Canara My Money: Unlock Instant Cash Up to ₹10 Lakhs with Your Online Deposits

Life throws unexpected financial curveballs, and sometimes you need quick access to funds. Canara Bank’s innovative “Canara My Money” product offers a convenient solution: a term loan against your existing online deposits. This article explores how Canara My Money empowers you to leverage your online savings for instant cash needs.

As a part of Canara Bank’s commitment towards digital lending to enhance customer experience and target tech savvy millennials and Gen Z customers, Canara Bank has launched new online loan against deposit product – Canara My Money.

The Advantages of Canara My Money Term Loan ✅

- The Facility will be available 24×7×365 basis.

- Seamless customer journey: It simplifies the requirement of short-term funds/ loans and facilitates easy customer journey from applying online through digital platform and straight-through processing (STP) and disbursement of loans.

- No Physical visit to the branch: This is an End-to-End digital term loan product against deposit opened online, through Internet/Mobile Banking.

- Zero Paperwork

The Features of Canara My Money 🎉

Purpose

Personal/Domestic needs only

Eligibility

Individual Retail Internet Banking Customers/ Users having Domestic Online FD (Fixed / Kamdhenu deposits) only.

Quantum

Maximum 75% of the deposits opened through Internet Banking or Rs.10.00 lakhs whichever is less.

Tenure

1 day less than the Term Deposit maturity date opened through Online

Repayment

Bullet Repayment

Margin: 25%

Rate of Interest

2% over the deposit rate of interest

Processing Charges: Nil

Documentation

Digital Documentation shall be invoked based on Aadhar number enabled OTP for consent/acceptance for execution of e-Stamping & e-Signing as per sanction terms & conditions.

Ineligible Deposits

Recurring Deposits, NRE Deposits, Tax-saver Deposits, Capital Gain Deposits, Deposits in the name of Minors/Joint Depositors/employees of our Bank/ Trusts/Companies/ HUFs/Third Party.

Mode of Disbursement

Through Ai1 app/Internet Banking/Bank Corporate Website/SMS platforms under 4STP mode directly to linked A/C of the Borrower.

Other Features

Customer can exercise the option of servicing the interest on monthly basis from his operating CASA linked account or Interest to be debited at the time of closure of loan.

Auto-Liquidation

If the stipulated margin reduces to 10% of the value of the security system will automatically liquidate the online deposit, by clearing the outstanding liability and credit the balance amount to the operative savings account.

Related: A Revolutionary ‘Canara Ready Cash’: A Pre-Approved Personal Loan up to ₹10 Lakh

5 Easy Steps to Apply for Canara My Money Online 🪜

Step-1: Customer can log into ‘Canara Bank Internet Banking’ or in Canara Ai1 app to access the below product selection web page.

