Early Financial Planning for your Child’s stable future through NPS Vatsalya Pension Scheme!

As you are aware that in the Union Budget 2024-25, the Hon’ble Finance Minister Smt. Nirmala Sitharaman has announced the NPS Vatsalya, a Scheme for the minor children. As communicated by the PFRDA the scheme shall be launched on 18.09.2024 by Honorable Finance Minister.

In the Budget announcement it was mentioned as

“NPS Vatsalya, a plan for contribution by Parents and Guardians for Minors will be started. On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.”

The account opening for the scheme has been enabled w.e.f. 12.09.2024 and Canara Bank branches have started enrolling the minor subscribers for the New NPS Accounts. Currently this functionality has been enabled for Online mode through myNPS only.

About NPS Vatsalya Scheme 📑

- Concept of Pension & financial planning, fostering financial literacy from early age

- Gift of long-time Investment for long-term financial stability

- Promotes importance of investing early and consistently for long-term benefits

Scheme Type

A saving-cum-pension scheme regulated and administered by the PFRDA

Eligibility

All minor citizens (From Birth to 18 years of age)

Operations

- Account opened in the name of minor and operated by Guardian

- Minor to be sole beneficiary

Document required

- KYC of Guardian shall be carried out by submitting Proof of Identity and Address (Aadhaar, Driving License, Passport, Voter ID card, NREGA Job Card, National Population Register)

- Date of Birth proof of the Minor (Birth certificate, School leaving certificate, Matriculation Certificate, PAN, Passport)

- NRE / NRO Bank Account (solo or joint) of the minor, in case the guardian is NRI

Contribution

Account Opening contribution: Min Rs. 1,000/- and Maximum no limit

Subsequent contribution: Min. Rs. 1,000/- p.a. and Maximum no limit

Pension Fund Selection

Guardian can choose any one of the Pension Fund registered with PFRDA.

Investment Choices

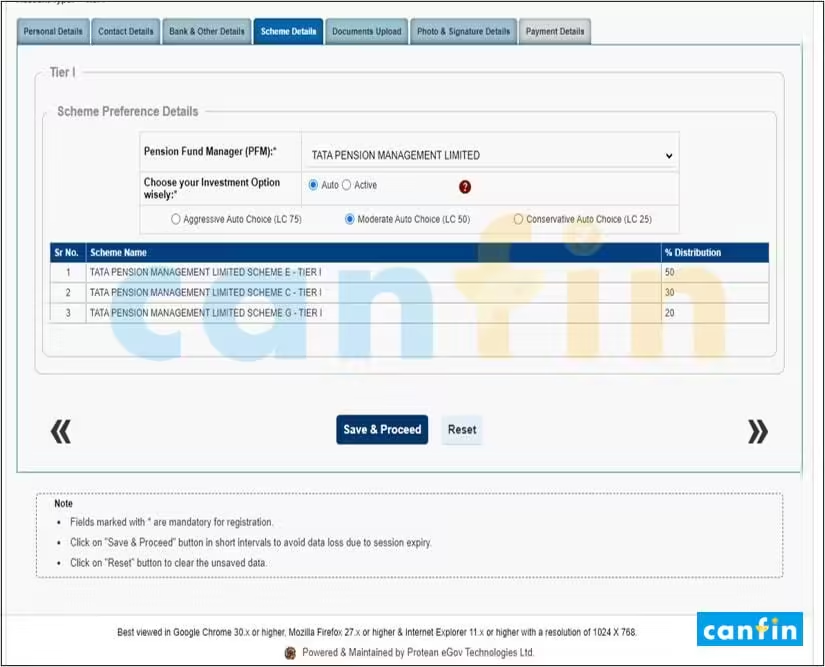

- Default Choice: Moderate Life Cycle Fund -LC-50 (50% equity)

- Auto Choice: Guardian can choose Lifecycle Fund – Aggressive -LC-75 (75% equity), Moderate LC-50 (50% equity) or Conservative-LC-25 (25% equity)

- Active Choice: Guardian actively decides allocation of funds across Equity (upto 75%), Corporate Debt (upto 100%), Government Securities (upto 100%) and Alternate Asset (upto 5%).

