Explore Canara TruEdge: Customized Accounts for Organizations and Institutions

Institutional accounts are a key component of a bank’s liability portfolio, offering stable deposits and fostering long-term banking relationships. These accounts serve a diverse range of organizations, including hospitals, schools, religious trusts, housing societies, and community clubs.

To better serve the distinct needs of such clients and strengthen customer segmentation, Canara bank has launched the ‘Canara TruEdge’ Savings and Current Accounts—specifically designed for institutions.

Eligibility ☑️

Only institutions under the below mentioned constitutions are eligible to open Canara TruEdge account:

- Sole Proprietary Concerns

- Partnership Firms

- Limited Liability Partnership

- Private and Public Limited Companies

- Public Corporations

- Registered Societies or Associations/Clubs

- Trusts / Provident Funds

- Government / Semi-Government Bodies etc.

- Charitable and Religious institutions

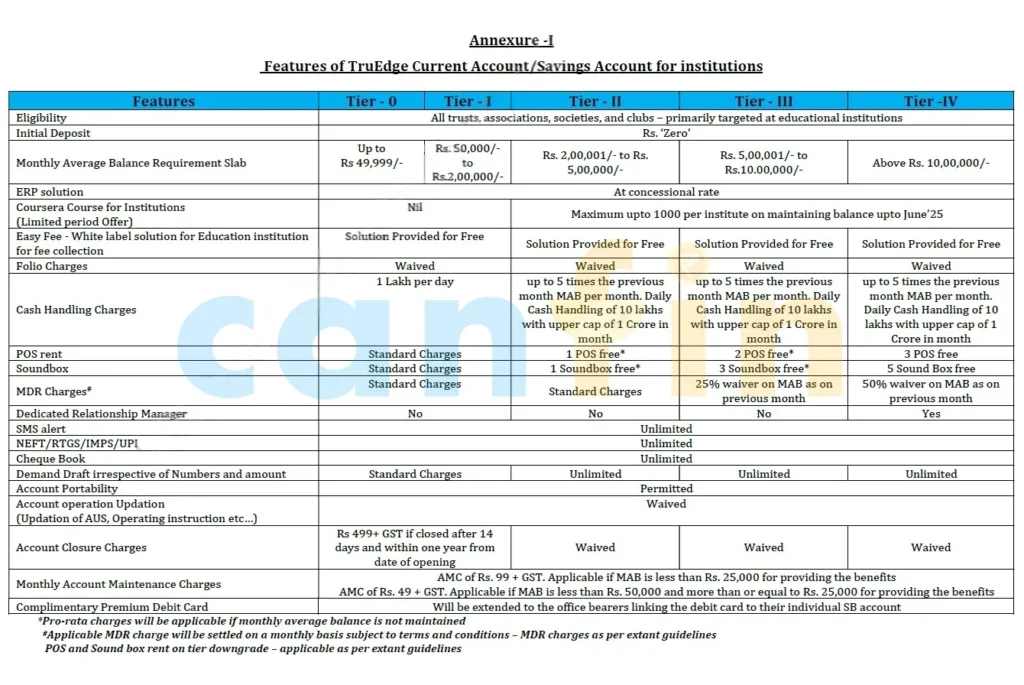

Dynamic Tiering System 📈

To enhance the overall value proposition for customers, a tier-based product structure has been introduced, directly linking benefits to the Monthly Average Balance (MAB) maintained in the previous month. Canara TruEdge account is categorized into five tiers, determined by the customer’s MAB. This tier classification and assessment process will be fully automated, ensuring seamless benefit allocation.

| Tier | MAB (Monthly Average Balance) Maintenance Slab |

| Tier 0 | < 50,000/- |

| Tier 1 | Rs. 50,000/- to Rs. 2 Lakh |

| Tier 2 | > Rs. 2 Lakh |

| Tier 3 | > Rs. 5 Lakh |

| Tier 4 | > Rs. 10 Lakh |

Depending on the slab that customer falls under, waivers listed below will be offered to customers. Those who fail to maintain the minimum monthly average balance of Rs. 50,000 will still receive benefits waivers associated with the base slab but will incur applicable monthly maintenance fees.

Email Subscription

Sign up for our newsletter and stay up to date!

Why Choose Canara TruEdge? 17 Key Features & Benefits ✅

1. Zero Initial Deposit Requirement 0️⃣

The account benefits are linked directly to the MAB (Monthly Average Balance) and hence initial deposit is not stipulated for the customers. They have to maintain the required MAB to avail the benefits. The month of Canara TruEdge account opening will be considered as a buffer month and the MAB calculation will start from the first of the following month.

Eg: Canara TruEdge Account opening month Base product features will be given to customer, Month end of the account opening, tier will be decided based on the average balance maintained in that month, arrived tier benefits will be passed on to the next month.

2. 18 Non-Home Branch Services Facility 🏛️

At-Par Services Across Branches (Including Non-home Branches) for selected services listed below:

- Fund Transfer request – Unlimited

- Cash deposit

- Balance Enquiry – Any Account of the institution

- Personalised Cheque Book Request

- Nominee Maintenance

- TD services such as Account opening, Pay-in, Payout instructions, Tax waiver

- Life Certificate submission

- KYC Updation

- Sweep in Sweep Out

- Passbook Issue/Lost Maintenance

- Account block/Unblock Services

- Account Statement Services

- 15G/15H submission

- Loan and SB interest Certificate

- Loan Repayment and Enquiry

- Partial Loan payoff

- PPF, Sukanya Sammridhi, Senior Citizen Savings scheme

- Mutual Funds, Life Insurance facilities

3. Free Coursera Course for students of Educational institutions 🎓

At the Canara bank’s discretion, onboarded educational institutions maintaining an Institutional Canara TruEdge Account shall be granted Coursera licenses to students, subject to the tier of the account and eligibility balance criteria as on 30.06.2025. This feature will be extended on a case-to-case basis.

