Sovereign Gold Bond (SGB) are government securities denominated in grams of gold, substitutes for holding physical gold. The Bond is issued by Reserve Bank on behalf of Government of India.

Sovereign Gold Bond (SGB) Scheme 2023-24 (Series-3 and Series-4)

(A) Date of Issue 📅

The bonds shall be issued as per the details given below:

| Tranche | Subscription Period | Date of Issuance |

| Series 3 | Dec 18 – Dec 22, 2023 | Dec 28, 2023 |

| Series 4 | Feb 12 – Feb 16, 2024 | Feb 21, 2024 |

Reserve Bank of India, vide its Press release Ref No: 2023-2024/1495 dated December 15, 2023 has communicated that the rate of Rs. 6,199/- per gram of Gold will be applicable for the subscription of The Sovereign Gold Bond 2023-24 Series-3 from period 18/12/2023 to 22/12/2023 (5 Days).

Further, Government of India, in consultation with the Reserve Bank of India, has decided to offer Discount of Rs. 50/- (Rupees Fifty only) per gram less than the nominal value to those Investors applying Online and the payment against the application is made through Digital Mode. For such Investors, the Issue Price of Gold Bond will be Rs. 6,149/- (Rupees Six Thousand one hundred and forty-nine only) per gram of Gold.

The Scheme is aimed at providing an alternative to buying physical Gold and the Issue Price fixed by RBI as mentioned above for the current series of SGBs is very attractive.

(B) Application 📄

Offline Mode 🏦

Visit nearest branch of any Commercial banks. The applicable Application Form for Sovereign Gold Bonds Scheme 2023-24 is attached below:

Every application must be accompanied by valid ‘PAN details’ issued by the Income Tax Department to the investor(s). Customer shall keep an acknowledgment receipt for future use.

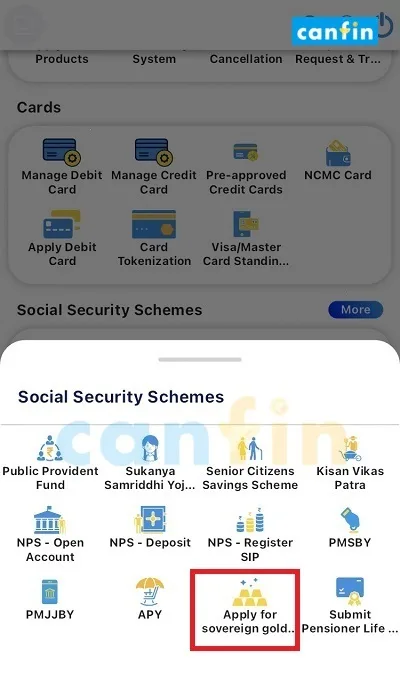

Online Mode 🌐 – 7 Steps to Apply for SGBs

- Internet Banking

- Mobile Banking App

Mobile Banking App 📱

Internet Banking 👨💻

(1) A Customer (Retail) who is having Internet Banking facility (e.g. in Canara Bank) is able to buy SGB online through Net Banking at their convenience from anywhere any time during the SGB tranche period only.

SGB Bond Online subscription can be done through Canara Bank Netbanking > Home > Investment > Government Business Product > Sovereign Gold Bond Scheme > SGB Online Subscription.

This link is also available on www.canarabank.com > Online Services > SGB Online Subscription.

