First Bank in India to pioneer a UPI interoperable CBDC app as a part of the Reserve Bank of India’s Central Bank Digital Currency Pilot Project. Using UPI Interoperable Canara Digital Rupee App, now customers can scan any merchant UPI QR code and make the payment through digital currency. This process brings a new level of convenience to digital payments, enhancing the overall transaction experience for users.

Digital Rupee (e₹ ), a new form of currency launched by the Reserve Bank of India. eRupee is a legal tender, similar to sovereign paper currency, and is issued in digital form by the Reserve Bank of India. A digital rupee would be a form of electronic money that exists solely in digital form, allowing for digital transactions and payments.

In September 2021, the Reserve Bank of India (RBI) had been exploring the idea of introducing a digital currency. The RBI revealed that it was working on a phased implementation strategy for a central bank digital currency (CBDC) from December 2021. The goal was to create a digital version of the Indian rupee that would coexist alongside physical cash.

A CBDC like the digital rupee would be issued and regulated by the central bank, making it a legal tender and a secure form of digital payment. It would leverage blockchain or other distributed ledger technologies to facilitate transactions and ensure transparency, efficiency, and security.

After the launch of the central bank digital currency (CBDC), or e-rupee, on 1st December 2022, the value of retail digital rupee in circulation amounted to just Rs 5.70 crore involving 17.1 lakh pieces of notes (digital) as on March 31, 2023, the Reserve Bank said.

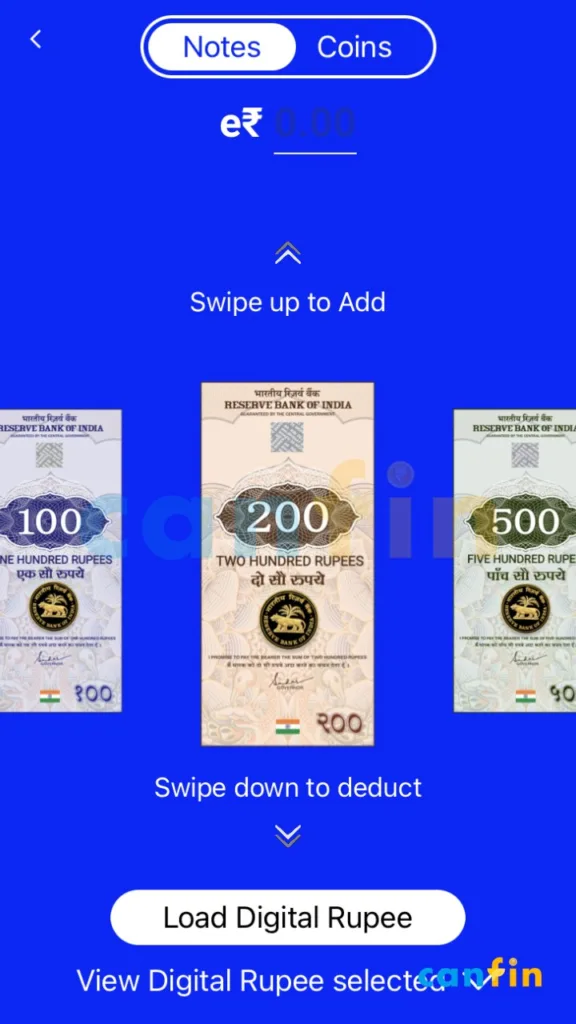

Digital Rupee App

Click below to Download App Now!

Canara Bank earlier launched eRupee pilot project on ‘Canara Digital Rupee’ App for its employees. Digital rupee is now available to All Canara bank customers.

Canara digital Rupee app facilitates secure, fast digital currency transaction using Digital Rupee wallets. This Digital Rupee wallet will be similar to your physical wallet but in digital form.

Registration Process:

- Select the SIM linked to your Bank Account.

- Set the app login “PIN, Pattern or Biometric”.

- Set the 6-digit wallet PIN.

- From the list, select a Canara Bank Account linked to your mobile number.

- Enter the “last 6 digits” and “Expiry Date” of the respective account’s Debit Card.

- Authentication is successful and registration is complete.

Things you can do on Canara Digital Rupee app:

- Load Digital Rupee Tokens

- Redeem/Unload Digital Rupee Tokens

- Send & Receive Digital Rupee Tokens

- Scan and Pay using Digital Rupee Tokens

Benefits of a Digital Rupee

The introduction of a digital rupee, or any central bank digital currency (CBDC), can offer several advantages. Here are some potential benefits of a digital rupee:

Financial Inclusion

A digital rupee can enhance financial inclusion by providing access to banking services and digital payments to individuals who may not have traditional bank accounts. It can help bridge the gap between the banked and unbanked population by allowing anyone with a smartphone or basic internet access to participate in the digital economy.

Reduced Transaction Costs

Digital payments typically have lower transaction costs compared to traditional payment methods. By using a digital rupee, individuals and businesses can avoid fees associated with physical cash handling, such as transportation, storage, and security. It can lead to cost savings and increased efficiency in transactions.

Enhanced Security

Digital currencies can incorporate advanced security features to protect against counterfeiting and fraud. The use of encryption and distributed ledger technology, like blockchain, can provide a secure and tamper-proof system for transactions, reducing the risk of financial crimes.

Faster and More Efficient Transactions:

Digital rupee transactions can be conducted in real-time, eliminating the need for manual processing and reducing settlement times. It can lead to faster and more efficient cross-border transactions, facilitating international trade and commerce.

Monetary Policy Implementation

A digital rupee can provide the central bank with more direct control over monetary policy. By having a digital currency, the central bank can track transactions in real-time, gather data on spending patterns, and adjust monetary policy measures accordingly. It can improve the effectiveness of monetary policy implementation.

Innovation and Financial Services Development

The introduction of a digital rupee can foster innovation in the financial sector. It can encourage the development of new digital payment platforms, applications, and services, stimulating economic growth and promoting financial sector modernization.

Transparency and Accountability

The use of a digital rupee can increase transparency in financial transactions. Every transaction can be recorded on a distributed ledger, providing a transparent and auditable transaction history. It can help reduce corruption and improve accountability in financial transactions.

It’s important to note that these advantages are based on the potential benefits of a digital rupee and may vary depending on the specific design and implementation of the digital currency.

Market Acceptance

Reliance Retail in partnership with Innoviti Technologies, ICICI Bank and Kotak Mahindra Bank became the first big, organised retail chain in the country to accept e₹-R. CCAvenue became the first payment gateway to process e₹-R for online retail transaction.

Be among first Indians to use e₹!

FAQs

What is UPI Interoperable CBDC App?

As a part of the Reserve Bank of India’s Central Bank Digital Currency (CBDC) Pilot Project, Using Canara Digital Rupee App, now customers can scan any merchant UPI QR code and make the payment through digital currency, opening the doors to digital currency transactions without the need for a separate onboarding process for CBDC