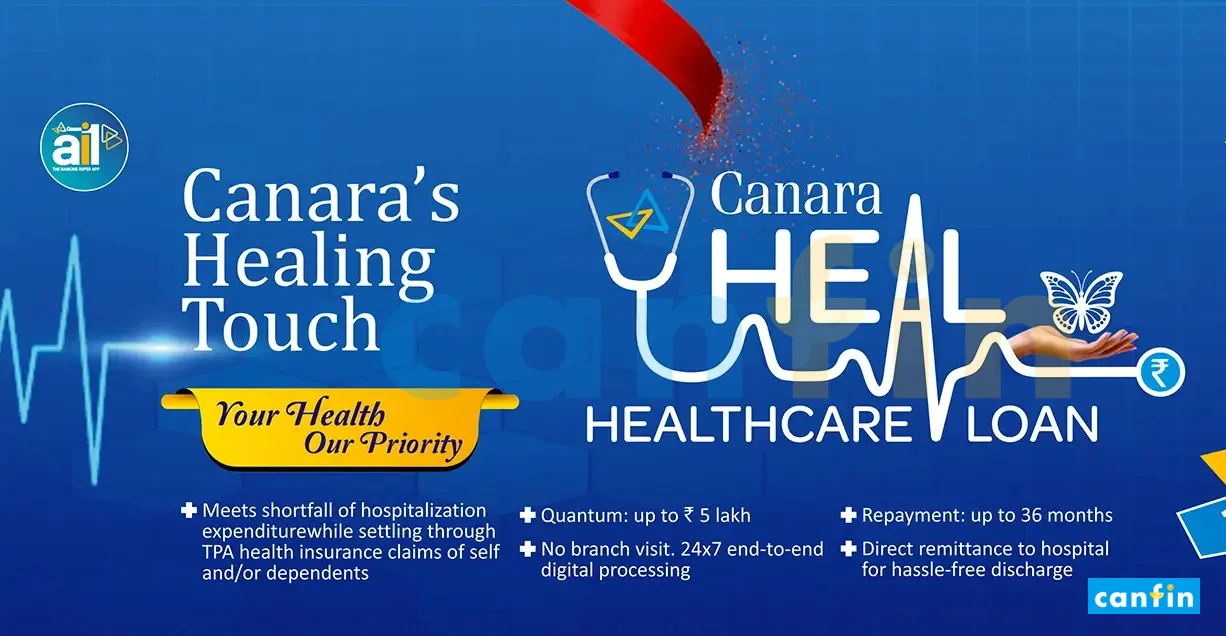

Canara Bank introduces Canara HEAL – Healthcare Loan for quick, hassle-free emergency medical expenses. Accessible online via Internet Banking, Mobile Banking, and Corporate Website.

Medical emergencies can strike unexpectedly, leaving you with a hefty hospital bill and a potential financial burden. Even with health insurance, there can be a gap between the covered amount and the total cost. This is where Canara Bank’s innovative Canara HEAL term loan comes in.

In order to facilitate quick & hassle free financial assistance in funding the shortfall of hospital expenditure while settling the claims of self and/or dependents through TPAs to both Existing & New customers, Canara Bank has launched Digital Emergency Healthcare Loan Product under Retail Loans – “Canara HEAL”- Emergency Healthcare Straight-through-Processing (STP). This is online-only product with quick disbursement.

The above loan facility can be availed through any of the Alternate Banking Channels i.e Internet Banking / Mobile Banking / Canara Bank Corporate Website at ease. The detailed product features of Canara HEAL Term Loan are as under:

Presently, Canara Bank has entered MOU with M/s Medi Assist Healthcare Services Limited & M/s Bajaj Allianz General Insurance Company for extending services under above product & shall cover all network hospitals across PAN India under said arrangement.

Who Should Consider to Apply for Canara HEAL? ❤️🩹

Canara HEAL is an ideal solution for individuals who:

- Have health insurance with coverage limitations.

- Anticipate potential shortfalls in their hospital bills.

- Value a convenient and hassle-free claim settlement process.

- Seek a flexible financing option for unexpected medical expenses.

Understanding Third-Party Administrators (TPAs) in Healthcare 🏥

TPAs are intermediaries between insurance companies and healthcare providers. They handle the processing and settlement of healthcare claims on behalf of the insurer. This can be a convenient option as TPAs manage the paperwork and ensure faster claim settlement. However, it’s important to understand that your insurance policy might have coverage limitations or exclusions.

Features of Canara HEAL Term Loan 💰

Purpose 🎯

A special scheme for funding the shortfall of hospital expenditure while settling the claims of self and/or dependents through TPAs to both Existing & New customers by way of Straight-through-Processing (STP) Healthcare loan with quick disbursement at 24*7 convenience of customers.

Eligibility ✅

Existing Customers 🙋🏻♂️

- Salaried and Non-Salaried Class customers are eligible.

- The customer should be resident Indian aged between 21-55 years.

- For Salaried customer, Minimum salary credit shall be Rs. 50,000.00 per month.

- For Non-Salaried Customer, minimum average balance maintained during the last 6-months shall be of Rs. 50,000.00

- The CIC score of the customer should be above 700.

- Customer should not have slipped to SMA/NPA category in last 12 months, if already availed any credit facility.

- Minors, Joint account holders with other than ‘SOW’ relationship, dormant/in-operative accounts, staff accounts, pensioners, NRE accounts certain pneumonic codes etc. are not eligible under said scheme.

- The existing customer should have more than 6 months relationship with Canara Bank.

- Only ‘INDIVIDUAL’ and Joint Accounts with relationship ‘SOW’ are only eligible.

- In the last 6 months at least 4 times monthly salary shall have been credited in the savings

bank account . - Minimum Credit turnover in savings account should be Rs 1.00 lakh & above in last 6 months. Credit transaction shall exclude IMPS, MB, UPI etc. mode transactions.

- Minimum Debit turnover in the savings account should be Rs 0.75 lakh & above in last 6 months.

All the existing eligible customers shall be sent SMS of the pre-approved limit along with link to avail from the Ai1 Mobile Banking App / Net Banking / Corporate Website.

New Customers 👤

- Only salaried class customers are eligible.

- The applicant shall open a new SB account through online.

Documents required to be uploaded by the New Customers:

- Aadhar & PAN shall be validated online & complete Video KYC.

- Employee ID Card

- Last 6-months salary slips & last one-year bank statement.

- Last 2-year ITR

The facility shall be availed through SMS Link / Ai1 Mobile Banking App / Net Banking / Corporate Website

Quantum & Net Take Home Salary 💵

Minimum of Rs 1.00 Lakh & Maximum of Rs 5.00 Lakh, OR

Shortfall of hospital expenditure while settling the claims through TPAs, OR

| Existing Customers | New Customers |

| For Salaried Customer: Six times of the average of last 3 months salary credited in the salary account AND For Non-Salaried Customer: Six times of the average SB balance maintained, OR | Six times of the average of last 3 months net salary credited in the salary account, |

| Wherever the customer has already availed canara budget or salary overdraft then the differential eligible amount, | |

| Whichever is lower | Whichever is lower |

Minimum Net Take Home Salary (NTH) of borrower should not be less than Rs. 20,000/- p.m. after meeting instalments of all existing loans and proposed loan.

Other Features 🧾

Repayment Period

Repayable in 36 EMI (Equated Monthly Instalments) including 2-months moratorium.