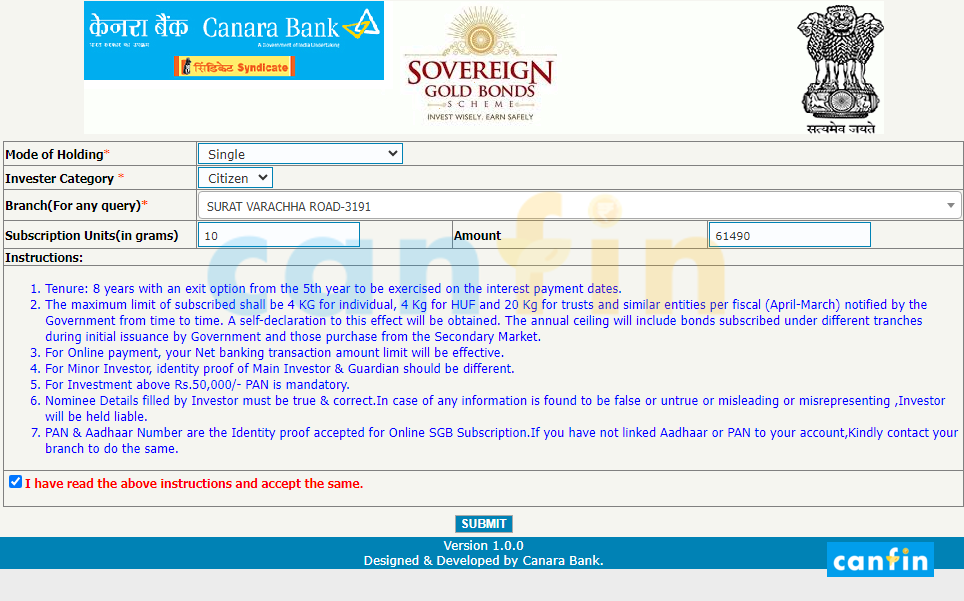

(2) On clicking above link following screen appears. Customer need to select Mode of Holding as ‘Single’ and Investor Category as ‘Citizen’ only and have to select their preferred branch and enter the Units

of Subscription for initiating the Online Subscription.

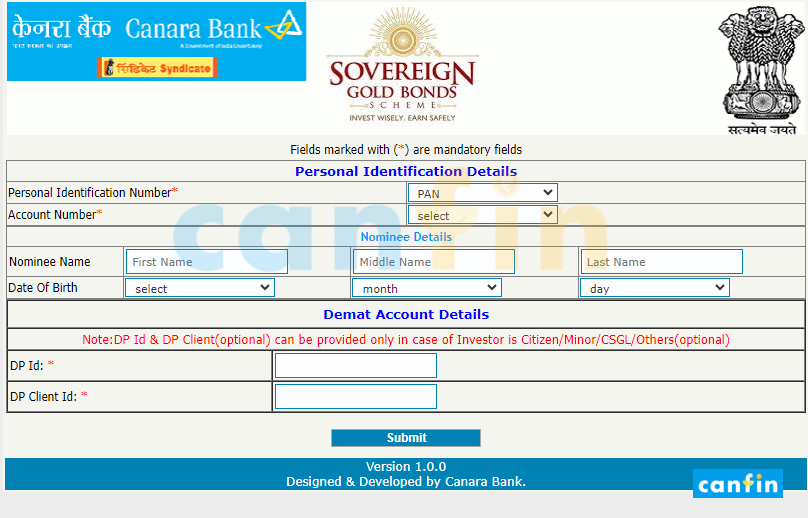

(3) After clicking submit button it will lead them to Internet Banking login page. After successful validation of their User ID and Password it will fetch their Personal Identification Details as per the selection as either Aadhaar or PAN and then have to feed their Nominee Details for proceeding further:

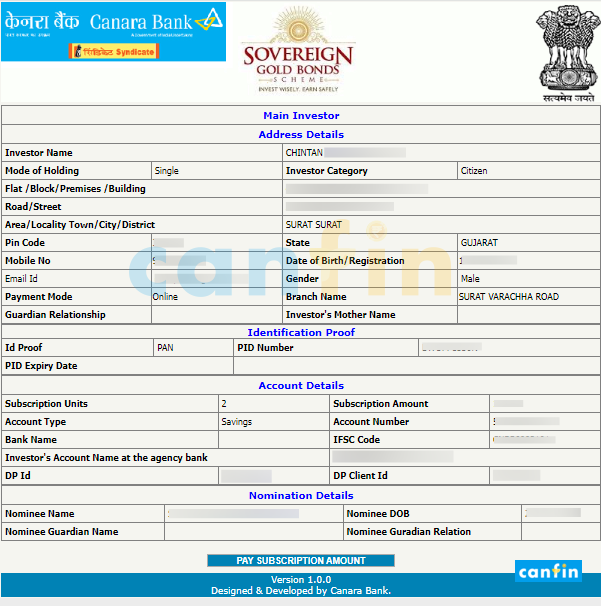

(4) In next screen, it will show the details entered by the customer to pay the subscription amount using their IMB Credentials:

(5) On Successful validation of the IMB User-ID and Password, the subscriber has to

select the Account Number from which SGB Bond amount has to be deducted.

