Discover financial empowerment with Canara Ai1 App. Obtain a complimentary free credit score report and take control of your financial well-being effortlessly.

Summary 📌

- Fresh Credit Score Report can be generated by Mobile Banking users every 90 days at free of cost from M/s Experian CIC.

- Credit Score can be viewed and detailed report can be downloaded from Mobile Banking application as well as User’s email.

Credit Score is a three-digit numeric indicator of a person’s credit worthiness or ability to repay debt. Credit Score of Borrower plays an important role in taking decision on sanctioning credit facility parameters such as quantum of loan, rate of interest etc.

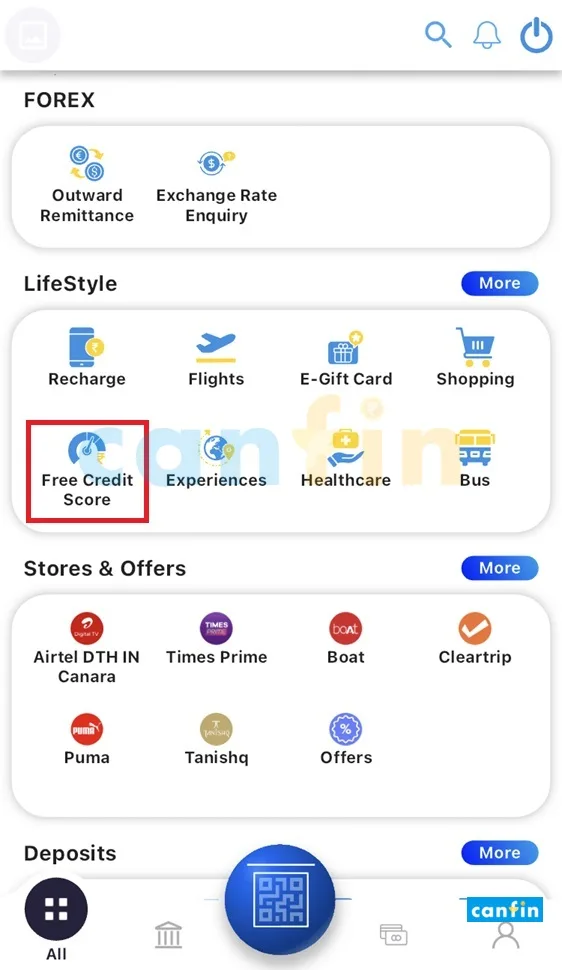

At present, Credit Score feature is available in Canara Bank Mobile Banking App under Lifestyle tab/services which is chargeable to users. Now, this feature is made available free of cost to users.

What is your Credit Score Report? 💯

- A three-digit credit score is based on your credit history, ranging from 300 to 900.

- It includes a summary of all your credit accounts, detailed payment history, and additional information.

- Your personal details connected to your credit account are also provided.

- The list encompasses applications made for loans and credit cards.

Why get your free Credit Score Report? ✅

- Stay informed: Regularly check your free Experian credit score to stay updated on your finances.

- Facilitate easy loan approvals: Maintain a good credit score to increase your chances of securing loans or credit cards.

- Spot financial fraud: Regularly monitor your credit report for suspicious loan accounts or inquiries.

- Maintain an updated report: Review your credit report regularly and dispute any changes promptly.

Conditions to avail Free Credit Score Report 🚩

- Customer shall be an Individual user of Mobile Banking app (Canara ai1 MB app).

- User shall have an email address to access this feature.

- On completion of 90 days from generation of last Credit Score Report, User can generate a fresh Credit Score Report.