Margin: Nil

Rate of Interest

Floating Rate: 11.55%

Fixed Rate: 12.30%

Processing Charges

0.50% of the loan amount with a minimum of Rs 1000/- and maximum of Rs 3000/-

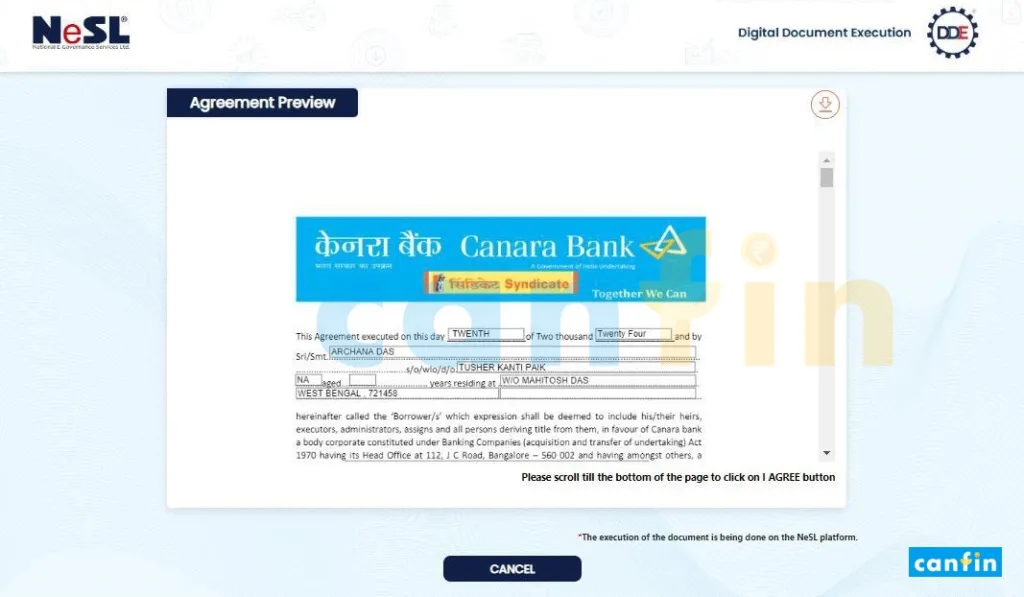

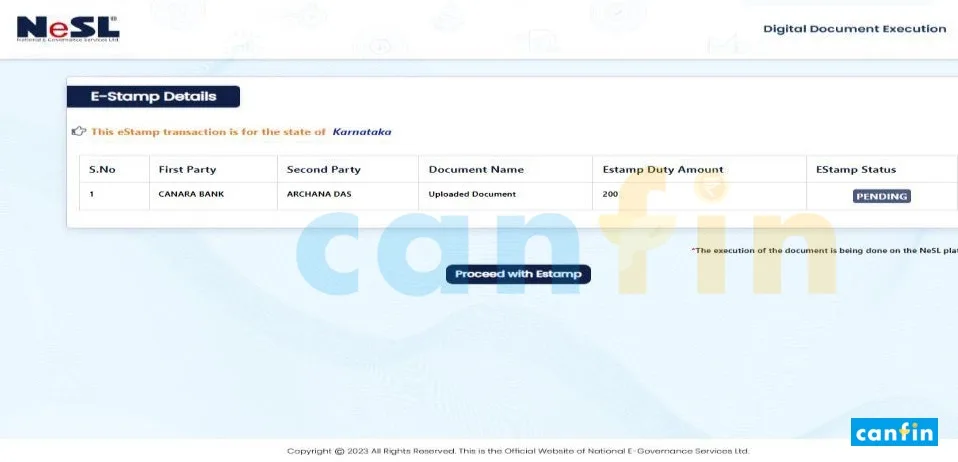

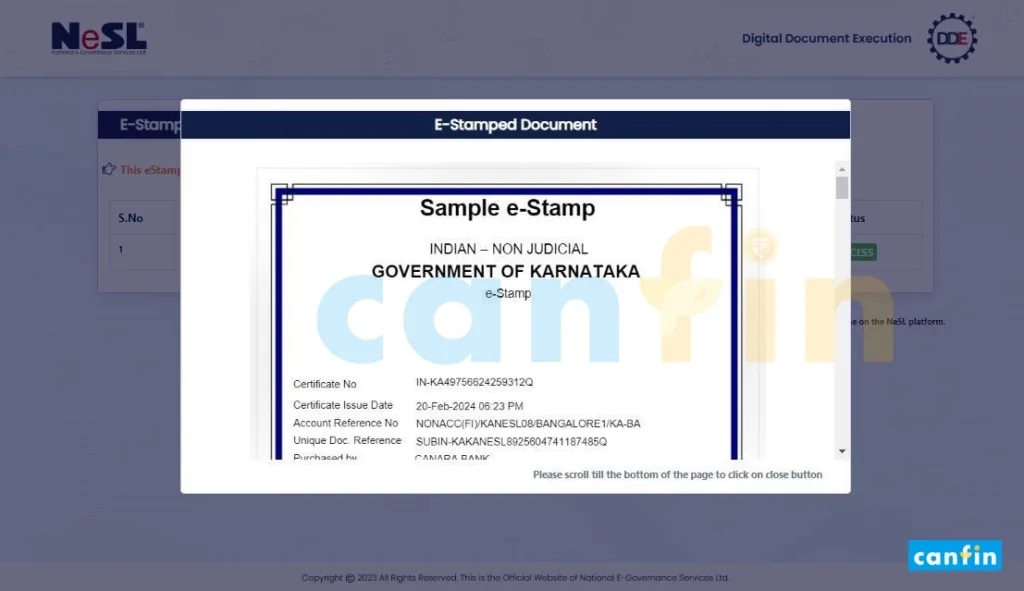

Documentation

Digital Documentation shall be invoked.

Mode of Disbursement

Through internet banking or Ai1 Mobile Banking App

Step-by-Step Guide to Apply for Canara HEAL Term Loan ✍️

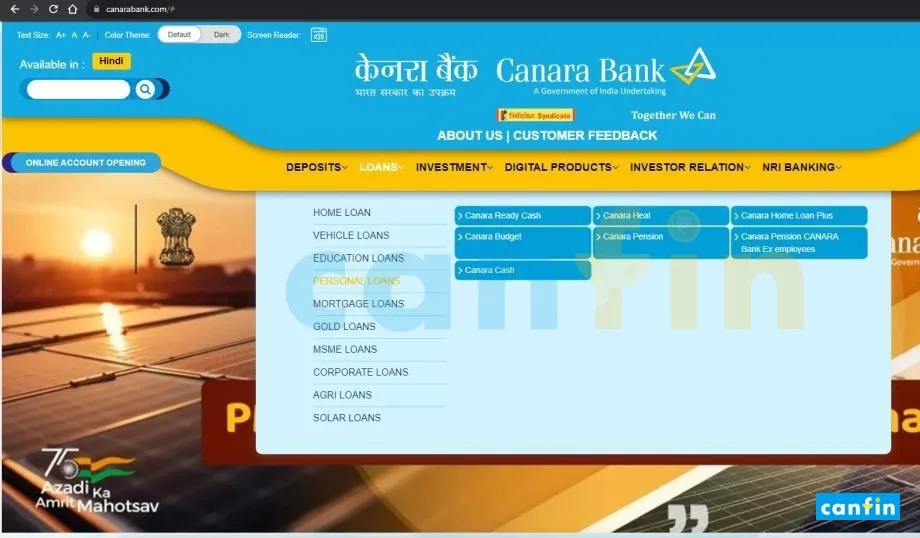

Navigation for availing the Canara HEAL loan under Canara HEAL is as below:

Got to www.canarabank.com > Loans > Personal Loans > Canara Heal > Click on Apply Online or Click below link:

Guide for Existing Customers 🙋🏻♂️

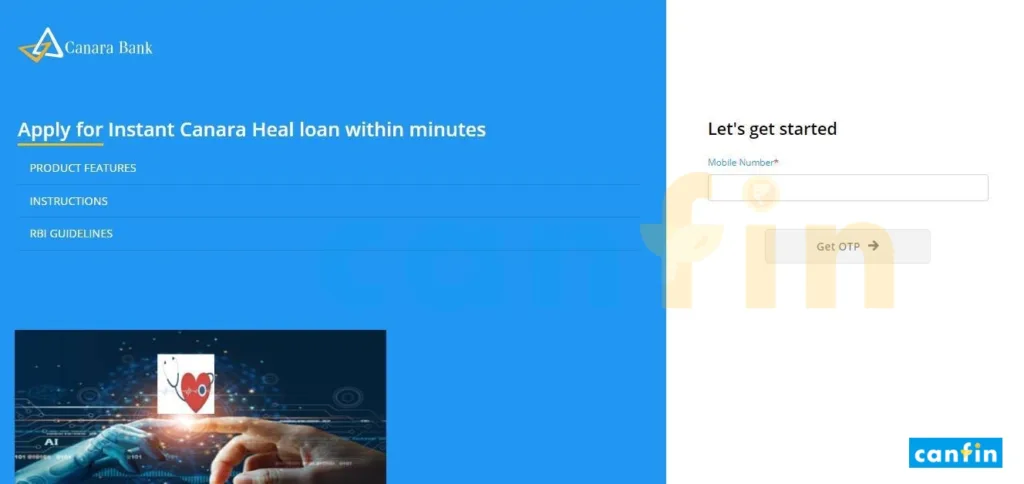

The customer shall initiate the journey by entering mobile number registered with Canara Bank.

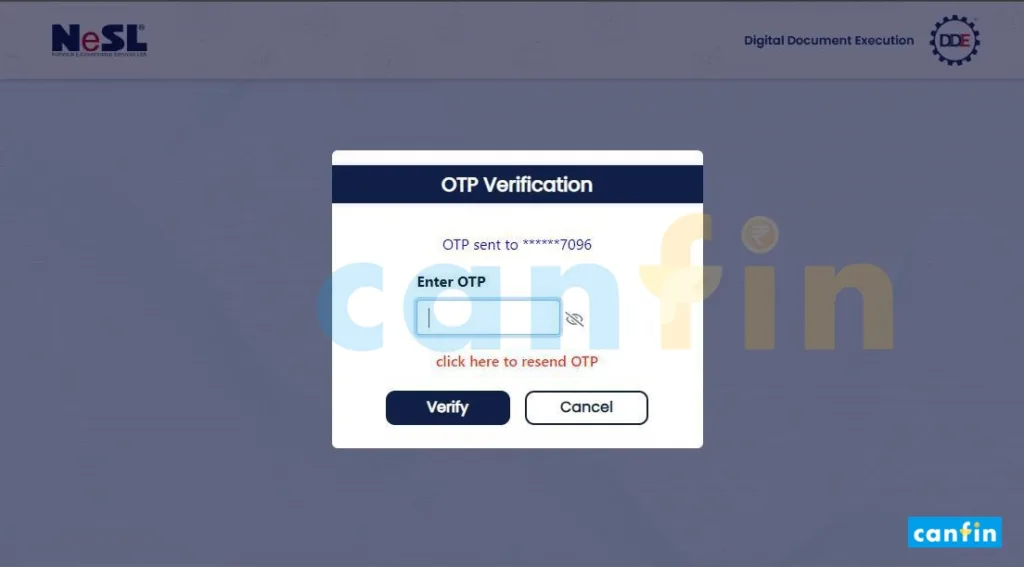

If found eligible, customer to proceed by entering and validating OTP received.

If found ineligible, message shall be displayed as ‘Eligibility not found for the customer’.