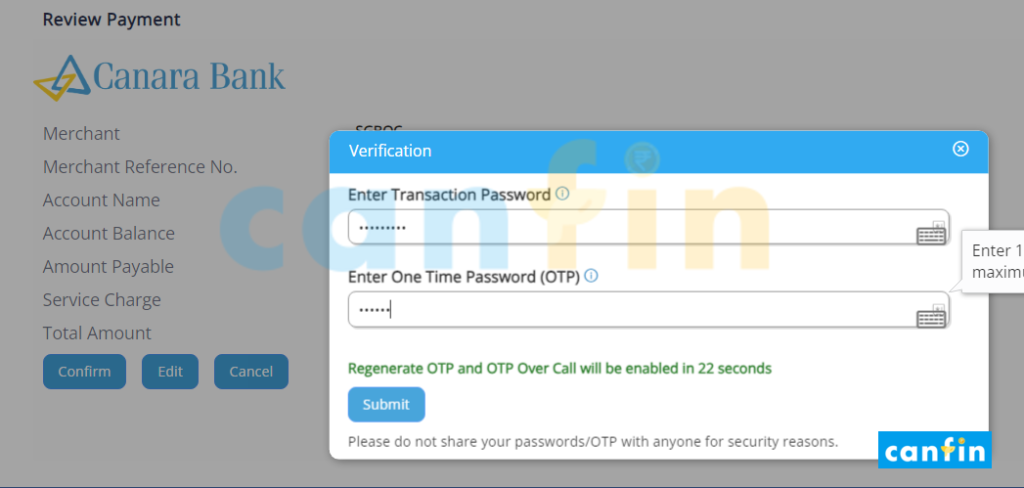

(6) Verify the payment through Transaction Password and OTP after selecting the account number Subscriber/Customer has to confirm the details entered.

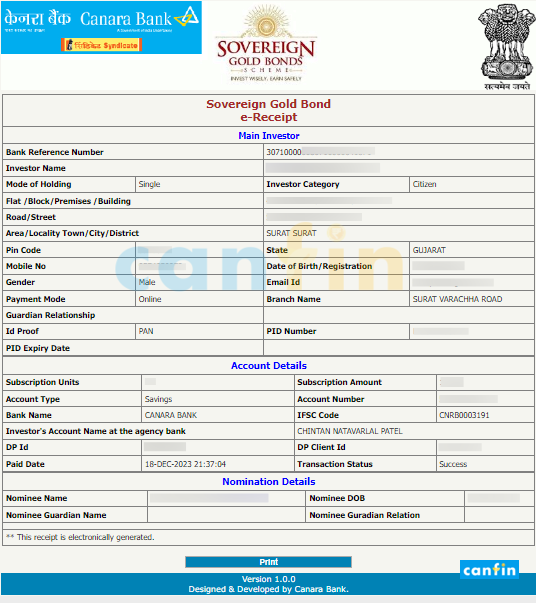

(7) Cyber Receipt with reference Number will be generated on successful entry of transaction password and OTP.

(C) Basic Things You Must Know About SGBs 📜

(1) Issuance

To be issued by Reserve Bank of India on behalf of the Government of India

(2) Eligibility

The SGBs will be restricted for sale to resident Individuals, HUFs, Trusts, Universities and Charitable Institutions.

(3) Denomination

The SGBs will be denominated in multiples of gram(s) of gold with a basic unit of One gram.

(4) Tenor

The tenor of the SGB will be for a period of 8 years with an option of premature redemption after 5th year to be exercised on the date on which interest is payable.

(5) Minimum size

Minimum permissible investment will be One gram of gold.

(6) Maximum limit

The maximum limit of subscription shall be 4 Kg for Individual, 4 Kg for HUF and 20 Kg for Trusts and similar entities per Fiscal Year (April-March) as notified by the Government from time to time. A self declaration to this effect will be obtained from the investors at the time of making an application for subscription. The annual ceiling will include SGBs subscribed under different tranches, and those purchased from the Secondary Market, during the fiscal year.

(7) Joint holder

In case of joint holding, the investment limit of 4 Kg will be applied to the first applicant only.

(8) Issue Price

Price of SGB will be fixed in Indian Rupees on the basis of simple average of closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Limited (IBJA) for the last three

working days of the week preceding the subscription period. The issue price of the SGBs will be less by Rs. 50/- per gram for the investors who subscribe online and pay through digital mode.