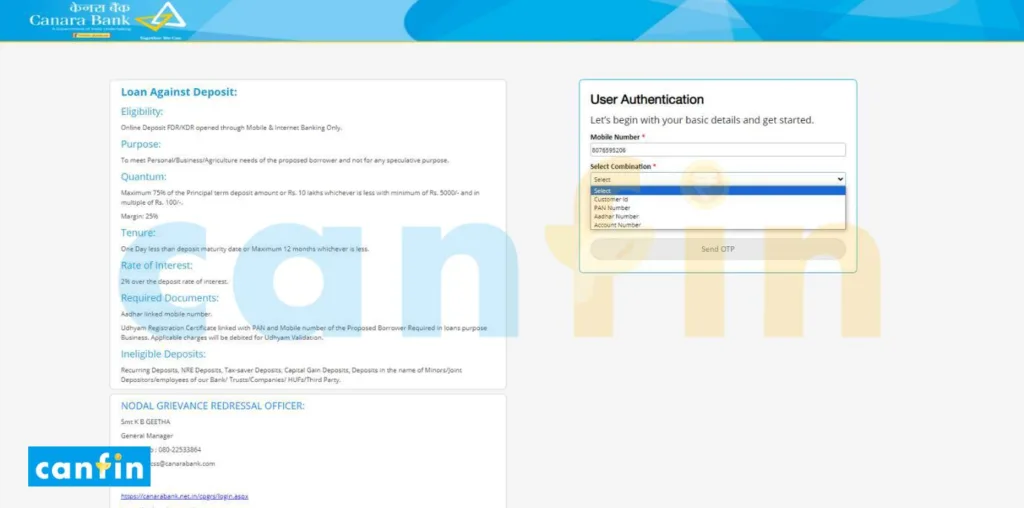

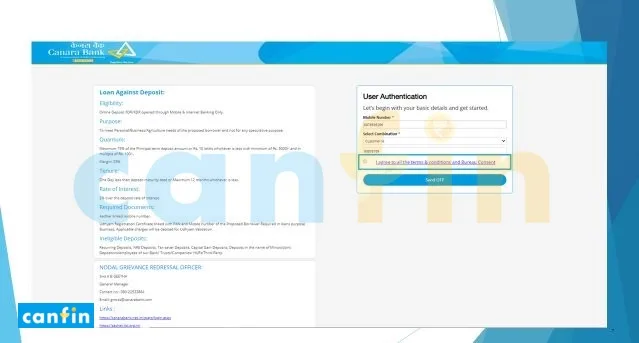

Step-2: Customer has to enter registered mobile number along with either Customer ID/ PAN/ Aadhar/ Account number, Check the box before “I Agree…” and click on ‘Send OTP’ button, enter OTP and validate it.

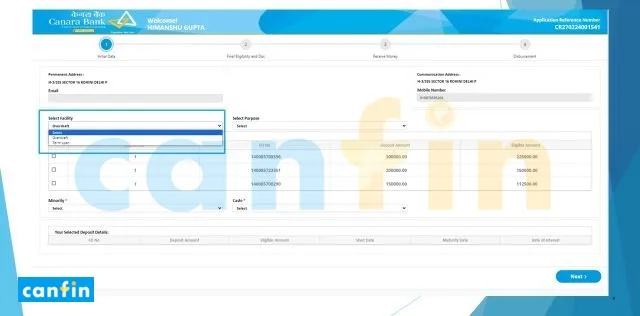

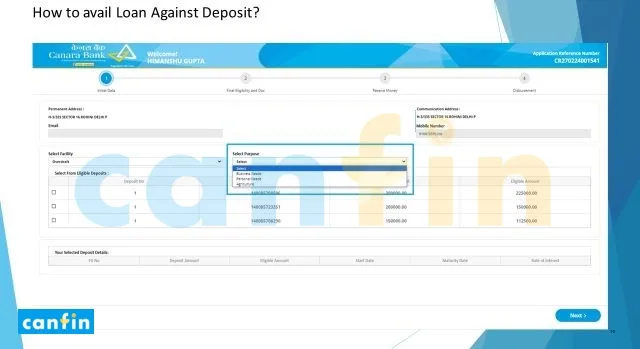

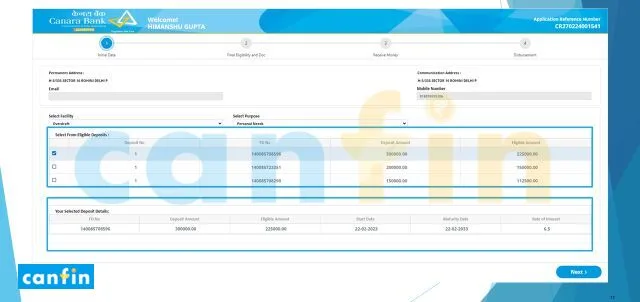

Step-3: Select type of facility as Term Loan and select purpose of the loan.

Select eligible deposit against which you want to get loan.

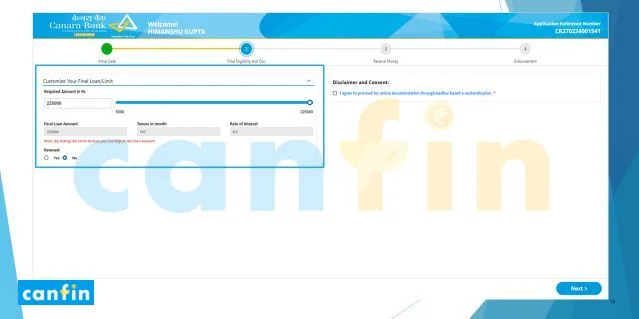

Step-4: Enter your desired amount of loan, if any.