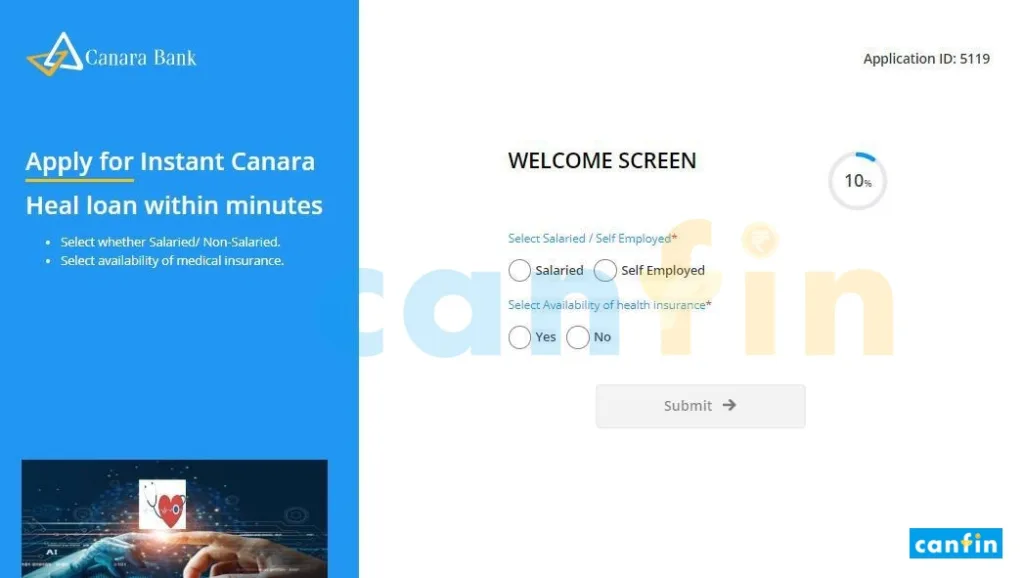

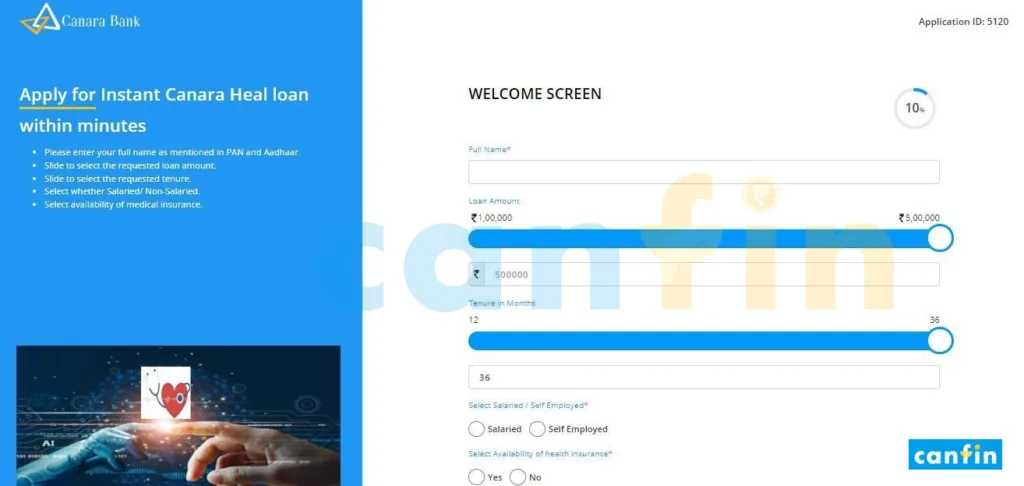

1. Welcome Screen

Welcome Screen will be displayed after validation of OTP. The customer to select Salaried/Self Employed and availability of Health Insurance.

If the customer selects ‘No’ for availability of Health Insurance, consent will be asked for sharing the lead to any of the associated Insurance Company and Journey shall be terminated.

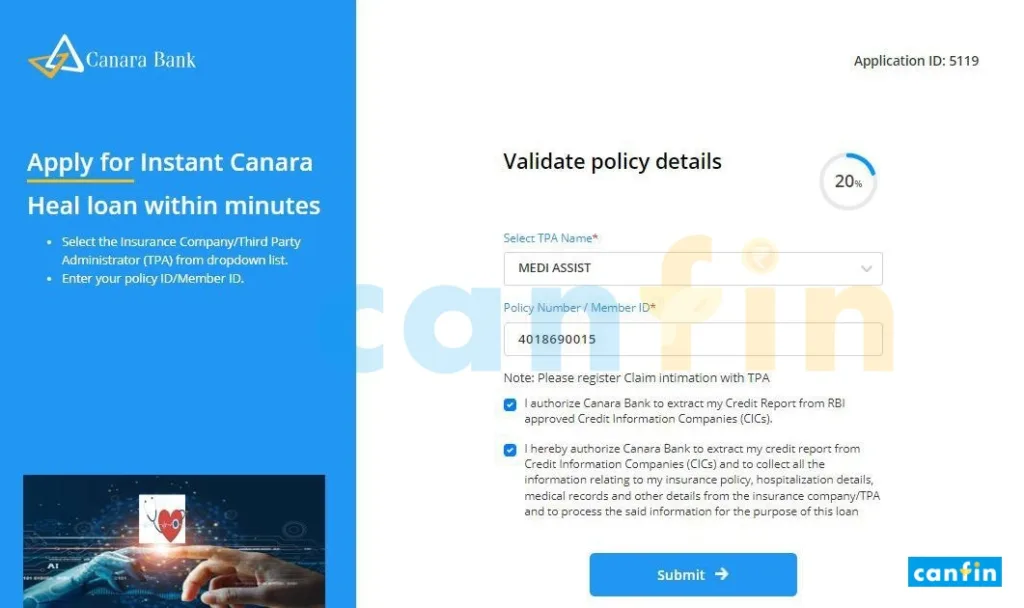

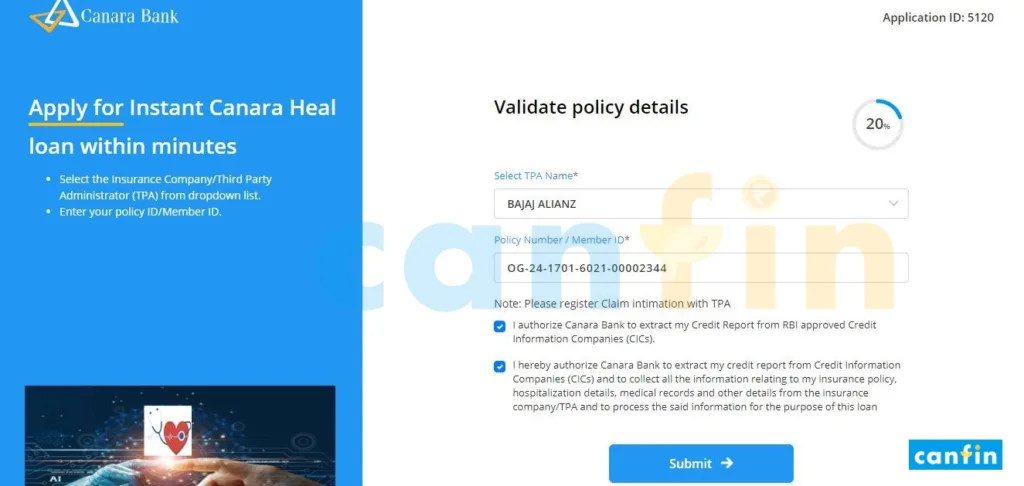

2. Validate Policy details

The customer shall select the Insurance Company/TPA and submit the Policy No / Member ID to proceed to next screen.

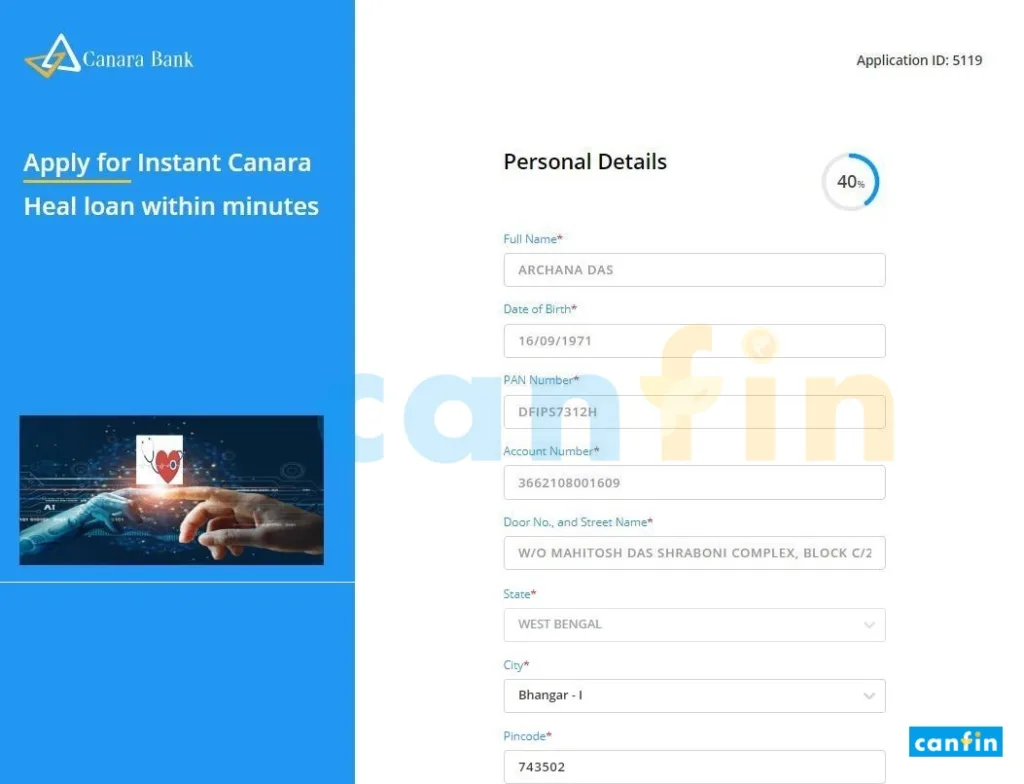

3. Personal details

The customer to furnish his personal details and proceed further.