7 Steps to avail Free Credit Score Report in Canara Ai1 App 📋

1. User shall login to Mobile Banking Application and click on “Free Credit Score” icon.

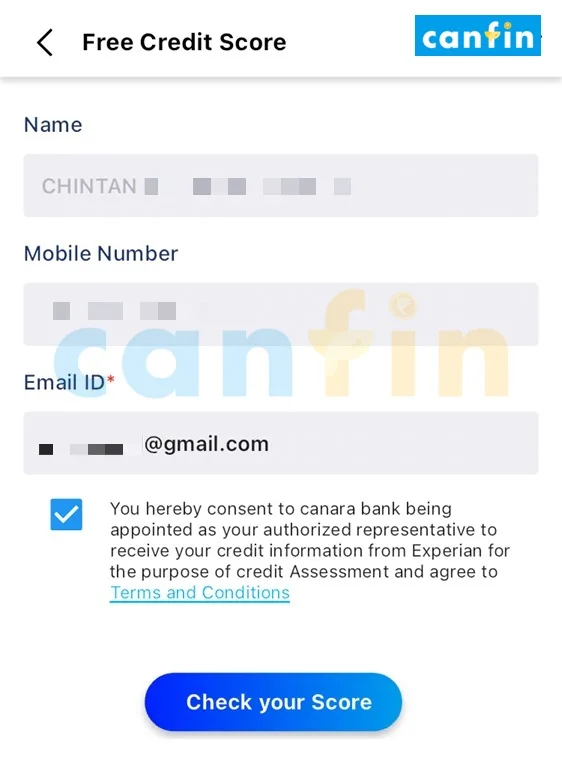

2. Name of User, Registered Mobile Number and email address will be auto populated. Email field is editable; User can edit email address displayed.

3. User shall click on “Check Your Score” button to generate his/her Credit Score.

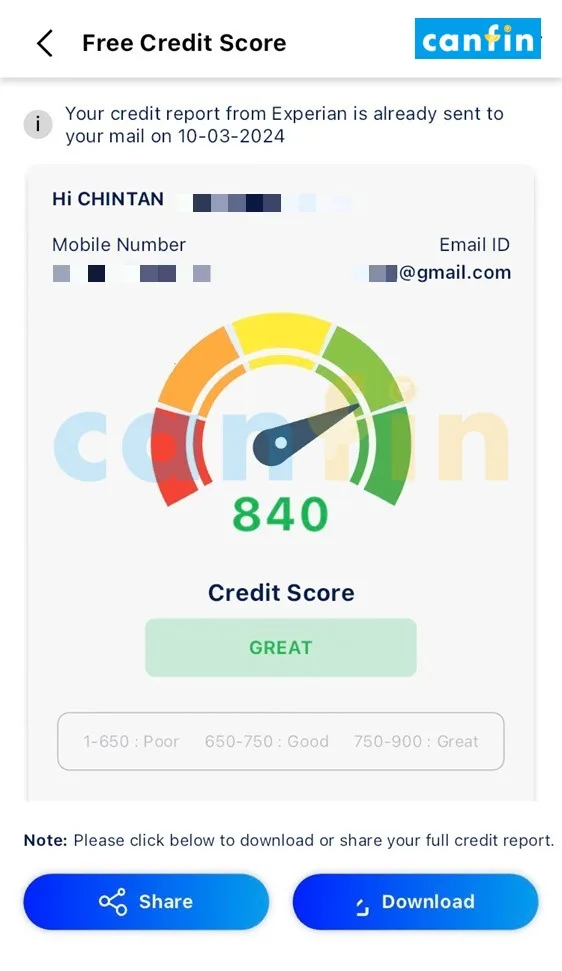

4. On successful generation of Credit Score Report, Credit Score and Score meter will be displayed immediately to user which can be shared by user using “Share” option.

5. Password protected Credit Score Report will be sent to user’s email address. The password is a combination of first four characters of the User’s name and last four digits of User’s Registered Mobile Number. Detailed instruction to view the report is sent to the user over email.

6. Alternately, User can download the Free Credit Score Report.

7. Once Free Credit Score Report is generated, it can be viewed/ downloaded at any point of time. User can generate a fresh Credit Score only after 90 days

This report will enable you to view your credit lines. This request will NOT change your Experian Credit Score.

In case of any discrepancy in Credit Score Report, User shall write to M/s Experian CIC India Ltd. Details for lodging complaint will be available under “Contacting Us” in Credit Score Report generated by user.

Frequently Asked Questions 🤔

Q. What makes the Credit Score so important?

For loan and credit card applications, a high CIBIL Score (near 900) indicates a positive financial history. Banks and Financial Institutes trust individuals with high scores, influencing borrowing limits and interest rates.

Q. How to enhance my Credit Score?

Your Credit Score relies on several factors. Here are 5 steps to improve it:

- Timely payment of dues

- Keep credit balances low

- Apply for new credit moderately

- Maintain a healthy mix of home loan, auto loan, gold loan, personal loan, credit cards.

- Review your credit history frequently throughout the year.