Withdrawal, exit and death

- Withdrawal up to 25% of contribution after lock-in-period of 3 years allowed for education, specified illness and disability. Max three times.

- Upon attainment of age of 18 years, Seamless shift to NPS Tier – I (All Citizen)

- Exit allowed on attainment of 18 years of age

- Corpus more than Rs. 2.5 lacs: 80% corpus is utilized for purchase of annuity and 20% can be withdrawn as lump sump

- Corpus less than or equal to Rs. 2.5 lacs: entire corpus can be withdrawn as a lumpsum.

- On death, entire corpus would be returned to the guardian.

Related: Ready to Invest in National Pension System (NPS)? Start in 2024 with this Master Guidelines

Email Subscription

Sign up for our newsletter and stay up to date!

3 Ways to Open the NPS Vatsalya Account 📝

NPS Vatsalya account can be opened through Points of Presence (POPs) which include Major banks, India Post, Pension Funds etc. or on Online platform (e-NPS)

1. Canara Bank Website

Customer can open NPS Vatsalya accounts through Canara Bank Corporate Website at below Navigation:

- Login to https://www.canarabank.com

- Go to Investment > Government Business Products > National Pension System > APPLY NPS ONLINE > Registration

OR Go Directly 👇

2. Canara Ai1 App

Login to the Canara Ai1 application and proceed to Social Security Schemes.

3. Canara Bank Internet Banking

Login to Internet Banking > Government Schemes > National Pension System (NPS) > Click here to open NPS Account

10 Steps to Open the NPS Vatsalya Account Online 📋

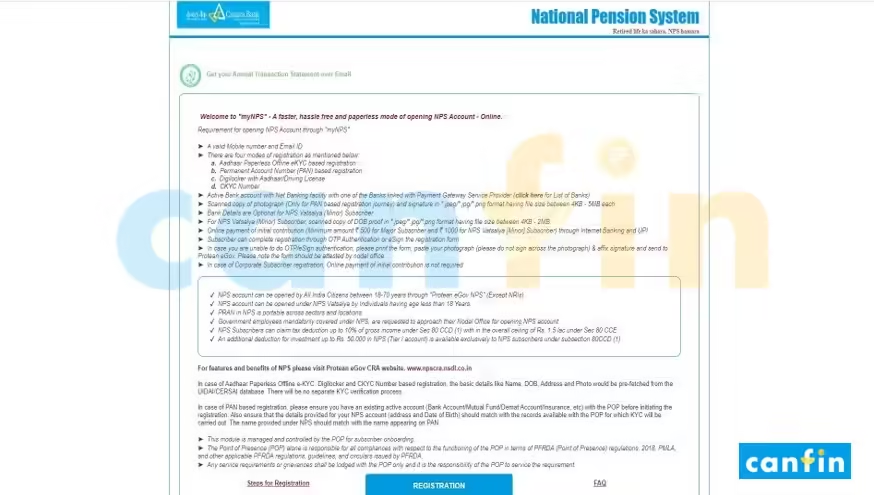

Requirement for opening Account through myNPS Portal:

- A valid Mobile number and Email ID

- There are four modes of registration as mentioned below:

- Aadhaar Paperless Offline eKYC based registration

- Permanent Account Number (PAN) based registration

- Digilocker with Aadhaar/Driving License

- CKYC Number

- Active Bank account with Net Banking facility with one of the Banks linked with Payment Gateway Service Provider

- Scanned copy of photograph (Only for PAN based registration journey) and signature in .jpeg/.jpg/.png format having file size between 4KB – 5MB each