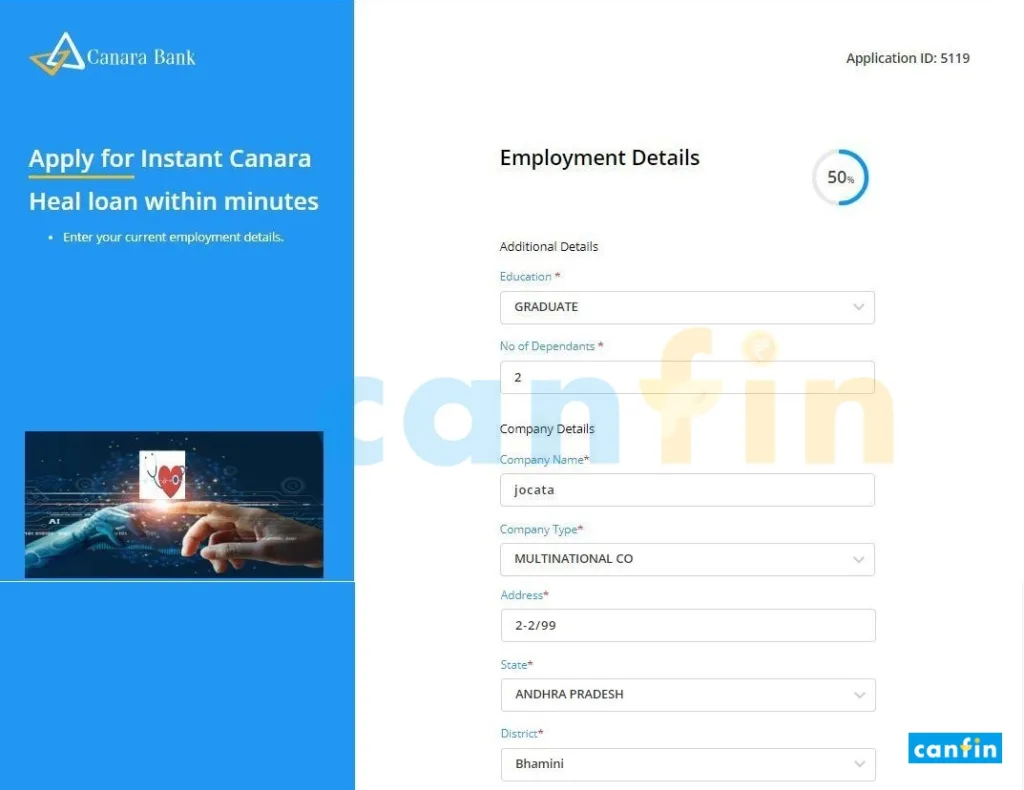

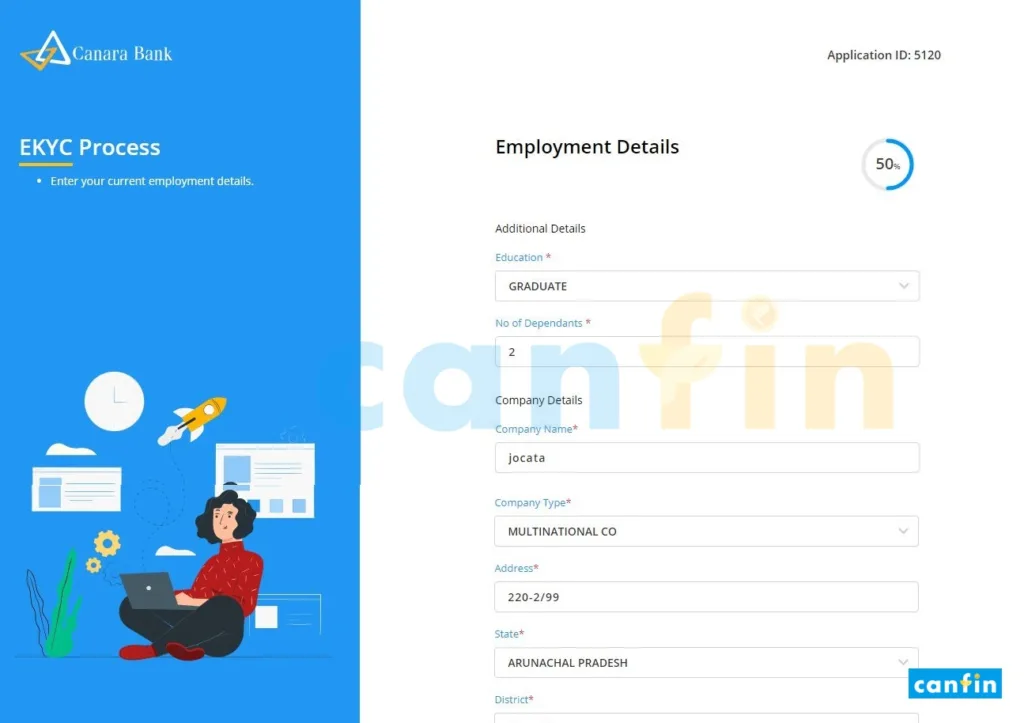

4. Employment Details

The customer to furnish his employment details and proceed further.

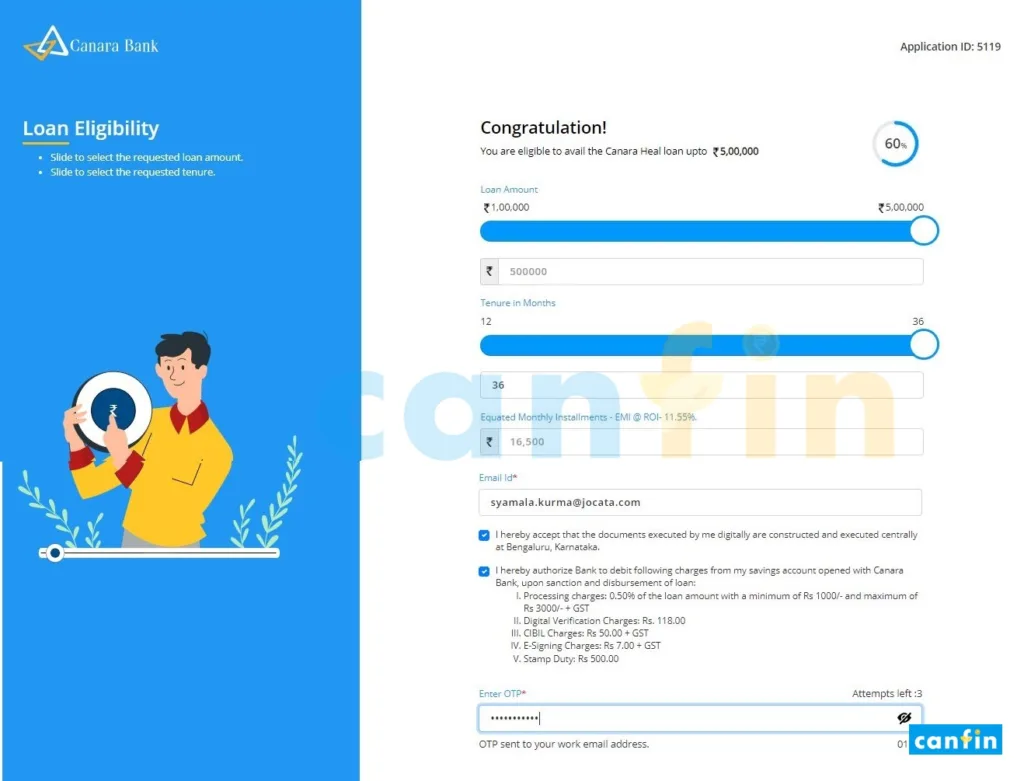

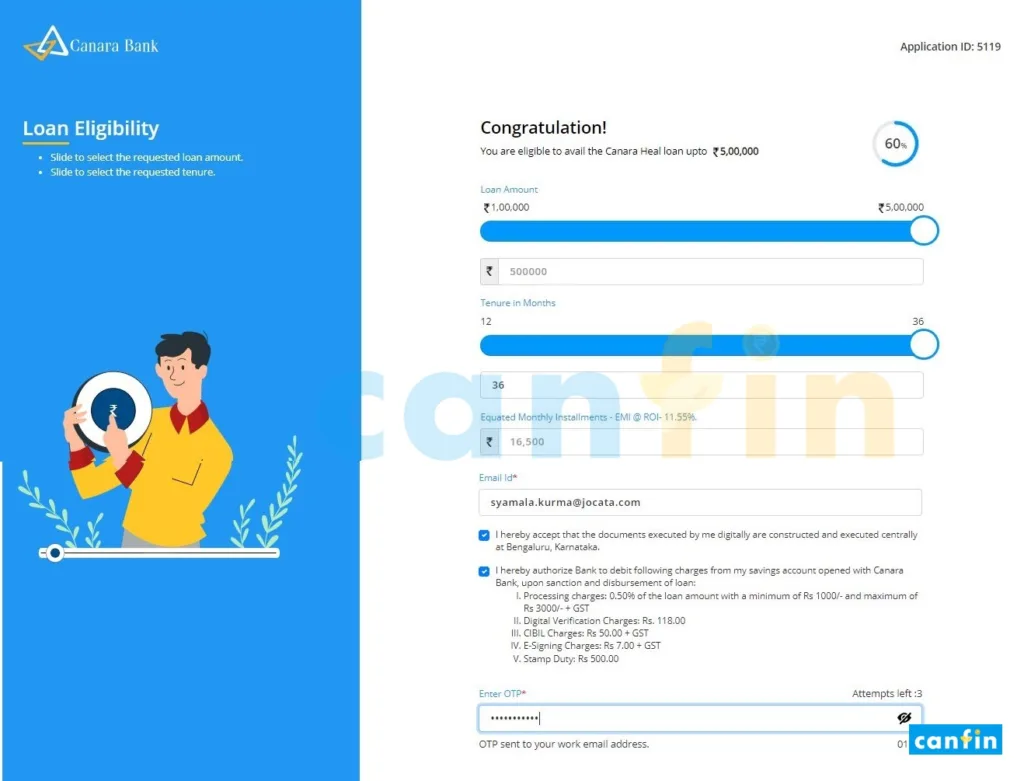

5. Eligibility Page

The customer can slide and select the requested Canara HEAL loan amount and tenure.

