination details of customer etc.

- Personalized Debit Card shall be sent to the given Communication Address of Account holder.

Related: Canara Bank Savings Account – 8 Things You Must Know!

FAQs

Q. What is Canara DiYA?

Canara DiYA (Digitally Your Account) is a digital portal to open a Canara Bank Savings Account Online. You can access Canara DiYA through your Web Browser or the Canara DiYA app.

Q. What is the Average Minimum Balance (AMB) for the Canara Bank Savings Account?

The average minimum balance of the savings account for Individuals residing in Metro and Urban areas is Rs. 2000, while it is Rs. 1000 for customers residing in Semi-urban and Rs. 500 for Rural areas. For More Details click below:

Q. Is a PAN card mandatory to open a savings account online?

Yes, PAN card is mandatory to open a saving account online.

Q. What is an Interest Rate for Canara Bank Saving Account?

Rate of interest on Savings Account is 2.9% for deposits below Rs. 50 lakhs. For deposits above Rs. 50 lakhs, check rates form link below:

I am trying to get my SB account opened online with Canara Bank, Bhilai Smrithi Nagar Branch. Every time it goes up to Time Slot Selection for Video KYC smoothly but once this time slot booking section comes, it is not showing any time slots rather in a new ribbon, with Select written over it, comes.

Thus, I am unable to get my SB account opened with Bhilai Smrithi Nagar Branch.

Kindly help me out with this, please.

Thank You.

Try to choose next dates else server issue, may resolve soon! I will let you know..

I have tried with different dates but was unable to get the Time Slot tab. Kindly look into it.

Thank You.

Server issue continues, try Instant Account Opening with Aadhar from branch without filling form.

Still am facing the same issue. Am unable to select the time slot it showing no option

I have booked the slot on 29.08.2023 at 5.30 pm but I came to the link that shared to the mail but not still now not yet called for video kyc.I have made the call to the customer care they said we didn’t know about this matter.

Pls help and reply me.

After that I have checked in the status it shows still slot is booked not able to change.Pls reply

Kindly share screenshot of URN number and Video call schedule to Customer Service Center nearest you on Contact Details here.

just I am try to getting my time slot for video kyc but when click on time slot no any time availability showing. please do any needfull action for this matters.

I’ll let you know tomorrow!

From yesterday onwards I am trying to access the site but it shows server error. when it will become operative to open savings account via online

It’s working: https://canarabankdigi.in/canaradiya/

I don’t get a Kyc video call

I completed my video KYC since 3 week but yet get any updates or account details. Even customer care are not able to track this matter. Help me regarding this. ..

Email your KYC details to hi@canfin.in

I tried to open canara bank account on line , but couldn’t complete the process for want of getting video KYC time slot . could you pl. help me …

Server issue continues, try Instant Account Opening with Aadhar from branch without filling form.

SIR, WHAT’S MAX. BALANCE LIMIT FOR THIS ACCOONT??

https://canfin.in/service-charges-nc/#1-average-minimum-balance-amb

Not minimum sir, I am asking about maximum balance

No Upper Limit

https://onlineaccountopen.in/learning-center/canara-bank-online-account-opening/

HERE ITS SHOWING SOME LIMITS SIR..

That upper limit of 1 Lakh is for normal ekyc accounts. Now, Since video kyc is been introduced, its fully KYC compliant Account, so theres no upper limit.

Sir,

I completed my video kyc successfully yesterday. But i didn’t receive any confirmation or account details yet. What shall i do n whom To contact!

Kindly share screenshot of URN number and Video call schedule to Customer Service Center nearest you on Contact Details here.

Sir yesterday I did many effort for online application canara diya finally I went last step video kyc but I couldn’t because I seen select video kyc time but only option again again select then whole process went wrong no result 😕😕😕

[…] Related: Canara DiYA (Digitally Your Account) – An Online Account Opening Made Easy in 15 Minutes […]

Unable to book video kyc. It keeps on saying slot booked by customer.

On which day?

Not able to proceed after entering aadhar OTP. Please provide solution.

Getting server error from last 2 days. Can’t open a account.

Yesterday completed my kyc via online. Till now i didn’t get account details and even sent mail to hi@canfin. There is no reply. Can u please resolve my issue.

Issue Resolved! ✅

I’m also facing the same issue. Yesterday my vkyc completed and they said you will receive your account num by today night.. Still waiting I didn’t get any mail from them. What I have to do

Visit branch or call customer service at 1800 1030