- Bank Details are Optional for NPS Vatsalya (Minor) Subscriber

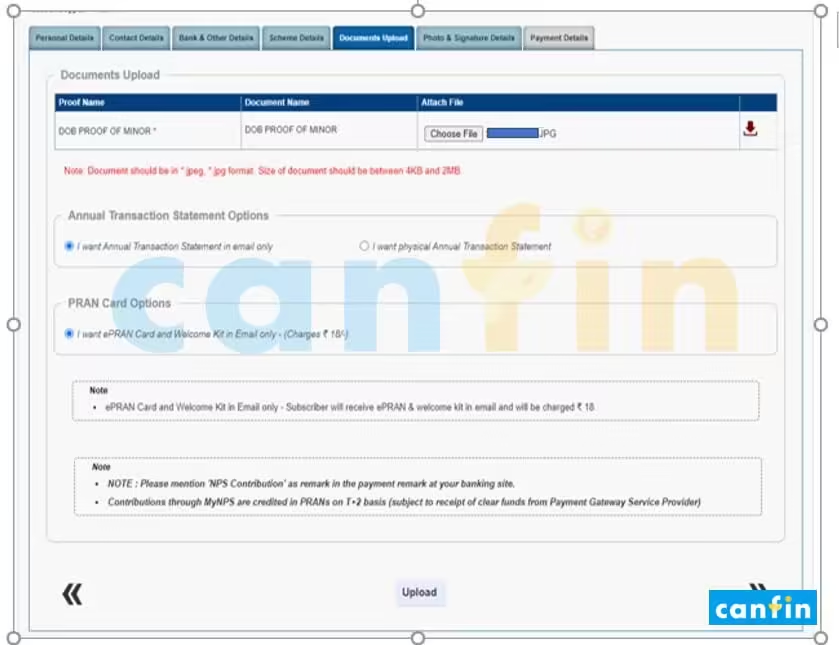

- For NPS Vatsalya (Minor) Subscriber, scanned copy of DOB proof in .jpeg/.jpg/.png format having file size between 4KB – 2MB.

- Online payment of initial contribution (Minimum amount ₹ 500 for Major Subscriber and ₹ 1000 for NPS Vatsalya [Minor] Subscriber) through Internet Banking and UPI.