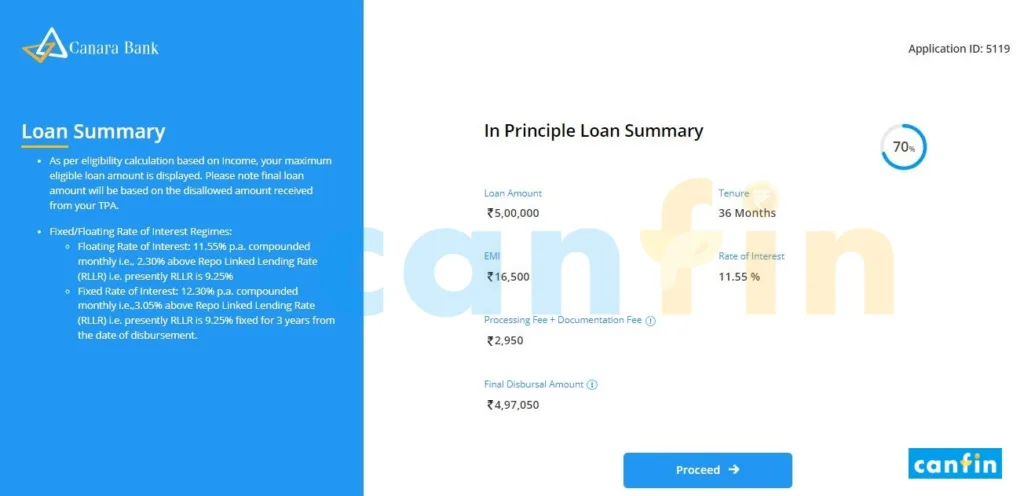

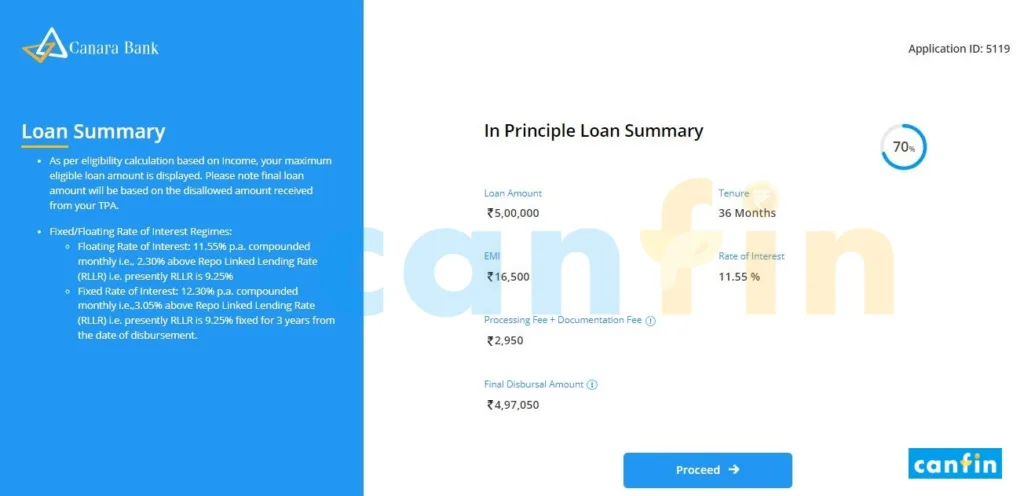

6. In-Principle Loan Screen

Based on the selection of requested loan amount and tenure, In Principle Loan Offer will be displayed to customer to accept and proceed for In Principle Sanction Letter.

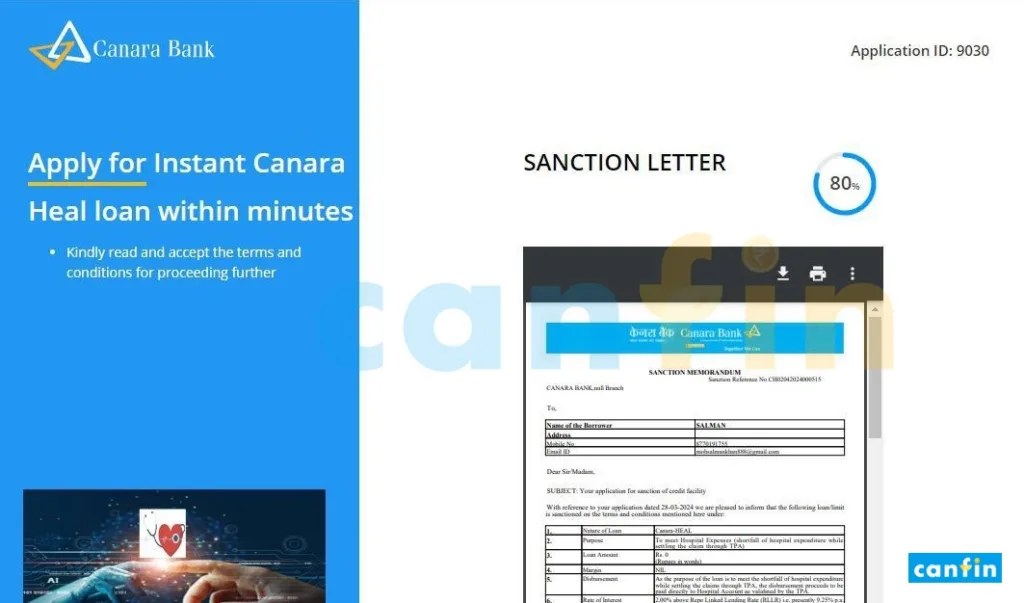

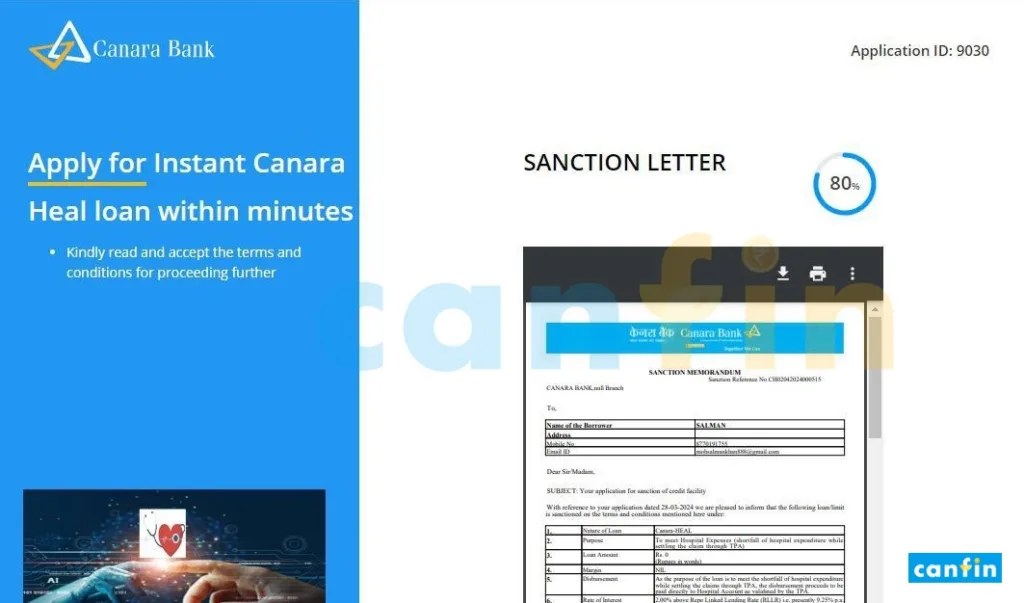

7. Sanction letter

At this screen, In Principle Sanction Letter will be displayed to customer for viewing and downloading the sanction letter.

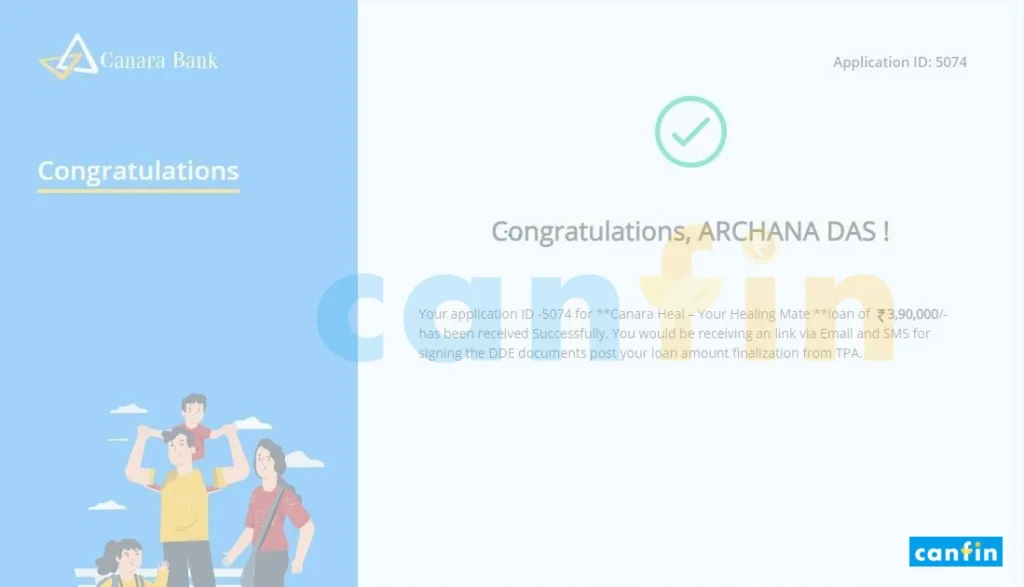

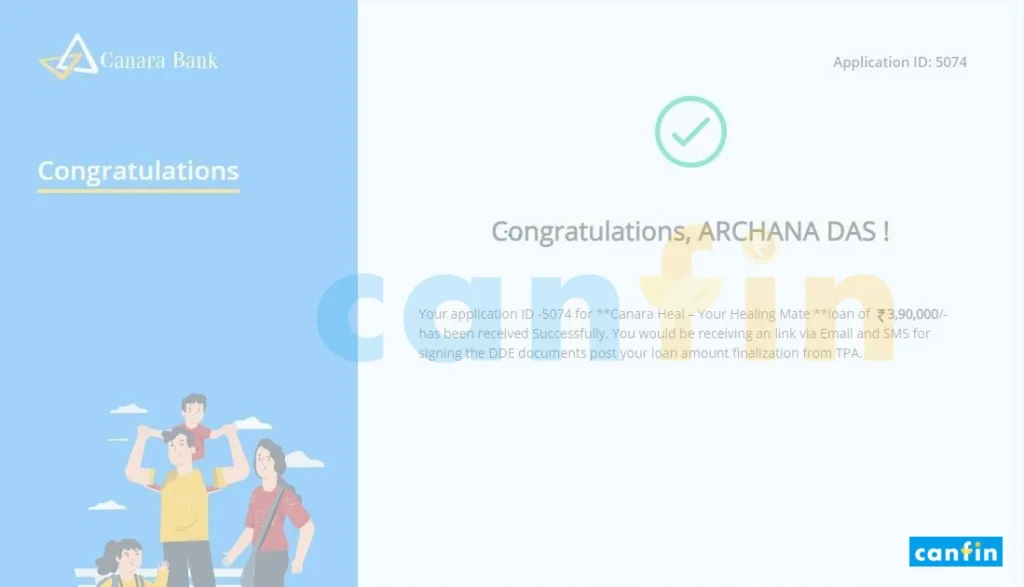

8. Congratulations screen

Upon accepting the In-Principle Sanction, the TPA/Insurance Company will validate the shortfall amount i.e., the claim amount disallowed by TPA/Insurance Company.