4. ERP (Enterprise Resource Planning) software solution 👨💻

ERP is a type of software that helps organizations manage and integrate various business functions, such as financials, human resources, supply chain management, learning modules and customer relationships, into a single system. ERP includes Hospital management software for healthcare institutes, School / college management software for education institutes. The bank will establish a Memorandum of Understanding with ERP (Enterprise Resource Planning) solution providers, which can be extended as a bundled package for institutions.

Different ERP providers will be selected for each type of institution, based on the institution’s specific needs. The details about the ERP solution providers and the associated process will be provided in due time.

5. Dedicated Relationship Manager 👨🏻💼

Assistant Branch Head shall be the relationship manager for the institution account opened under Canara TruEdge product.

6. Complimentary Premium Rupay Select Debit Card 💳

It shall be extended to the office bearers of the institutions on the request of the entity/institution (based on the supporting documents such as resolution/trust deed/specific request letter duly signed by the authorized signatories). The office bearer, if not an existing customer of Canara Bank, has to mandatorily open an SB account to avail this facility.

7. Cash handling charge 💵

Waivers based on previous Month Monthly Average Balance maintenance

8. Simplified Process Flow for All Value-Added Services 🔀

A streamlined process ensures easy onboarding and access to various banking add-ons. Institutions can activate services without lengthy paperwork or delays.

9. Fee Collections Solution (Canara Easy Fee) 🧾

Canara Easy Fee provides a hassle-free digital platform for institutions to collect student fees or member contributions. It enables real-time tracking and reconciliation of payments.

10. API Banking Solution (Application Programming Interface) 💻

APIs enable seamless integration of banking functions into your existing systems. Automate collections, payments, and account validation directly through your platform.

11. Payment Gateway / BBPS Services 💳

Offer secure and instant bill payments using Canara’s BBPS-compliant gateway. Customizable gateway services are available to meet the specific needs of each institution.

12. POS (Point of Sale) Machine Rent Waiver 📠

Selected account tiers enjoy rent waivers up to 3 POS machines, supporting smooth debit and credit card transactions. A cost-effective way to enable digital payments on-site.

13. Rent Waivers on Soundbox for BHIM QR Merchants 🔊

Merchants using BHIM QR through Canara receive rent waivers up to 5 Soundbox devices. Get instant audio confirmation of payments at no extra cost.

14. MDR Waivers Based on Previous Month’s MAB 📠

Enjoy Merchant Discount Rate (MDR) waivers based on your Monthly Average Balance. The higher the balance, the greater the waiver on transaction charges.

15. Free Unlimited NEFT & RTGS Transactions 🔁

Transfer funds anytime, anywhere without incurring NEFT or RTGS fees. High-value and bulk payments are made easy and cost-free for institutional clients.

16. Free Unlimited Cheque Leaves 💶

No cap on cheque book issuance—eligible institutions receive unlimited cheque leaves. Ideal for organizations requiring frequent cheque-based transactions.

17. Free Demand Drafts (DDs) Based on Tier 🎫

Eligible Canara TruEdge account holders receive free DDs based on their tier classification. This is especially beneficial for institutions that rely on DDs for fee or vendor payments.

These Benefits are linked based on the “5 Tier Mechanism” dependent on Monthly Average Balance (MAB) 🙌

Charge Structure for Canara TruEdge 🎟️

⚠️ Charges on Non-Maintenance of Monthly Average Balance

MAB Less than Rs. 25,000/- then Rs. 99+GST

MAB Rs. 25,000 to Rs. 50,000/- then Rs. 49+GST

⛔ Account Closure Charges

Rs. 499 + GST, if closed after 14 days and within one year from date of opening.

Read More: 6 Reasons Why Canara Aspire Savings Account is a Game-Changer for Young Bankers

Frequently Asked Questions (FAQs) 🤔

Q. Can you provide an example of how Monthly Average Balance (MAB) affects tier eligibility and charges for Canara TruEdge institutional account over the first few months after opening?

Yes, here’s an example to illustrate how the Monthly Average Balance (MAB) impacts tier eligibility and associated charges for a Canara TruEdge institutional account:

- Account Opening: The account was opened on 24th April 2025. A deposit of ₹15 lakhs was made on 26th April and maintained till 30th April. Since this is the account opening month, the institution is eligible for Base product features and bank charge waivers. No non-maintenance charges are levied during this buffer period.

- May 2025: For May, the Monthly Average Balance (MAB) is calculated on a pro-rata basis for 7 days (from 24th to 30th April), which comes to ₹10.71 lakhs. Based on this, the institution qualifies for Tier IV benefits for May.

- June 2025: If the customer maintained only ₹40,000 as balance in May, they would still receive a service charge waiver. However, due to non-maintenance of the required MAB, a non-maintenance charge of ₹49 will be levied.

- July 2025: If the customer maintained a balance of ₹25 lakhs in June, they would again qualify for Tier IV benefits for July.

This example shows how the Canara TruEdge account’s benefits and applicable charges are dynamically linked to the MAB of the previous month, ensuring a transparent and rewarding banking experience.