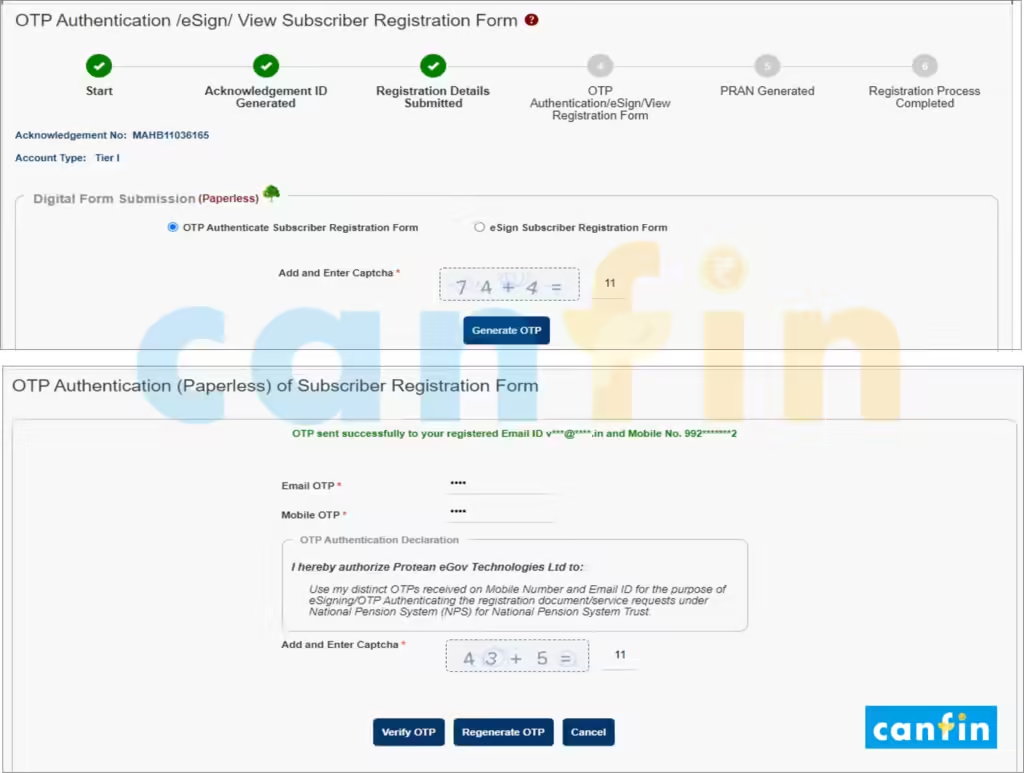

Subscriber can complete registration through OTP Authentication or e-Sign the registration form. In case you are unable to do OTP/e-Sign authentication, please print the form, paste your photograph (please do not sign across the photograph) & affix signature and send to Protean e-Gov. Please note the form should be attested by nodal office.

In case of Corporate Subscriber registration, Online payment of initial contribution is not required.

To begin, Click below link to go to myNPS Portal.

The User has to click on “REGISTRATION” option to proceed further for opening NPS Account.