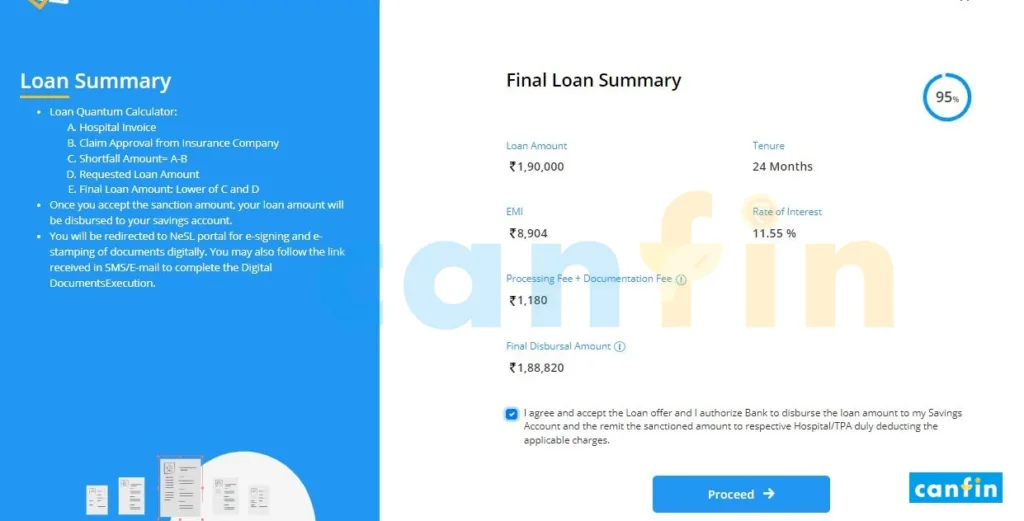

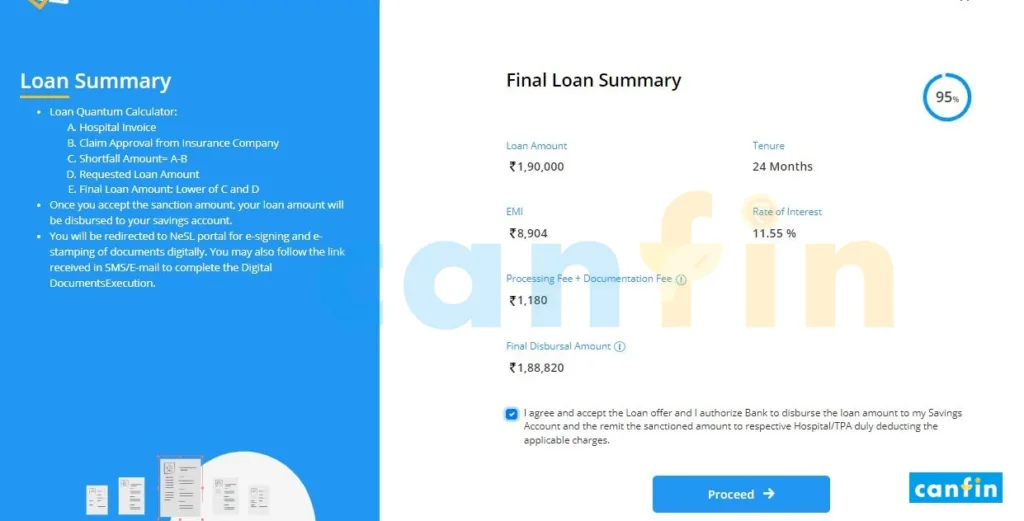

9. Final Loan summary screen

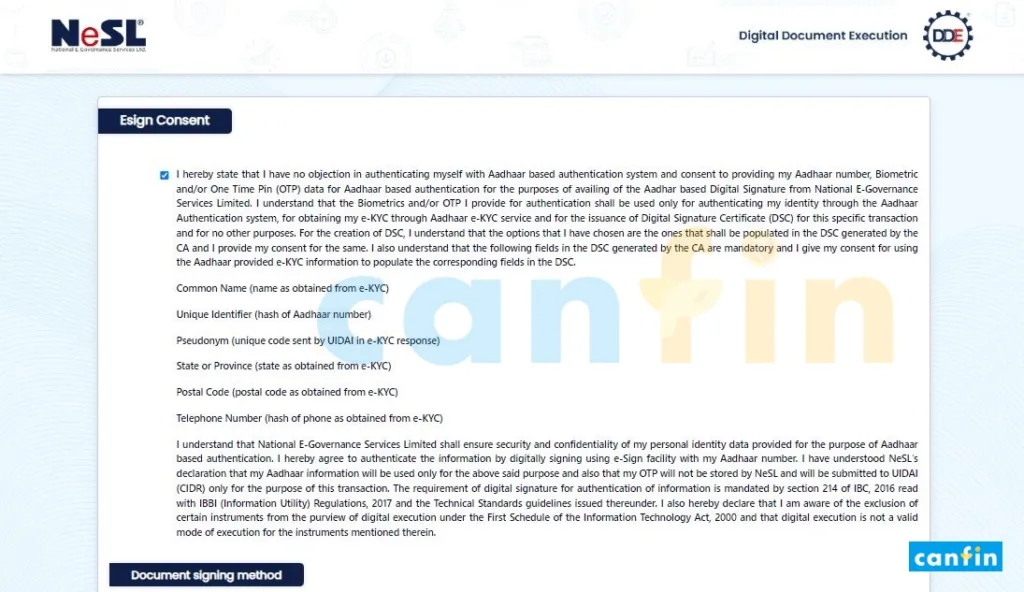

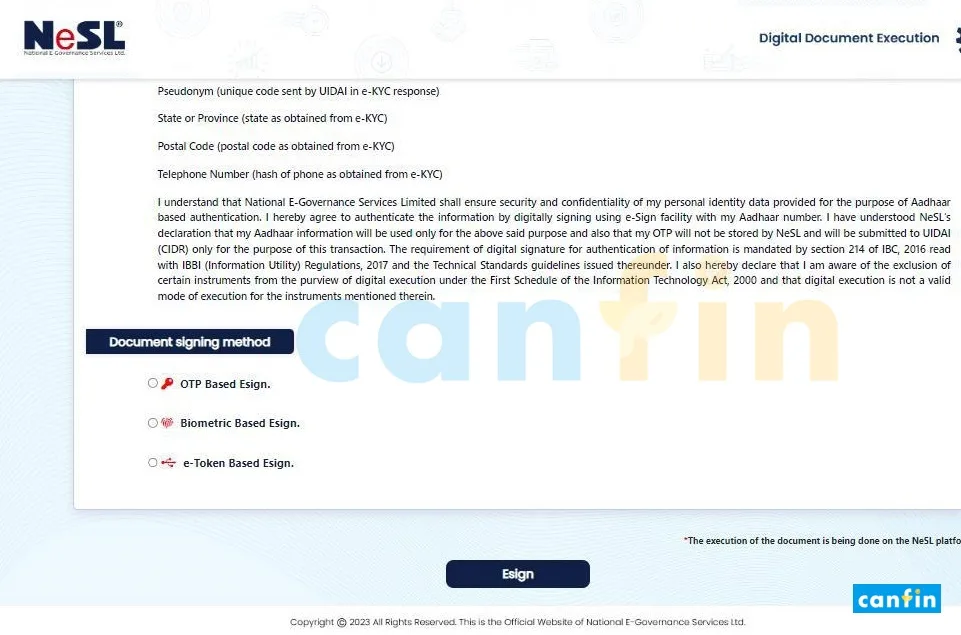

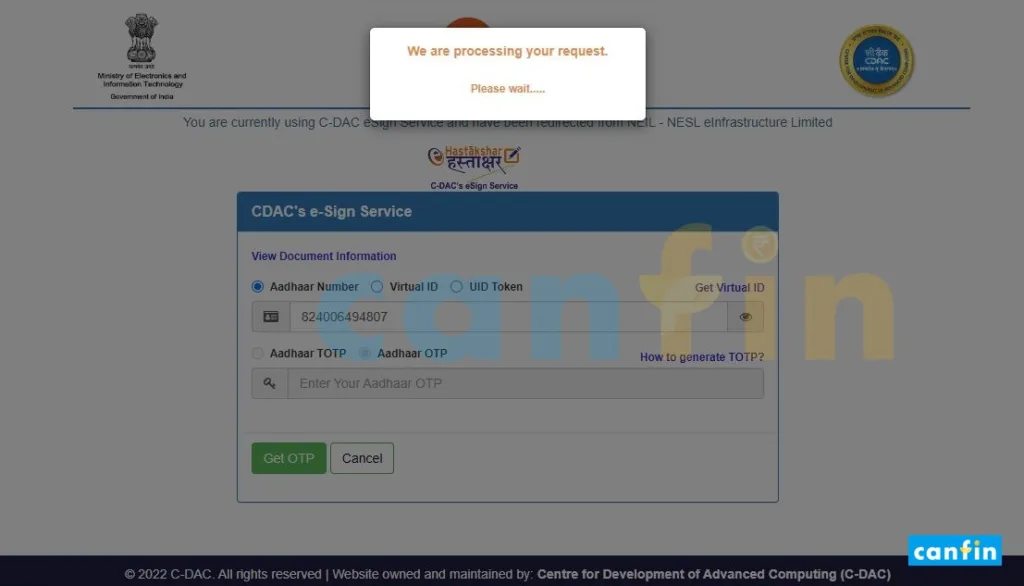

The final Canara HEAL Loan summary will be displayed based on shortfall amount validated by TPA/Insurance Company. Upon accepting the final amount, the customer will be redirected to NeSL portal for e-signing of documents by Aadhar OTP.

