Discover Canara Ready Cash by Canara Bank: Get pre-approved personal loans up to ₹10 lakh quickly and hassle-free!

As a part of technology-led-transformation for smart & tech-enabled banking targeting segment of Millennials & Gen-Z customers (Born 1997-2012), Canara Bank is committed towards Digital Lending wherein End-to-End digitalization facilitates the customer journey from applying online through digital platform and straight through processing (STP) and disbursement of loans.

In view of the above, for facilitating End-To-End digitalization & to enhance customer experience of availing online personal loan, Canara Bank has launched New Pre-Approved Personal Loan (PAPL) – “Canara Ready Cash” up to Rs. 10 Lakh to existing customers (Canara SB Premium Payroll Customers) of Canara Bank through Straight-through-Processing (STP) Mode under Digital Lending Platform.

The above loan facility can be availed through any of Canara Bank Alternate Banking Channels i.e. Internet Banking / Mobile Banking / Bank Corporate Website at ease. The detailed product guidelines / features of Canara Ready Cash”- Pre-Approved Personal loan are as under:

Product Guidelines of Canara Ready Cash 💵

Nature of Facility:

Term Loan facility- “Canara Ready Cash”- Pre-Approved Personal Loan (STP)

Purpose:

Any genuine requirements other than speculative purposes with quick disbursement through Straight-through-Processing (STP) 24/7 at convenience of customers.

Eligibility:

- Existing customers (SB Premium payroll customers) of Canara Bank shall be eligible

- Age of the Applicant: 21-55 years

- CIC Score: The CIC score of the customer should be in a scoring band of 700 and above.

Quantum:

The loan quantum shall be 10 times of average of last 6 months’ net salary credited with a Minimum of Rs. 50,000/- & up to Maximum of Rs 10.00 Lakh within the overall eligibility under Canara Budget scheme norms At any point of time, total loan quantum sanctioned under Canara Budget.

Net Take Home Salary:

Minimum Net Take Home Salary (NTH) of borrower should not be less than 25% or Rs. 10,000/- p.m. whichever is higher after meeting instalments of all existing loans and proposed loan.

Repayment Period:

Maximum period up to 60 months

Rate of Interest:

1) Floating ROI: 11.95%

2) Fixed ROI: 12.70%

Processing Charges:

0.50% of the loan amount with a minimum of Rs 500/- and maximum of Rs 2500/-

Security: Nil

Moratorium: Nil

Margin: Nil

Documentation:

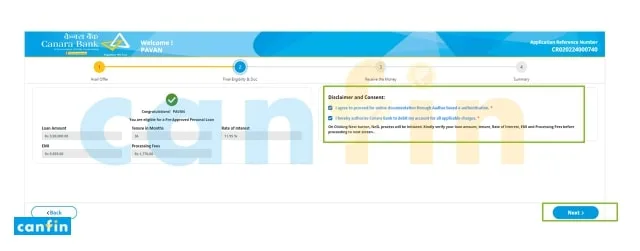

Digital Documentation shall be invoked based on Aadhar number enabled OTP for consent/acceptance for execution of E-stamping & E-Signing for Canara Reay Cash Personal Loan.

Mode of Disbursement:

Through Ai1 app / Internet Banking / Bank Corporate Website / SMS platforms under STP mode directly to Salary A/C of the Borrower.

Other Applicable Charges:

- Digital Verification Charge: Rs. 200/- + GST

- CIC Charges: Rs. 50/- + GST (Per Report Generated)

- E-Stamping Charges: As Applicable

- E-Stamp Certificate Fee: Rs.7/- + GST for each document e-stamped

- E-signing Charges: Nil

- DDE Charges: Rs.25/- + GST for loan tenure up to 3 years.

- Additional Rs.10/- + GST for each year above 3 years.

5 Easy Steps to Apply for Canara Ready Cash Loan Online 🪧

1. All The Existing customers (Canara SB Premium Payroll Customers) of Canara Bank shall be sent with an SMS with regard to Canara Ready Cash in-principle pre-approved limit along with a pop-up notification in Ai1 Mobile App / Internet Banking Portal.