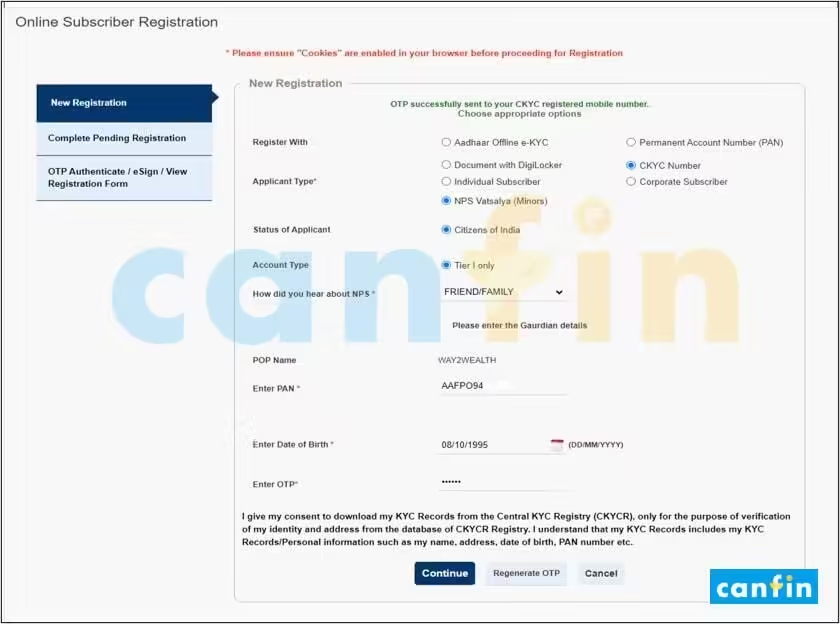

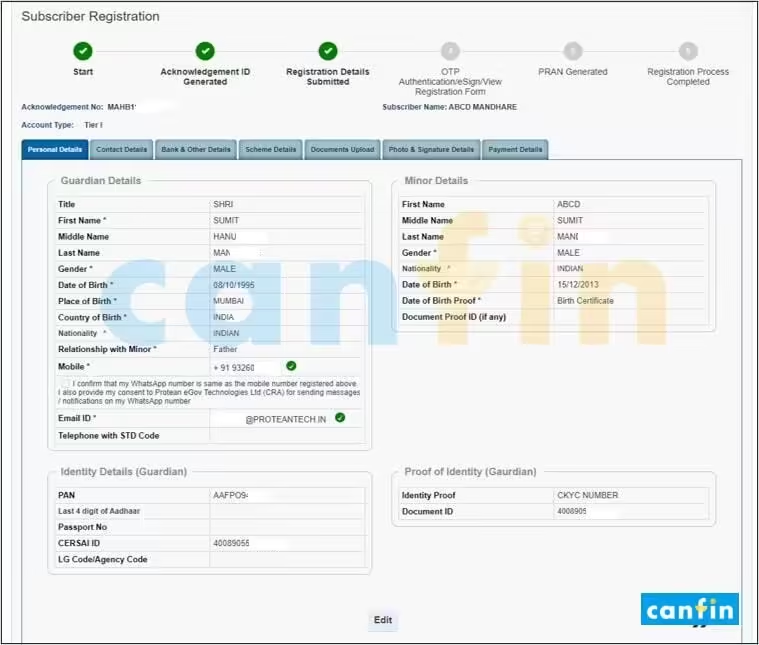

1. Guardian to Select Type of Subscriber as NPS Vatsalya (Minor), Enter PAN & DOB, Verify with Mobile OTP and Continue.

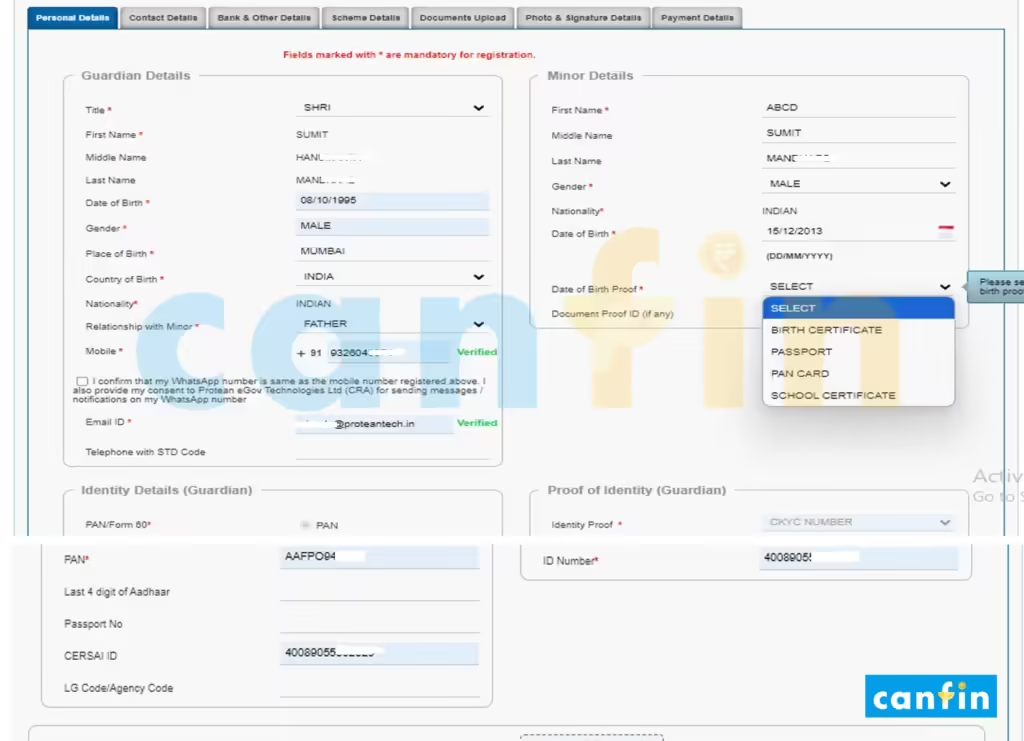

2. Auto-population of Guardian personal details like Guardian’s Name, DOB, & Gender, Mob. & Email, POI & CERSAI ID. User (Guardian) need to Verify Email ID via OTP Provide Minor Name, Gender, DOB & DOB Proof (Birth Certificate, Passport, PAN Card, School Certificate)