Digital Documents Execution (DDE) through NeSL (National e-Governance Services Ltd) 📱

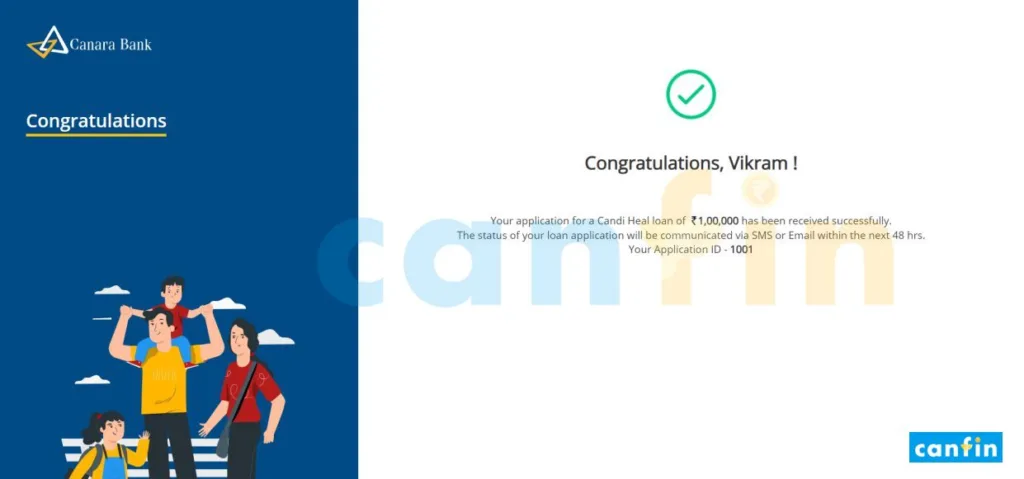

10. Congratulations screen

The journey terminates here with e-signing and direct remittance of loan proceeds to Hospital for settling the final bill.

Guide for New Customers 👤

1. Welcome screen

Upon logging in as a New to Bank (NTB) Customer, the applicant has to enter the name as per PAN and Aadhar, slide and select the requested loan amount, select employment type (Salaried / Self Employed) and Availability of Health insurance.

2. Validate policy details

The customer shall select the Insurance Company / TPA and submit the Policy No / Member ID to proceed to next screen.

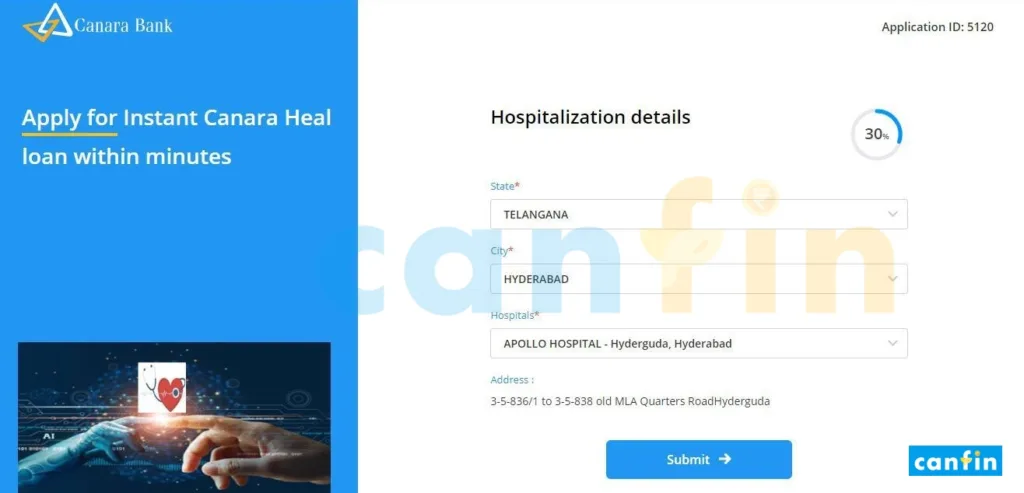

3. Hospitalization screen

The customer has to select state, city of name of hospital to proceed further for e-KYC process.

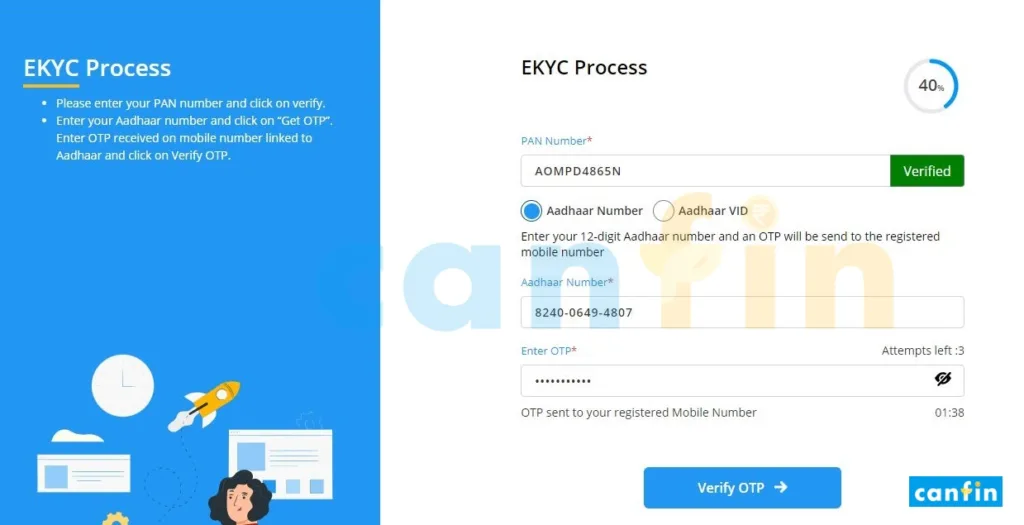

4. e-KYC screen

At e-KYC screen, the customer enters and verify his PAN and Aadhar by OTP.

5. Employment Details

The customer to furnish his employment details and proceed further.

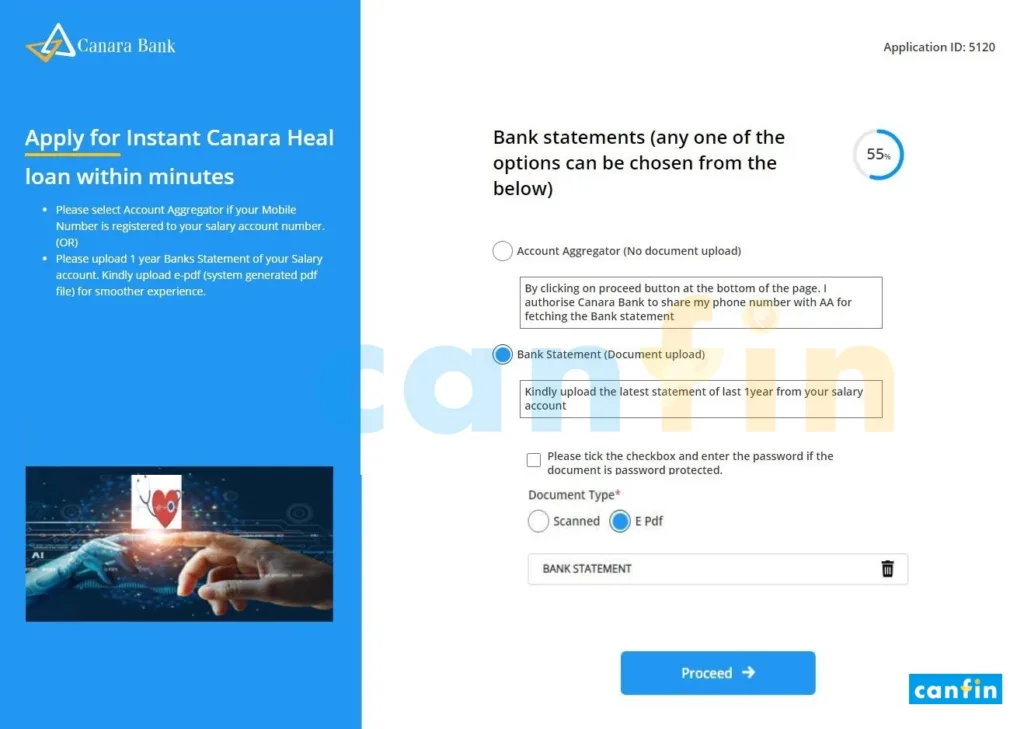

6. Bank statement screen

The customer has to provide his salary account statement of 1 year.

Customers can opt for Account Aggregator, which does not require document upload. The number used for logging in to HEAL application should be registered with Salary Account of the customer for Account Aggregator feature.

For Document upload, customer to upload e-PDF account statement (system generated) of 1 year. If the document is password protected, the customer need to enter password by clicking the checkbox.