(9) Payment option

Payment for the SGBs will be through cash payment (up to a maximum of Rs. 20,000/- only) or demand draft or cheque or electronic banking.

(10) Issuance form

The SGBs will be issued as Government of India Stock under Government Securities Act, 2006. The investors will be issued a Certificate of Holding for the same. The SGBs will be eligible for conversion into demat form.

(11) Redemption Price

The Redemption Price will be Indian rupees based on simple average of closing price of gold of 999 purity, of previous three working days published by IBJA Ltd.

(12) Sales channel

SGBs will be sold through Commercial banks (except Small Finance Bank, Payment Banks and Regional Rural Bank), Stock Holding Corporation of India Limited (SHCIL), Clearing Corporation of India Limited (CCIL), designated post offices (as may be notified) and recognized stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange Limited, either directly or through agents.

(13) Interest rate

The investors will be compensated at a fixed rate of 2.50% per annum payable semi-annually on the nominal value.

(14) Collateral

The SGBs can be used as collateral for loans. The loan-to-value (LTV) ratio will be as applicable to any ordinary gold loan mandated by the Reserve Bank from time to time.

(15) KYC documentation

Know-your-customer (KYC) norms will be the same as that for purchase of physical gold. KYC documents such as Voter ID, Aadhaar card/PAN or TAN /Passport will be required. Every application must be accompanied by the ‘PAN Number’ issued by the Income Tax Department to individuals and other entities.

(16) Tax treatment

The interest on SGBs shall be taxable as per the provision of Income Tax Act, 1961 (43 of 1961). The capital gains tax arising on redemption of SGB to an individual is exempted. The indexation benefits will be provided to long term capital gains arising to any person on transfer of the SGB.

(17) Tradability

SGBs shall be eligible for trading.

(D) Benefits 🎁

- Alternative to investing in physical gold.

- Mitigation of risks linked to the storage of physical gold.

- Gold Bonds can be converted into Demat form.

- Gold Bonds can serve as collateral for obtaining loans.

- Capital Gains Tax exemption upon the redemption of gold bonds.

- Biannual interest payments at a rate of 2.50%.

- Online investors are eligible for a discount.

(E) Premature Redemption 🏁 under SGB 2017-18 Series XII

- Premature Redemption Price = Rs. 6,199/- per unit of SGB.

In terms of Government of India Notification F.No.4(25) – W&M/2017 dated October 06, 2017 (SGB 2017-18 Series XII – Issue date December 18, 2017) on Sovereign Gold Bond (SGB) Scheme, premature redemption of Gold Bond may be permitted after fifth year from the date of issue of such Gold Bond on the date on which interest is payable. Accordingly, the next due date of premature redemption of the above tranche shall be December 18, 2023.

Further RBI vide their Press release: 2023-2024/1496 dated December 15, 2023 has enumerated the redemption price of Sovereign Gold Bond shall be based on the simple average of closing gold price of 999 purity of previous three business days from the date of redemption as published by the India Bullion and Jewellers Association Ltd (IBJA). Accordingly, the redemption price for premature redemption due on December 18, 2023 shall be Rs. 6,199/- (Rupees Six thousand one hundred and ninety-nine only) per unit of SGB based on the simple average of closing gold price for three business days, i.e., From 13th December to 15th December, 2023

(F) Frequently Asked Questions 👤

What is a Sovereign Gold Bond (SGB), and who is the issuer?

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold, providing an alternative to holding physical gold. The Reserve Bank issues these bonds on behalf of the Government of India.

Why choose Sovereign Gold Bond over physical gold, and what are the benefits?

SGBs offer a protected quantity of gold, ensuring investors receive the ongoing market price at redemption. They eliminate storage risks and additional costs, offering a secure alternative to physical gold. SGBs also provide periodic interest and exemption from making charges and purity concerns.

Are there risks associated with investing in Sovereign Gold Bonds?

While there’s a risk of capital loss if the gold market declines, investors don’t lose in terms of the units of gold they’ve paid for.

Who is eligible to invest in Sovereign Gold Bonds?

Indian residents, including individuals, HUFs, trusts, universities, and charitable institutions, are eligible. Minor investments can be made with a guardian’s application.

Is joint holding allowed for Sovereign Gold Bonds?