3. FATCA and Address Details of Guardian will be Auto-Fetched.

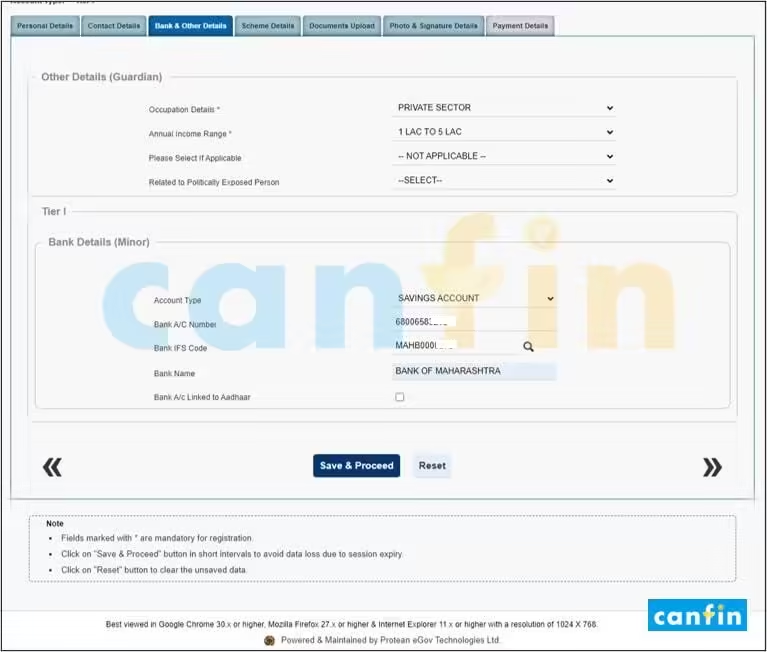

4. User (Guardian) need to enter: Other details like occupation and annual income, etc., Bank Account details of Vatsalya (Optional), if provided will be verified online.

5. User (Guardian) is required to select PFM and Scheme Preference for investment.

6. User (Guardian) will upload the DOB Proof of Vatsalya.

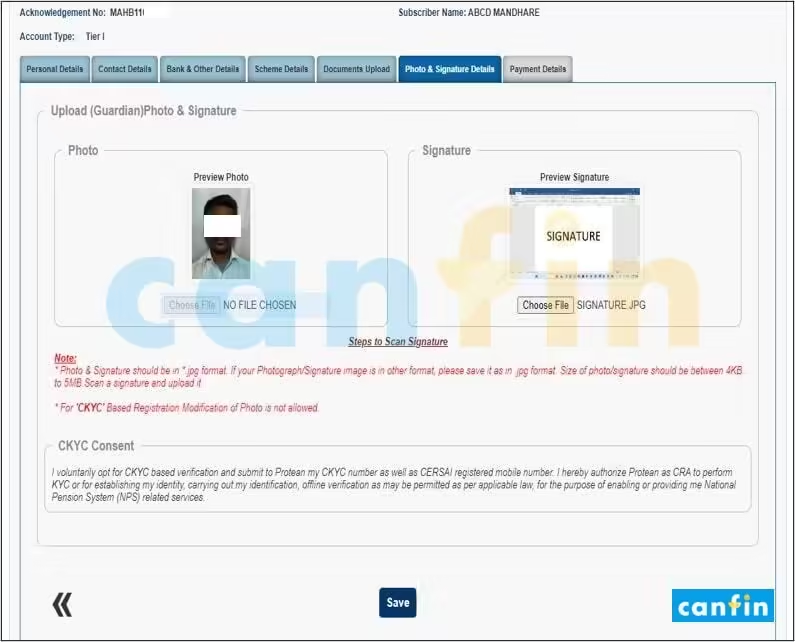

Photograph – Auto fetched, Signature – Auto Fetched (based on the availability in CERSAI Database)

7. User (Guardian) will review and confirm all the details: Personal Details, Contact Details, Bank and Other Details, Scheme Details, Documents Uploaded, Photo and Signature.