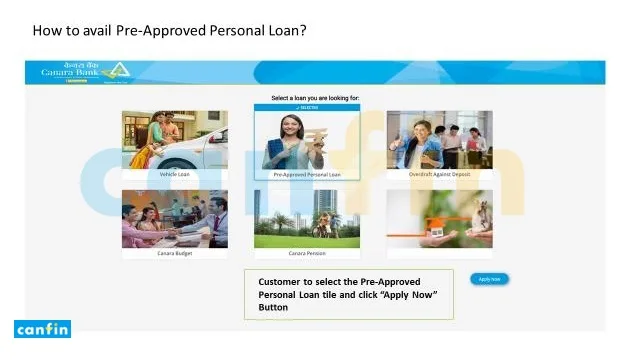

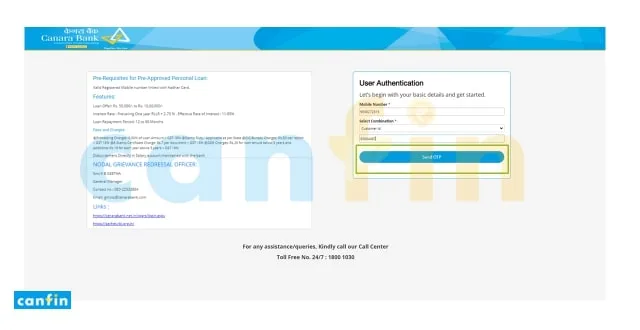

2. In order to avail Pre-Approved Personal Loan (PAPL) through Ai1 app/Internet Banking/Bank Corporate Website, customer has to enter his registered mobile number in login credentials screen. Accordingly, customer will be receiving OTP as part of login verification.

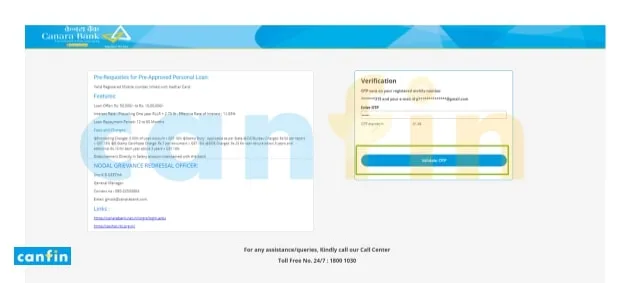

Once, OTP is verified, customer shall be redirected to pop-up link.

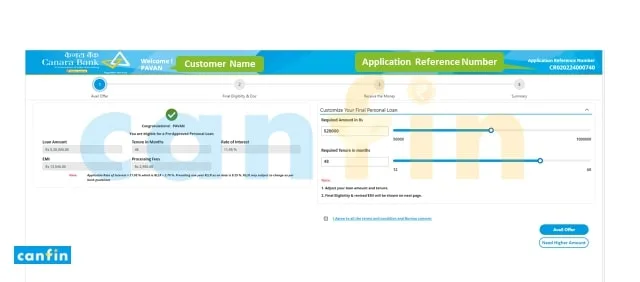

3. If customers click on pop-up link in Ai1 App / Internet Banking / Bank Corporate Website, system will show the limit, ROI, Loan tenure & EMI. Customer can customize the required amount and tenure. Click on I agree to all Terms and Conditions and give consent for Credit Bureau Check.

If customer opts for availing limit by clicking “Yes” button, Key Fact Statement (KFS) along with Sanction terms & conditions shall be displayed based on the loan amount & tenure.

4. Once customer provides consent by agreeing Key Fact Statement (KFS) along with Sanction terms & conditions, customer shall be opted for Digital Document Execution for e-stamping & e-signing through OTP mode for availing the preapproved limit by clicking “Yes” button.

If the CIBIL CIC Score is below 700, a message with regard to ineligibility due insufficient Credit Score shall be displayed and customer journey shall be terminated.

5. Once customer executes e-Signing and e-Stamping of the documents through Digital Document Execution (DDE), loan account will be opened in system/CBS through API & disbursement amount shall be credited to the Salary account of the customer immediately duly intimated through SMS/email to the customer. Customer can download all e-Signed Documents.

All the applicable charges shall be debited from the customer’s operating/identified Salary Account post Canara Ready Cash loan disbursement.

[…] Related: A Revolutionary ‘Canara Ready Cash’: A Pre-Approved Personal Loan up to ₹10 Lakh […]