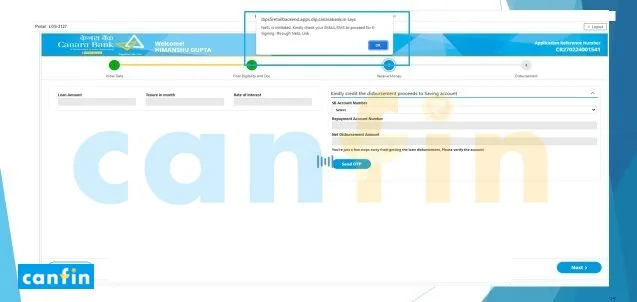

Step-5: At this stage of NeSL, e-Signing of the documents take place.

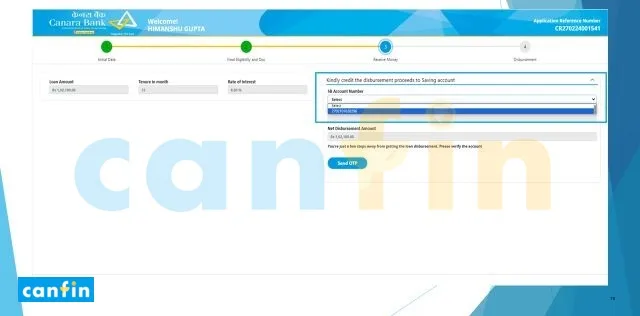

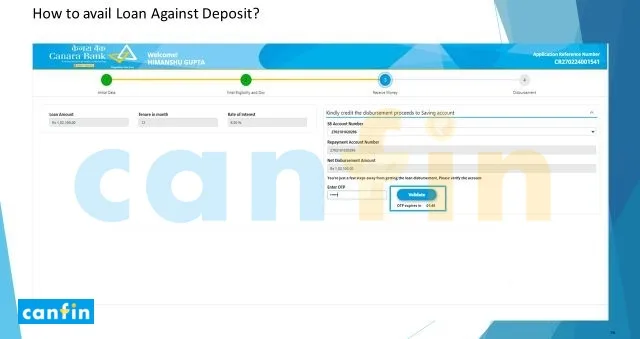

Select the SB account number for disbursement and click “Send OTP”.

Enter the OTP and click “Validate” for the loan to be processed!

After loan account is opened, customer can view the Canara My Money Term Loan details in account summary.

Terms & Conditions for online Loan Against Deposit 📃

- The maximum permissible loan amount is 75% of the Principal deposit against the Fixed Deposit Receipts (FDRs)/ 75% of outstanding balance of their Kamdhenu Deposit Receipts (KDRs), which are opened online through Internet Banking/ Mobile Banking channels OR Rs. 10 Lakhs, whichever is less.

- Loan can be availed if the deposit is un-encumbered. No additional loan is permitted on the same deposit during the pendency of the loan.

- In case any of the depositors is a minor, loan against deposit shall not be considered.

- The loan amount can be repaid either in part or in full at any time.

- The maturity proceeds will be adjusted to loan account and the balance will be credited to SB account in case the borrower have not opted for Auto-Renewal of deposit.

- Addition/Deletion of names shall not be taken place during the pendency of the loan against deposit opened through Internet and Mobile Banking.

- The Interest payable on FDRs shall be credited to the loan account instead of original

Standing Instructions to credit CASA account.

Frequently Asked Questions 🤔

Q. What is Canara My Money Term Loan?

Canara My Money is a unique online term loan product available under the Retail Segment of Canara Bank. It allows you to access instant credit of up to ₹10 Lakhs (subject to eligibility and loan-to-value ratio) based on your online deposits held through internet or mobile banking.

Q. What is the maximum loan period?

The period of loan shall be one day less than the date of maturity of the deposit.