8. User (Guardian) is required to complete Dual OTP/ e-Sign Authentication.

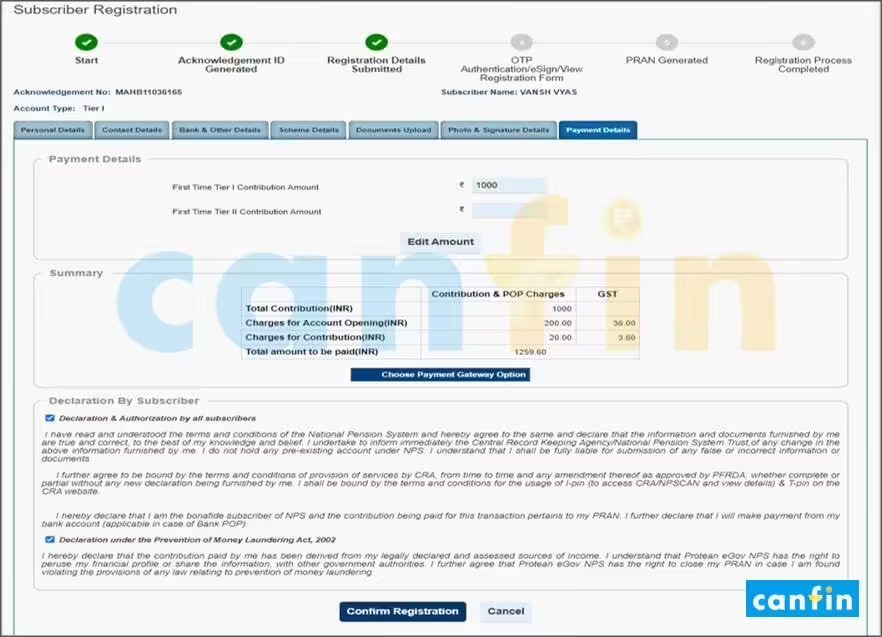

9. User (Guardian) is required to make mandatory contribution of Rs.1000/- for completing the NPS A/C opening journey.

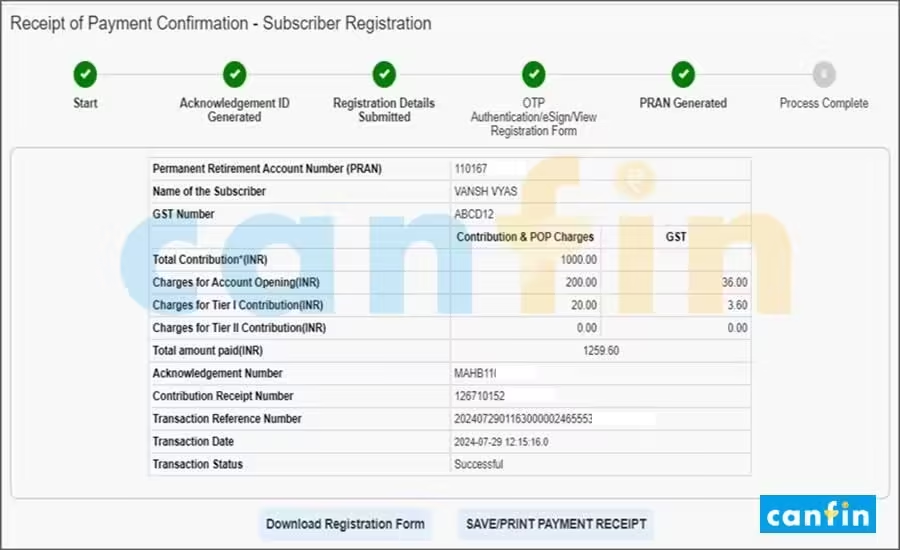

10. After successful payment PRAN will be generated. User (Guardian) will be able to download Payment Receipt and e-Signed Registration Form.

Frequently Asked Questions (FAQs) 🤔

Q. What are the tax deductions available for NPS Vatsalya subscribers?

NPS Subscribers can claim tax deduction up to 10% of gross income under Sec 80 CCD (1) with in the overall ceiling of Rs. 1.5 lac under Sec 80 CCE. An additional deduction for investment up to Rs. 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1)

Q. What is initial Account Opening contribution for NPS Vatsalya subscribers?

Initial account opening subscription is minimum of Rs. 1,000/- and Maximum no limit.