Yes, joint holding is permitted.

Can a Minor invest in Sovereign Gold Bond?

Yes, with the application made by their guardian.

Where can investors obtain the application form for Sovereign Gold Bonds?

Issuing banks, SHCIL offices, designated Post Offices, and agents provide application forms, which can also be downloaded from the RBI’s website.

What are the Know-Your-Customer (KYC) norms for Sovereign Gold Bonds?

Every application must include the investor’s PAN number issued by the Income Tax Department.

Can an investor hold more than one investor ID for Sovereign Gold Bonds?

No, an investor can have only one unique investor ID linked to any prescribed identification document.

What is the minimum and maximum limit for SGB investment?

Bonds are issued in one-gram denominations, with a minimum investment of one gram and a maximum limit of 4 kg for individuals per fiscal year.

Can each family member buy 4 kg in their own name?

Yes, each family member can purchase bonds in their own name, subject to eligibility criteria.

Can an investor/trust buy 4 kg/20 kg worth of SGB every year?

Yes, investors/trusts can buy within the specified limits each fiscal year.

What is the rate of interest, and how is it paid?

The bonds bear a fixed interest rate of 2.50% per annum, with interest paid semi-annually.

Who are the authorized agencies selling SGBs?

Bonds are sold through nationalized banks, scheduled private banks, scheduled foreign banks, designated Post Offices, SHCIL, and authorized stock exchanges.

If I apply, am I assured of allotment?

If the eligibility criteria are met and application money is remitted on time, allotment is assured.

When will customers receive the Holding Certificate?

The Holding Certificate is issued on the date of Sovereign Gold Bond issuance and can be collected from designated entities.

Can I apply for Sovereign Gold Bond online?

Yes, online applications are accepted through the websites of listed scheduled commercial banks.

At what price are the bonds sold?

The nominal value is fixed based on the average closing price of gold for the last three business days preceding the subscription period.

Will RBI publish the daily gold rate applicable?

Yes, the gold price for the relevant tranche will be published on the RBI website two days before the issue opens.

What will I get on redemption?

On maturity, Sovereign Gold Bonds are redeemed in Indian Rupees based on the average closing price of gold of 999 purity for the previous three business days.

How is the redemption amount received?

Both interest and redemption proceeds are credited to the investor’s bank account.

What are the procedures for redemption?

Investors are informed one month before maturity, and on the maturity date, proceeds are credited to the bank account on record.

Can I encash the bond anytime, and is premature redemption allowed?

Premature redemption is allowed after the fifth year on coupon payment dates, and the bonds can be traded if held in demat form.

What is the process for exiting my investment?

Investors can approach the concerned entity for premature redemption, with proceeds credited to the bank account.

Can I gift the bonds, and is it transferable?

Bonds are transferable to relatives/friends meeting eligibility criteria and can be gifted via an instrument of transfer.

Can these securities be used as collateral for loans?

Yes, Sovereign Gold Bonds are eligible as collateral, subject to the decision of the lending institution.

What are the tax implications on interest and capital gain?

Interest is taxable, while capital gains tax on redemption is exempted, with indexation benefits for long-term gains.

Is TDS applicable on the bond?

No, TDS is not applicable, but bondholders must comply with tax laws.

Who provides customer services after bond issuance?

Issuing banks, SHCIL offices, Post Offices, designated stock exchanges, and agents handle customer services.

What are the payment options for investing in Sovereign Gold Bonds?

Payment can be made through cash, cheques, demand drafts, or electronic fund transfer.

Is a nomination facility available forSovereign Gold Bonds?

Yes, a nomination facility is available as per Government Securities Act provisions.

Can the bonds be held in demat form?

Yes, with a specific request in the application form, bonds can be held in a demat account.

Can these bonds be traded?

Yes, Sovereign Gold Bonds are tradable, especially in demat form, and can be sold and transferred as per regulations.

What is the procedure in the event of the investor’s death?

The nominee or legal heir can claim the bond, adhering to the provisions of the Government Securities Act.

Can I get part repayment of these bonds at the time of exercising the put option?

Yes, part holdings can be redeemed in multiples of one gram.

How do I contact RBI for queries on Sovereign Gold Bonds?

Investors can email queries to a dedicated email address created by the Reserve Bank of India on

sgb@rbi.org.in