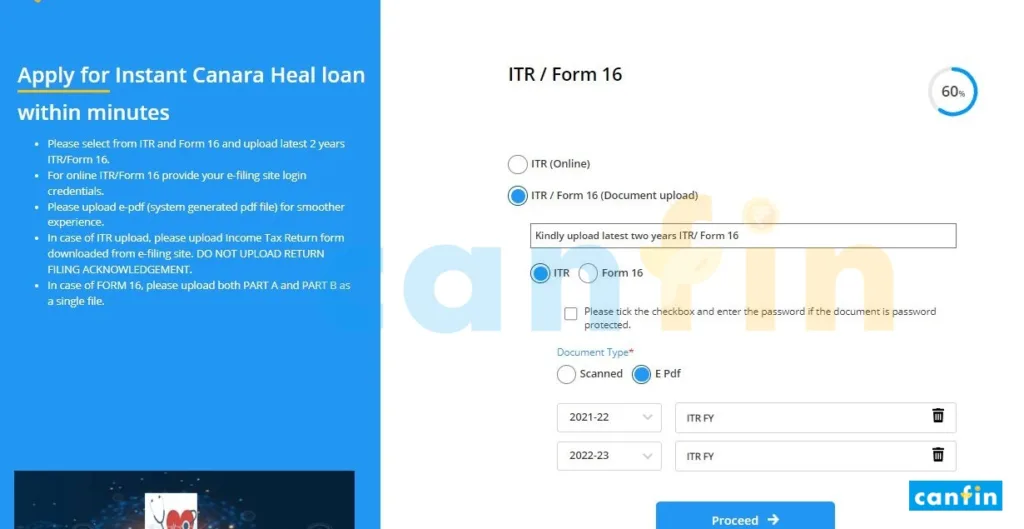

7. ITR / Form-16 Upload

The customer has to provide his ITR/ Form 16 for latest 2 Financial Year.

Customers can opt for online ITR option by providing his login credentials of e-filling site.

For Document upload, customer to upload e-PDF ITR/Form 16 (system generated) for latest 2 financial years. If the document is password protected, the customer need to enter password by clicking the checkbox.

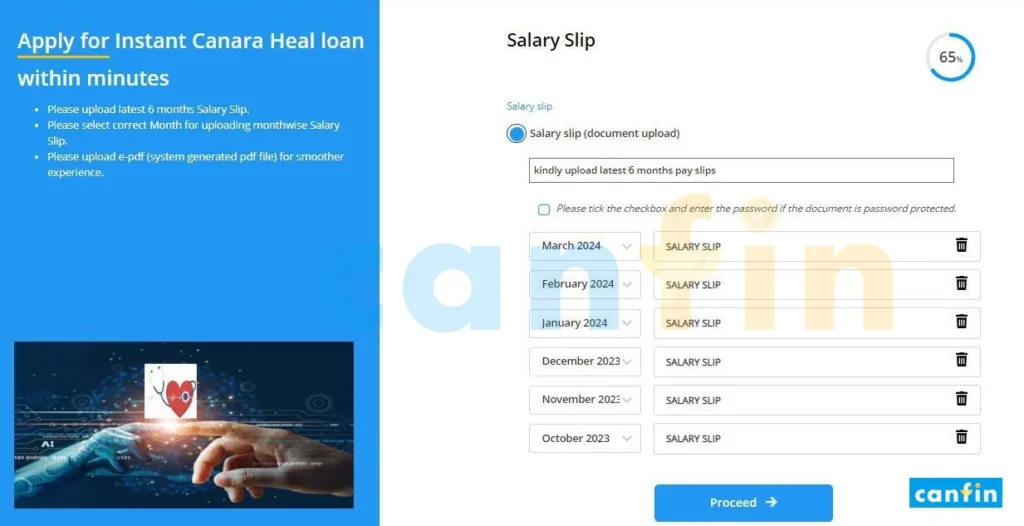

8. Salary slip

The customer has to upload e-PDF (system generated) files for latest 6 months’ salary slips duly selecting the month and entering password, as applicable.

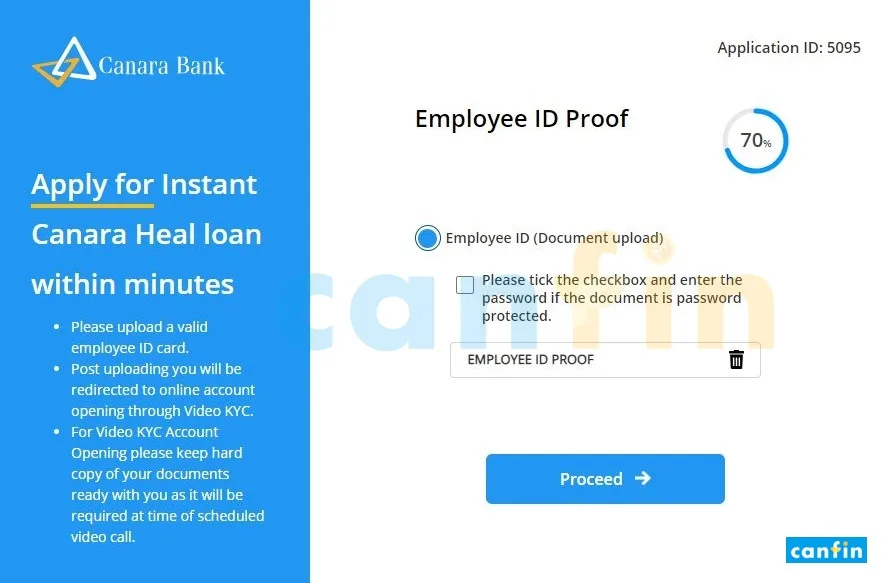

9. Employee ID screen

Customer to upload Employee ID in PDF format.

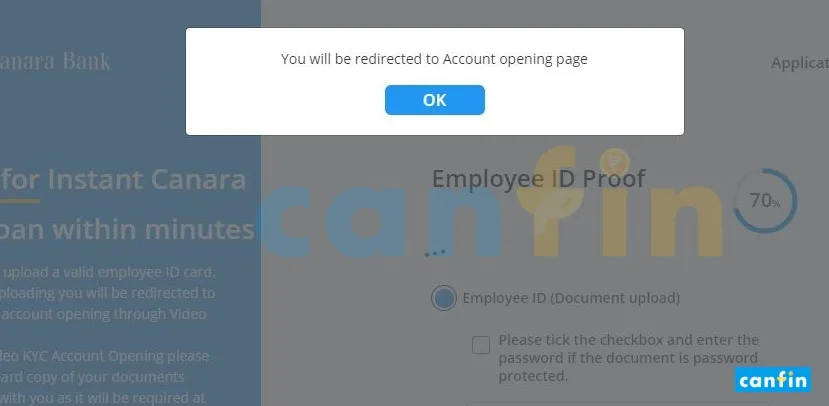

Upon successful upload, if the customer is found eligible as per the scheme criteria, he will be redirected to online account opening through video KYC.

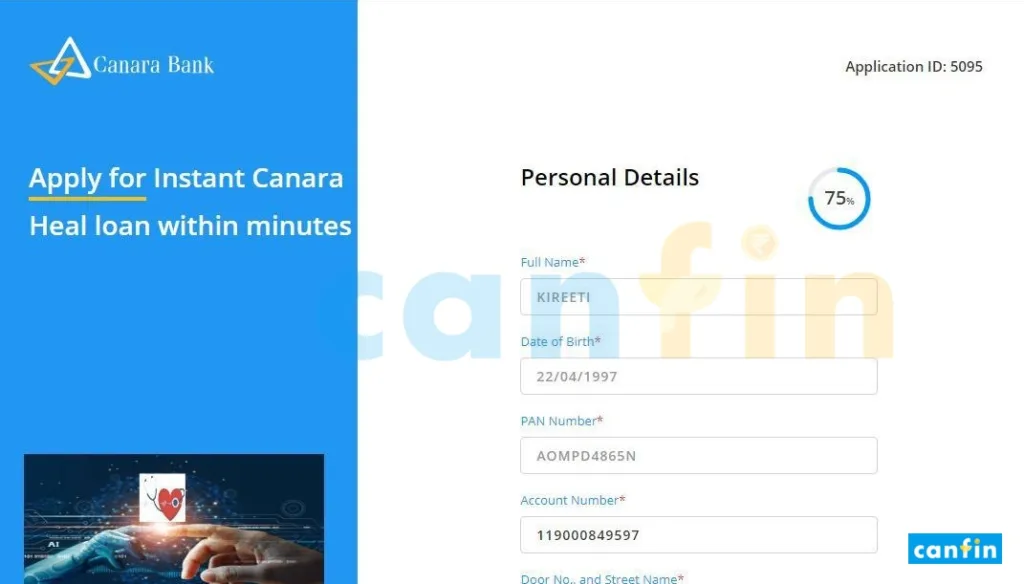

10. Personal details

The personal details fetched from CBS after successful account opening through Video-KYC is displayed in this screen. Customer to verify and proceed.

11. Eligibility Page

The customer can slide and select the requested loan amount and tenure.

12. In Principle Loan Screen

Based on the selection of requested loan amount and tenure, In Principle Loan Offer will be displayed to customer to accept and proceed for In Principle Sanction Letter.

13. Sanction letter

At this screen, In Principle Sanction Letter will be displayed to customer for viewing and downloading the sanction letter.

14. Congratulations screen

Upon accepting the In-Principle Sanction, the TPA / Insurance Company will validate the shortfall amount i.e., the claim amount disallowed by TPA/Insurance Company.

15. Final loan summary screen

The final Canara Heal Loan summary will be displayed based on shortfall amount validated by TPA/Insurance Company. Upon accepting the final amount, the customer will be redirected to NeSL portal for e-signing of documents by Aadhar OTP.

16. Congratulations screen

The journey terminates here with e-signing and direct remittance of loan proceeds to Hospital for settling the final bill.

Canara HEAL is a valuable financial tool that empowers individuals to manage unexpected healthcare costs effectively. By bridging the gap between your insurance coverage and the actual bill, Canara HEAL provides peace of mind during a stressful time. Explore Canara Bank’s website or visit a branch to learn more about Canara HEAL and ensure you’re financially prepared for any medical emergency.

Frequently Asked Questions (FAQs) 🤔

What is Canara HEAL Loan?

Canara HEAL is a new loan specifically designed to bridge the gap in your hospital expenditure. It is a term loan offered by Canara Bank under the Retail Segment, meaning it caters to individual customers. This loan is particularly beneficial for those who have availed of healthcare services through a Third-Party Administrator (TPA).